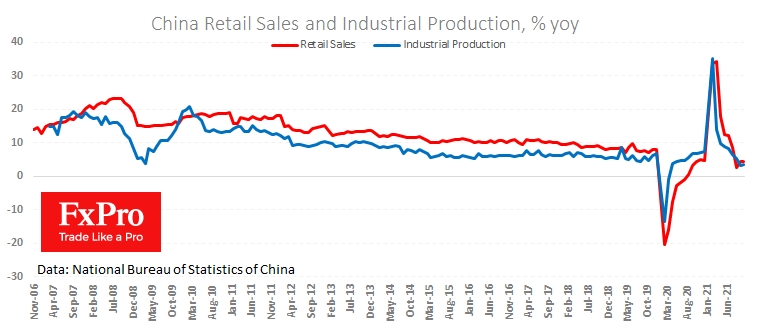

A new batch of data from China has somewhat dampened fears that the developer debt crisis has a toxic effect on the world's second-largest economy.

In October, industrial production expanded by 3.5% y/y compared with 3.1% a month earlier - the first acceleration in eight months. Retail trade growth rebounded to 4.9% y/y from just 2.5% in August.

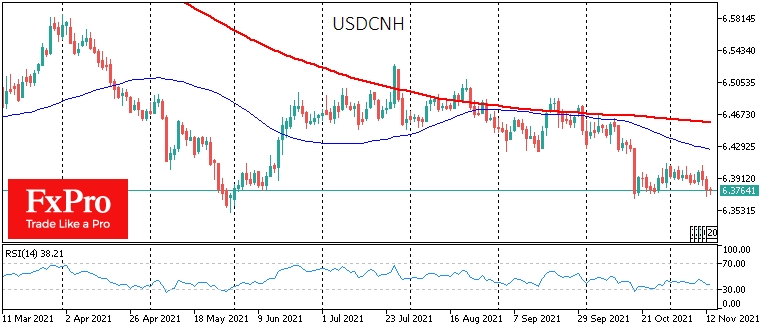

So far, this data does little to help China's stock market, which is cruising near levels of three months ago but does not spoil the Yuan's appetite.

The ability of the Chinese currency to add in the face of stock market problems and the rising dollar is worth noting. Investors should consider whether this Renminbi dynamic results from short-term market inefficiencies or a manifestation of a paradigm shift.

The dollar index, which measures the fluctuations of the US currency against a basket of the euro, yen, pound, Loonie, Swedish krona and Swiss franc, reached its highest since July 2020, above 95 last week.

The upward trend in the dollar formed in early summer with the first firm signals from the Fed for a reversal of monetary policy to tighten, and the DXY has added 6% in that time. However, since July, the Chinese Renminbi has already countered this wave of pressure by adding 2%, making it the second-best performing currency year-to-date.

This looks like a resounding victory for the Renminbi because historically, the currencies of emerging countries and China are falling faster than the DM currencies on Dollar strength. So, it’s a double victory, given all the problems IT giants and developers have had in the meantime.

The markets appear to be sharing the flows of the currency and stock markets rather than running away from the Renminbi as they did in the early volleys of the trade wars in 2018.

With the current USD/CNH quote near 6.38, the Chinese Renminbi is near the year's highs against the dollar. A drop below 6.35 could have a dam-breaking effect with a further acceleration of the Chinese currency.

The chances of such an outcome will strengthen if we see a corrective DXY pullback in the coming days. In that case, we might see more investors looking at the Renminbi differently to emerging markets, viewing it as a stable currency in times of uncertainty and a young competitor to the dollar.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ignoring China's Problems And The Rise Of The Dollar, Yuan In A New League

Published 11/15/2021, 10:32 AM

Updated 03/21/2024, 07:45 AM

Ignoring China's Problems And The Rise Of The Dollar, Yuan In A New League

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Hi sir i can help you sir in how to used it

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.