Is it possible for a bear market to occur when the U.S. economy is expanding? Certainly. In fact, most bear markets are already well on their way to becoming 20% price declines long before a recession is formerly identified.

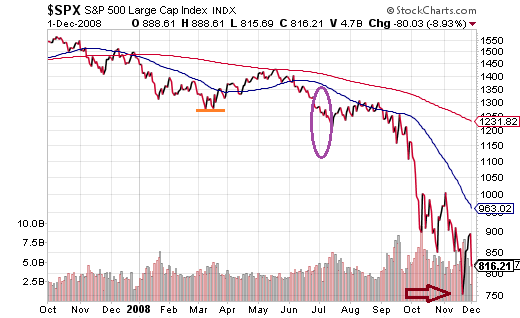

Consider the most recent bearish retreat (10/07 – 3/09). The National Bureau of Economic Research (NBER) officially declared on 12/1/08 that the U.S. recession had started in December of 2007 – a declaration that came nearly one year after the economic downturn’s inception.

Nine months before NBER expressed its “recession” call, the S&P 500 had already plummeted close to the 20% level (March, 2008.) At that moment, the Federal Reserve saved financial markets by joining JP Morgan Chase (NYSE:JPM) in bailing out Bear Stearns. Then, in the first week of July, five months before the NBER proclamation, the S&P 500 had descended more than the requisite 20%. And by the time anyone could count on an authenticated recession, the S&P 500 had already plummeted roughly 47.8% – close to half of its entire value.

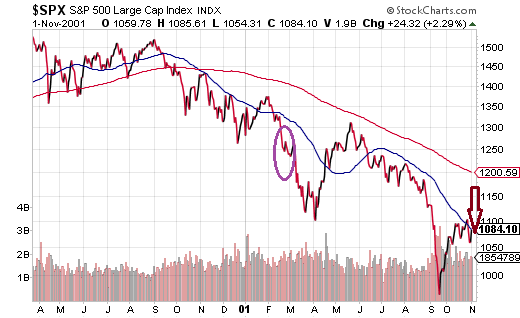

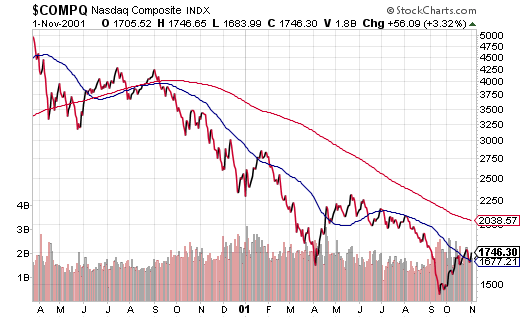

Well, okay. I suppose that the world’s best economists should err on the side of caution before making hasty decisions. Perhaps NBER, composed of academic economists from Harvard, Stanford and other top-notch universities, were quicker in warning investors prior to the 3/2000-10/2002 tech wreck?

Unfortunately, nine months before NBER expressed a March 2001 recession start in November of 2001, the S&P 500 had already made its bearish descent. (Nine months again?) It gets worse. The S&P 500 had already dropped 29% by November of 2001 and the “New Economy” NASDAQ had already plummeted 65%!

In spite of the obvious evidence that U.S. stock assets tend to fall long before the most prominent minds affirm contraction in the U.S. economy, an overwhelming number of analysts keep exclaiming that there is no recession in sight. And without a recession, they say, there’s not going to be a bear.

I am not sure this is an accurate statement. Since 1950, we have seen non-recession 20%-plus drops in 1962, 1966, 1978 and 1987. We have also seen non-recession drops that do not get the full benefit of the bear title (e.g., 1998’s Asian currency crisis/Long Term Capital Management, 2011’s euro-zone, etc.), yet reached the 20% threshold via “intra-day” price movement and/or “rounding.” What’s more, why do people automatically assign the recession tag to bear markets like the 3/2000-10/2002 tech wreck when the recession first began one year later in March of 2001? Perhaps because NBER later revised the recession date as having started in Q4 2000?

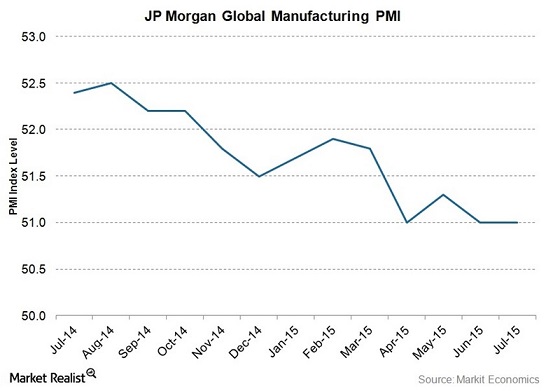

I have no idea if we will see a bear on this correction go-around or the next 10%-19% pullback or the one after that. What I do know is that the commodity slump has resulted in ConocoPhillips (NYSE:COP) slashing 10% of its global workforce; high paying oil jobs continue to disappear in a world of $45 oil. I also know that the Federal Reserve wants to hike overnight rates, likely raising the borrowing costs for consumers and businesses just as the Atlanta Fed expects Q3 GDP at an anemic 1.2%. Perhaps most importantly, I recognize that the U.S. economy is part of a global economy that has been decelerating. JP Morgan’s Global Manufacturing PMI is now at 50.7 where a reading below 50 would be indicative of a global manufacturing recession.

In mid-August’s “15 Warning Signs,” I discussed the reasons why a pullback from the market top was exceptionally likely. One week later, in “Don’t Blame China,” I talked about the reasons why investors should expect a relief rally. And in my Thursday (8/27) commentary, “Are You Selling The Drama Or Buying The Rally,” I wrote:

If history teaches us that benchmarks tend to retrace half of their losses before retesting their lows – if you feel like you’ve been here before and you don’t choose to be scarred like that again – perhaps you might anticipate better buying opportunities in the weeks ahead.

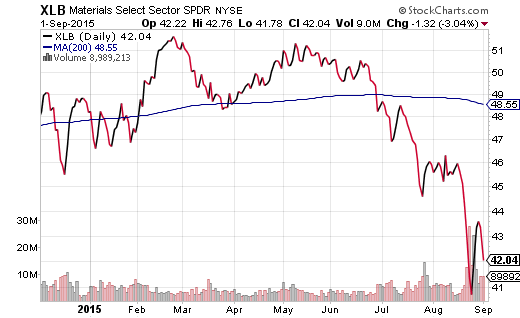

You should not be surprised by yesterday’s (Tuesday, September 1) extremely volatile move lower. The S&P 500 has moved back below the correction point of 1917 because the global economy is decelerating and investors are fearful that a rate hiking campaign by the Federal Reserve might be the straw that breaks the U.S. camel’s spine. And manufacturer-dependent sector funds like Materials Select Sector SPDR (NYSE:XLB) are taking the heaviest hits.

Do I think that a Fed tightening cycle might cause an imminent U.S. recession? Not if chairwoman Yellen and other committee members decide upon a sloth-like pace of one-eighth of a point every third meeting or a “one-n-done” quarter point that would not be revisited for six months.

Then again, I am not sure that the recession/non-recession matters as much as others do. Right now, U.S. stocks require clarity on rate policy more than they require anything else. The longer it takes for the Fed to provide clarity, the more U.S. stocks are likely to struggle.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.