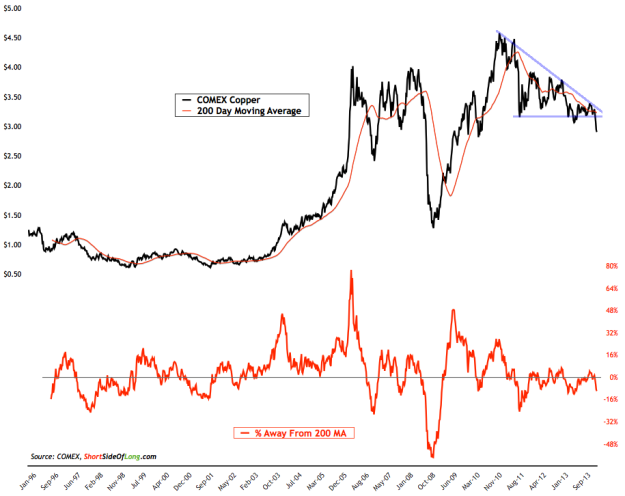

Chart 1: After a 3 year downtrend, Copper is moving into a panic sell off

In early February I focused on the commodity index breaking out. At the time I wrote that:

…Agricultural sector of the commodity index is finally starting to bottom out. And since agriculture makes over 40% of the CRB Index, it was one of the main reasons behind this weeks breakout.

Those exposed to Agricultural commodities have benefited over the last quarter, with Sugar and in particular Coffee outperforming S&P 500 by a large margin. However I also stated that Agricultural rally on its own is not enough to confirm a commodities bull market.

…it is important to get confirmation from the economically sensitive commodities before one should take a bullish stance. For example… Copper and Brent Crude are yet to break out of their respective downtrends.

Copper is one of the most important metals in the building sector and a great barometer of the overall Industrial Metals space, which has also not broken out yet. Moreover, Brent Crude Oil is a better gauge of global Oil prices relative to West Texas Intermediate Crude and a great indicator of the global economic activity.

In Chart 1 seen above and Chart 2 seen below, we can see that these important industrial commodities are NOT confirming the rally. Copper has already broken down and most likely moving into its final panic sell off after a 3 year bear market. On the other hand, Brent Crude has consolidated for three years and also should drop into oversold levels before one considers a bottom to be in place.

A strong sell off in both of these commodities could be a bullish signal that a final wash out has occurred. Rarely do bear markets go on for more than three years without a meaningful rally (this outlook goes for many commodities, majority of which peaked between early to mid 2011).

Chart 2: Brent Crude is at a decision point and a breakdown looks likely!