In the movie the Hunt for Red October, Sean Connery plays Marko Ramius, a Soviet Union submarine commander, who wants to defect to the United States. Jack Ryan, played by Alec Baldwin, plays a CIA analyst who attempts to prevent Ramius’ stealthy submarine from attacking American soil.

October has historically been viewed as a bloody period in the stock market, given the multiple October crashes occurring in 1929, 1987, and 2008. However, the large number of bears and skeptics who were on a hunt for red (losing) October were rudely surprised last month. Rather than plunging in value, stocks ascended to new record green heights. Specifically, the S&P 500 index rose +4.5% in October, bringing 2013′s total climb to +23.2% (NASDAQ +29.8% for the year).

While the Soviet “Cold War” may have ended in the early 1990s, when it comes to retirement and financial assets, the emotional war for a prosperous future seems to never end for those without an investment plan.

How Can it Be?!

As the financial markets have recently grinded to new all-time record highs, I still stumble across a vast number of skeptics and doubters. These cynical cats make comments and ask questions like:

- “You’re shorting the market, right?” (i.e., betting prices will go down)

- “I’ll just get in and buy when the market goes down.”

- “How can the stock market keep setting new highs when the economy is so weak?”

- “This country is going to hell in a handbasket…what are these politicians in Washington thinking?!”

- “The only reason the market is up is due to the Federal Reserve’s money printing and artificial manipulation of the financial system.”

These are but a few of the widespread concerns, and understandably so because fear, uncertainty, and doubt are exactly what media outlets shovel in the faces of the masses. However, unlike humans, the financial markets do not watch TV or listen to the radio. As famed investor Benjamin Graham notes, “In the short run, the market is a voting machine but in the long run it is a weighing machine.” Or in other words, emotions can rule the short-term, but positive or negative fundamentals will rule the day over the long-term.

While the concerns listed above may have some validity, here are some alternative perspectives to help explain why patient investors have been rewarded:

Record Profit

Source: Ed Yardeni (Dr. Ed’s Blog)

This isn’t the first or last time I’ve focused on earnings data. At the end of the day, my investment philosophy that “prices follow earnings” aligns with legend Peter Lynch’s views:

“People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

Stocks are Cheap (Not Expensive)

Despite the massive run-up in prices, stocks are cheap. There are some metrics that show equity prices as fairly valued, but there is plenty of data to support why stocks have and continue to be loved.

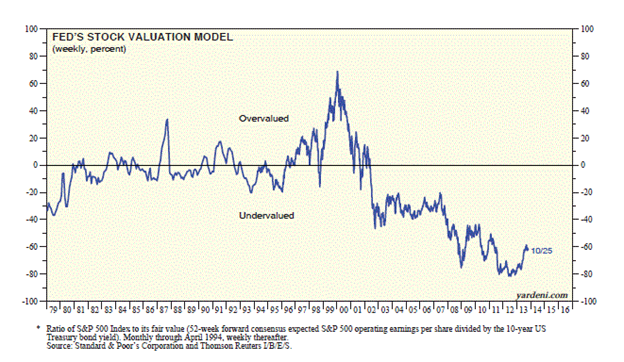

Source: Ed Yardeni (Dr. Ed’s Blog)

Although the Federal Reserve’s economic model above shows how overvalued technology stocks were during the late-1990s bubble, eventually the speculative period burst. On the flip side, you can see how attractively priced (undervalued) stocks look today (prices are significantly below the historical average).

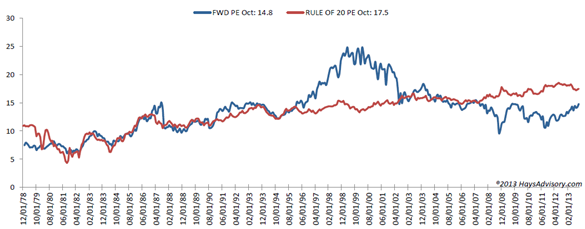

If that’s not enough evidence for you, take a peek at strategist Don Hays’s “Rule of Twenty” chart below. If you go back multiple decades, you can see a fairly tight correlation between the blue line (stock valuation/prices) and red line (Rule of 20), which creates an estimated fair value target that integrates inflation. So as you can see, when the blue line rises above the red line, stock prices are overvalued. Once again, you can see that stocks currently are relatively cheap historically (blue line below the red line), based on Hays’s analysis.

Economy Keeps Chugging Along

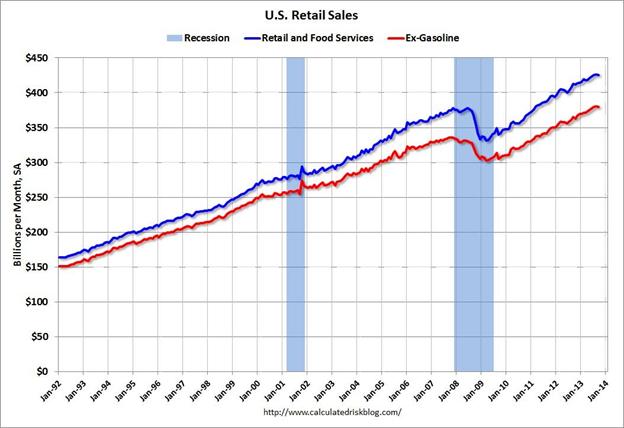

The job market has improved dramatically, housing prices have rebounded, and families have lowered the debt on their balance sheets. The net result of these developments is evidenced by record consumer spending at retail (see chart below):

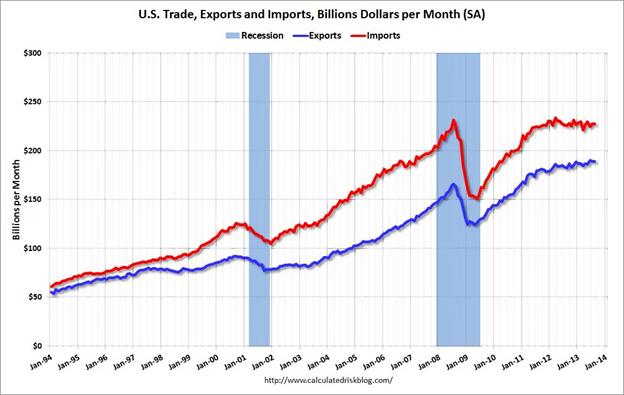

The 15 out of 16 quarters of economic growth as measured by Gross Domestic Product (GDP) have also been assisted by record exports (see chart below). Even though growth in the U.S. remains sluggish, innovative companies have found creative ways to export unique goods and services abroad.

Even though Halloween is behind us, there are still bound to be some scary tricks ahead of us, including heated debates over government shutdowns, debt ceilings, and sequestrations. The key to a successful financial future is having a balanced, diversified portfolio that meets your long-term objectives, while helping you avoid investment torpedoes. Investing based on emotional, knee-jerk reactions to noisy mainstream media headlines is a sure way to sink your portfolio. That’s advice I’m sure Jack Ryan could agree on. If investors follow this guidance, their Hunt for Red October can turn into green portfolios.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.