When I called my editor and told him that I was going to write today's column showing you how to double your money with Google – now known as Alphabet (NASDAQ:GOOGL) Inc. – he reacted like many investors do…

…But, that stock is $800 a share!?

Yep… but that doesn't mean you have to give up on it.

Today I want to show you a powerful Total Wealth Tactic that could double your money even with a pricey stock like Google… for pennies on the dollar.

Here's what you need to know.

Make 2X Your Money

Most investors dream big, and rightfully so.

Companies like Google are the stuff legends are made of. Every $1,000 invested in the internet behemoth when it IPO'd would be worth $18,800.00 today.

If you're rolling your eyes at that statement, you're not alone.

For most investors, Google is a painful reminder of an investment they should have made, but didn't. It's the "one that got away" and they're scared to touch it today… either because they think they don't have time to wait, or it's too expensive.

I understand, but let's get those things off the table right now because they're self-defeating.

If you're going to make investment decisions based on what you didn't do, then you may as well try to drive while looking out the rear view mirror.

Google is a power player and, as such, it's the company to beat.

Not only is the Silicon Valley giant redefining the internet, but Google has 10 or more $100 billion businesses within it that have yet to be unlocked, involving everything from artificial intelligence to cloud computing, self-driving cars, and more. That means the stock is going to move.

But in which direction? And how do you play that at $800 a share without getting burned?

A quick look at the chart suggests Google stock is trending higher in what traders call a "bullish channel." It's not pretty, but it's quite clear and it points sharply higher. What's more, that's on top of a textbook perfect breakout earlier this week when the stock shot up to close at an all-time high of $801.50 after trading as high as $804.63.

That's important because the first step in making any trade is to have an opinion about what happens next. In this case, it's that Google is going to move higher.

My guess is to the psychologically important $1,000 a share range, and that means you're going to have to have deep pockets to play along.

A single share will set you back around $800. A round lot of 100 shares will lighten your wallet to the tune of $80,000. Either way, you'll be risking a lot of money for a 25% gain.

So let me show you an alternative that could do dramatically better.

The trade I'm going to share with you today is known as a "vertical call spread." It involves simultaneously buying and selling two different call options and it has the potential to double your money even if Google moves just $10.

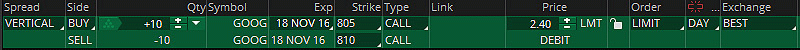

In this case, you'd buy the November $805 strike calls and sell the November $810 strike calls for a total cost of $2.40 per share, or $240 per spread. If Google closes at or above $810 on Nov. 18, this trade will be worth $500 per spread, which means you will have made 108% on your money, excluding fees and commissions for simplicity.

Not bad, eh?

I particularly like vertical call spreads because they help keep risk to razor-thin levels. That's obviously very important in today's markets, which is why they're such a powerful Total Wealth Tactic.

Instead of risking the $80k that'd be required for 100 shares to make 25% if the stock moves to $1,000 a share, this trade means you've got $240 per spread on the line and you'd only need about a $10 move to double your money. Buy 10 spreads and your total risk is still only $2,400.

If you're starting to get a wry grin on your face as you consider the profit potential, that's good… because here's something else that's very important.

Learning how to use vertical call spreads means that you'll never have to go "all in" like the vast majority of investors do. Most people think only about the potential to capture a 100% gain, but the real magic in a trade like this one is that you'll never inadvertently risk a catastrophic wipeout again because you can trade with far smaller blocks of capital.

What's more, vertical call spreads are cheap – meaning they're inexpensive. That gives you the ability to assemble a much broader portfolio than would otherwise be possible. Plus, you'll still have the kind of potential that puts a huge Cheshire-cat grin on even the most jaded investors' faces.

And if you're wrong? That happens to everybody sooner or later if you are in the markets long enough.

The key with vertical spreads is that you know what you are risking to the penny every time. There is no guessing and no emotional decision making in the heat of battle like there would be when a stock is going against you.

Last but not least, vertical call spreads like the one I've described can be a great way to participate in trades you couldn't otherwise afford to touch. There are more than 3,000 optionable stocks to choose from in every industry and segment you can imagine. There are even optionable indices and ETFs, if that's more your speed.

Now, I can hear your brain clicking… what about stocks that are going down?

That's a great question, and a relevant one at the moment.

Vertical spreads work in reverse, which means that you can apply the thinking I've shown you today to stocks that are going down or about to go down, too. Only then you'll be buying a vertical put spread, which I'll save for another time and another column.

What I want you to understand today is that expensive stocks like Google are still tradable. They're not out of reach like most people think and the media would have you believe. Best of all, they can still be a source of huge profits.

In closing, a special note.

Options require pre-approval from your broker. You can't just pile in or pile on. Like every investment, they involve the potential for loss, so you want to make sure you understand what you're getting into.

Fortunately, that's usually a fairly simple and straightforward process depending on your knowledge, what you want to trade, and the strategies you intend to use.

Speaking of which, sometimes a double isn't good enough. I'm actually tracking a few trades using this strategy that could quintuple your money…

…and I'll share those with you in the weeks ahead.