We are in the thick of the second-quarter earnings season. As many as 1000 companies are scheduled to post their financial numbers this week, including 189 S&P 500 members.

Results till now have shown a modest improvement from the extremely weak levels over the last couple of quarters. However, growth is still non-existent. As of Friday, Jul 22, we saw Q2 results from 126 S&P 500 members that together account for 32.7% of the index’s total market capitalization. Total earnings for these members are down 1.1% from the same period last year on 2.6% lower revenues, with 70.6% beating EPS estimates and 55.6% coming ahead of top-line expectations.

Just like the other sectors, Technology is also likely to fall prey to earnings decline from the year-earlier level. Total earnings in the tech sector are expected to be down 3.0% on 2.7% higher revenues, compared to last quarter’s 4.5% earnings decline on 0.4% higher revenues. Excluding Apple (NASDAQ:AAPL), the tech sector’s earnings are anticipated to be up 3.5%. (Read more: Decisive Week for the Q2 Earnings Season)

However, given the surge in the adoption of smartphones, tablets and other mobile devices, Internet is still an attractive segment. Also, exponential growth in consumer spending online and continued advancement in technology is keeping investors’ interest in the sector alive.

Among all the companies slated to reveal second-quarter figures this week, let’s see what’s in store for these five Internet stocks on Jul 26.

Twitter, Inc. (NYSE:TWTR) recorded a positive earnings surprise of 46.15% last quarter. In fact, Twitter outperformed the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive surprise of 38.28%.

Notably, our proven model shows that Twitter is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This holds true for Twitter as elaborated below:

The Earnings ESP for Twitter is +6.67%. This is because the Most Accurate estimate stands at a loss of 14 cents while the Zacks Consensus Estimate is pegged at a loss of 15 cents. Meanwhile, the company has a Zacks Rank #3, which increases the predictive power of ESP. Therefore, the combination of Twitter’s Zacks Rank #3 and +6.67% ESP makes us reasonably confident in looking for an earnings beat.

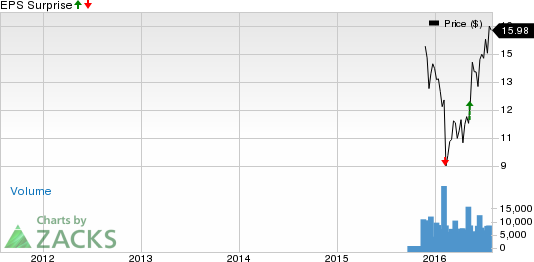

Match Group, Inc. (NASDAQ:MTCH) went public last November, and in its first earnings announcement as a publicly traded entity missed earnings estimates by 5.3%. The succeeding quarter was better, with the company’s earnings beating estimates by 20%.

For the current quarter, Match Group has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 13 cents. Match Group has a Zacks Rank #2, which increases the predictive power of ESP. However, a 0.00% ESP makes surprise prediction difficult. (Read more: Match Group Q2 Earnings Preview: What to Expect?)

MATCH GROUP INC Price and EPS Surprise

Zix Corporation (NASDAQ:ZIXI) recorded in-line results last quarter. Zix Corporation outperformed the Zacks Consensus Estimate just once in the last four quarters, with an average negative surprise of 0.42%.

For the second quarter, Zix has an Earnings ESP of +0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 6 cents. It currently carries a Zacks Rank #3. So, in this case, we can’t say whether the company will beat estimates this time around.

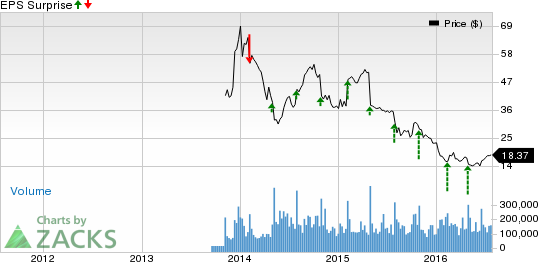

Akamai Technologies, Inc. (NASDAQ:AKAM) recorded a positive earnings surprise of 1.96% last quarter. Also, Akamai outperformed the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive surprise of 4.05%.

For the current quarter, Akamai has an Earnings ESP of +0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 50 cents. It currently carries a Zacks Rank #3. So, we can’t say whether the company will beat estimates this time around. (Read more: Akamai Technologies Q2 Earnings: What's in Store?)

AKAMAI TECH Price and EPS Surprise

Radware Ltd. (NASDAQ:RDWR) delivered a negative earnings surprise of 120.0% last quarter. Notably, Radware outperformed the Zacks Consensus Estimate just once out of the trailing four quarters, with an average negative surprise of 35.65%.

For the second quarter, Radware has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at a breakeven. The company has a Zacks Rank #2, which increases the predictive power of ESP. However, a 0.00% ESP makes surprise prediction difficult.

AKAMAI TECH (AKAM): Free Stock Analysis Report

RADWARE LTD (RDWR): Free Stock Analysis Report

MATCH GROUP INC (MTCH): Free Stock Analysis Report

ZIX CORP (ZIXI): Free Stock Analysis Report

TWITTER INC (TWTR): Free Stock Analysis Report

Original post

Zacks Investment Research