The selloff continued yesterday as the S&P 500 fell for the third consecutive day. This pushed us to 2,080, a level that’s acted as both support and resistance multiple times this year. While not as psychologically important as 2,100, it was meaningful enough to arrest the slide. The question now is if this puts the worst behind us.

Volume was the lightest we’ve seen in weeks, showing the technical weakness didn’t scare many owners and the dip was more due to a lack of demand than a surge in supply. While it is nice to see owners remain confident, capitulation bottoms form when owners panic and dump stock at a steep discount. Clearly that didn’t happen yesterday. That means either we see a slow and methodical rebound from here, as tight supply trumps light demand, or we plunge lower and trigger that emotional capitulation bottom.

Slow climb higher or sharp selloff lower? The risk/reward seems pretty clear. But in spite of that, I continue to be bullish medium-term for all the reasons I listed in last week’s posts and am looking forward to profiting from a near-term emotional drop in prices. For those with long-term portfolios, don’t let this noise or price-action shake your resolve.

Individual Stocks:

AAPL – Apple (NASDAQ:AAPL) had their dog and pony show and just as expected, didn’t announce anything all that interesting. Minor updates to OS X and iOS and a music streaming service that will no doubt prove as wildly successful as their two-year old iTunes radio. What? You never tried iTunes radio? Yep, exactly like that. Apple is a handset maker and as long as the iPhone continues to sell well, you can ignore the iPad, iWatch, iTV, iRadio, iStreaming, iMac, iCar, and all the other side projects they have. The stock lives and dies by how many phones they sell. Which is why the most noteworthy development yesterday was AT&T's (NYSE:T) decision to stop offering subsidized phones through the Apple Stores. This will be especially critical if other carriers follow suit. Between the slowing evolution of new must-have features and the end of phone subsidies, we could see the phone upgrade cycle stretch from two years to three plus as consumers have to pay more and get less in return. Since the global high-end smartphone market is saturated (those who can afford a $600+ phone already have one), a slowing upgrade cycle will be a big headwind once the iPhone 6 upgrade surge runs its course. While not a story right now, it is a material concern for long-term owners.

EBAY – eBay Inc (NASDAQ:EBAY) was smacked down by the broad market and shows why it is risky to chase a stock extended from the breakout. But in spite of yesterday’s nearly 4% dip, the breakout is still intact and isn’t under threat unless we fail to hold $58.

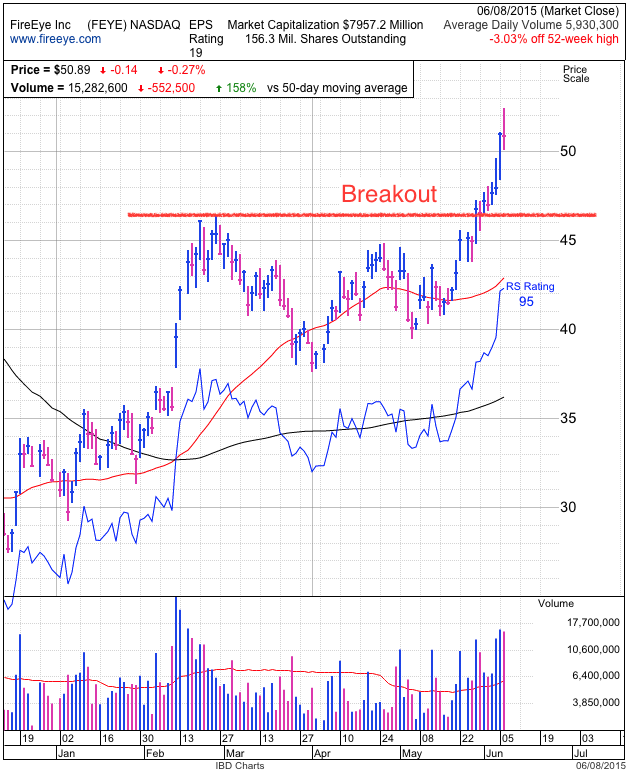

FEYE – Fireeye Inc (NASDAQ:FEYE) had a strong open but gave up those gains through the day under the weight of the weak broad market. The breakout still looked good, but with a sky-high valuation it is subject to more volatility if the entire market hits a rough patch.

ALGN – Everything I said about eBay equally applies to Align Technology Inc (NASDAQ:ALGN), even coincidentally enough, the $58 price level.

It seems like the broad market and individual stocks could see some near-term weakness, but this will be yet another buyable dip. Those with stock should buckle down and prevent their emotions from getting the better of them. Those with cash should remain patient because we will likely see better prices in coming days.