There’s a spirited debate raging among economists about the long-run potential for growth in the US economy. Among those who expect that the future will suffer a lesser rate of growth is Robert Gordon, an economics professor at Northwestern and a member of the Business Cycle Dating Committee at the National Bureau of Research. In a series of papers recently (here, for instance), he argues that a number of trends (demographics, wealth inequality, falling educational results, rising debt levels) will squeeze the average annual growth rate of GDP in the decades ahead.

The case for managing expectations down is turning into a mini-career for Gordon. In yet another study released this week, he lays out his forecast from a slightly different perspective. This time he reasons that the economic activity that went down the rat hole in the Great Recession is forever lost and that official predictions by the Congressional Budget Office that assume otherwise are expecting too much. Gordon writes in his new piece that “if the projections in this paper are close to the mark, the level of potential GDP in 2024 will be almost 10 percent below the CBO’s current forecast.”

There’s no shortage of analysts who disagree with Gordon’s pessimistic outlook, but he’s hardly alone either. Andrew Smithers, for instance, cuts to the chase in a blog post at the Financial Times last month, writing that “the US recovery has been slow because its long-term capacity for growth has slowed.” A recent forecast from the OECD warns that “global growth will slow from 3.6% in 2010-2020 to 2.4% in 2050-2060 — due to ageing and gradual deceleration in emerging economies.” Meanwhile, Tyler Cowen at George Washington University has rocked the case for optimism with his 2011 book The Great Stagnation, which asserts that the low-hanging fruit that’s fueled growth in the past has been picked and so economic activity will be constrained from here on out.

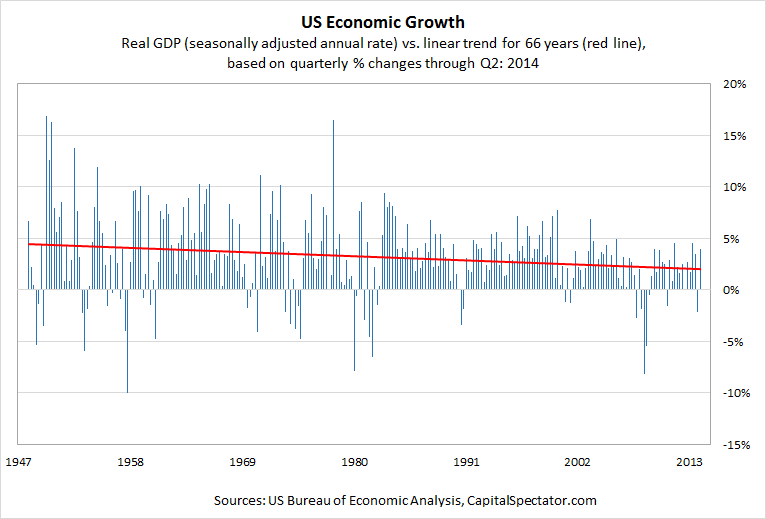

Forecasting is a mug’s game, of course, particularly when trying to predict events years ahead and accepting the guesstimates as gospel. But it’s interesting to note that the rearview mirror offers some support for the forecasts of Gordon, Smithers and Cowen. In short, the pace of GDP growth has been slowing, and for decades. As the chart below shows, the linear trend for quarterly changes in GDP since the late-1940s tips downward through 2014’s second quarter. The result doesn’t change if we look at the last 20 or 30 years of data.

Clearly, the crucial period that’s pushing the trend lower in recent years is the extraordinary slump in 2008-2009. It’s debatable if we should let this outlier event dominate the analysis of the trend. Then again, it’s clear that breaking free of the Great Recession’s blowback has proven to be unusually difficult. Although the US economy seems to be doing better lately, the recovery still has a long way to go to recover what was lost.

The good news, at least in this case, is that no one can really see decades into the future. It’s unclear what innovations might transform economic activity in ten or 20 years. Therein lies the best hope for thinking that the Gordons of the world underestimate the capacity for growth. That said, the case for optimism looks challenged these days. But this isn’t the first time that the business cycle has knocked the economy off its trend. The question is whether the historical record of revival remains intact? The answer is coming, but slowly, through time.