After weakness on Monday and Tuesday, stock market bulls were trying to regain the upper hand Wednesday after the latest Federal Reserve minutes were released. From MarketWatch:

Federal Reserve officials have decided to end its asset purchase program in October if the economy stays on track, according to the minutes of the June meeting released Wednesday. According to the plan, the Fed will make a $15 billion final reduction at its October meeting, after trimming it by $10 billion at each meeting up to that point. After a discussion of its exit plan, Fed officials generally agreed to keep reinvesting the proceeds of securities that mature on its balance sheet until after it had hiked interest rates.

Volatility To Respect?

After rallying 170 points between April 11 and July 3, the S&P 500 “gave back” 21 points on Monday and Tuesday. The longer you study markets and investor psychology, the more apparent it becomes that your investment approach should balance these two basic objectives:

- We need to leave our investments alone long enough to make money. All things being equal, we prefer to trade less, rather than more, frequently.

- When prudent, we need to adjust our portfolios to avoid the next inevitable bear market or financial crisis.

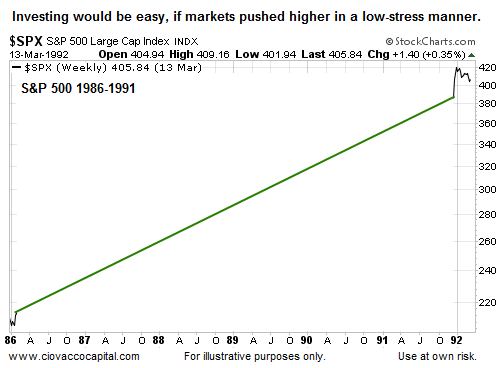

Without Volatility Investing Would Be Easy

If volatility was not part of the equation, we could all “stay the course” while capturing the S&P 500’s 78% advance that occurred between early 1986 and late 1991 (see graph below).

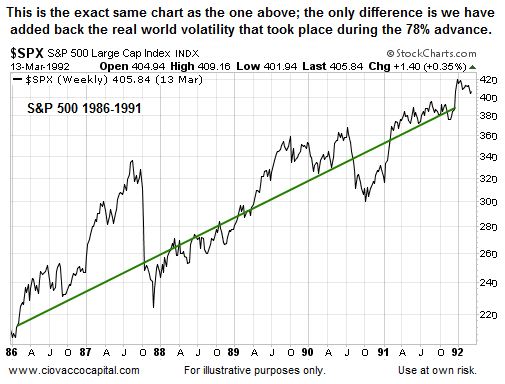

Unfortunately, markets are not that easy. Capturing even a portion of the 78% gain was much more difficult in the real world, which is marked by regular ups and downs during any market advance.

How About Recent Volatility?

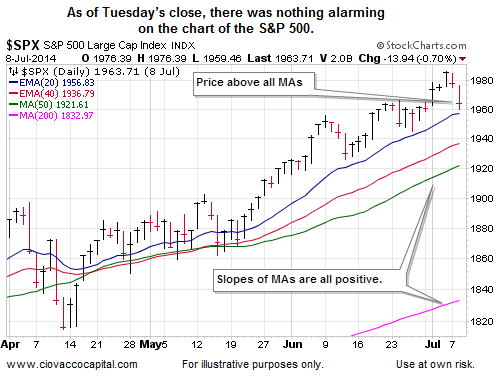

From a probability perspective, there are numerous ways to help discern between “volatility to ignore” and “volatility to respect”. One method, described in detail in this 2008: Was There Anything Investors Could Have Done video, is to use moving averages as a guide. How did the moving averages (MAs) look as of the close on Tuesday, July 8? As shown in the chart below, the market was still in “volatility to ignore” mode.

It Is New To You If You Have Not Seen It

Since the topic of dividend investing falls outside of our writing norms, you may have missed yesterday’s analysis of the performance of blue-chip dividend payers during the last bear market. The table below provides some insight. The entire piece, including five more tables, can be found here.

Investment Implications - No Changes

Based on the evidence and our disciplined rules, we made no allocation changes during Monday and Tuesday’s pullback in stocks. We continue to hold U.S. stocks SPY) and leading sectors, such as technology QQQ). Since there are always things to be concerned about (valuations, earnings, Fed taper, Europe, Iraq, etc.), we will continue to monitor the hard evidence with a flexible and open mind.

Thus far, the reaction to earnings season has been favorable, or at least not bull market derailing. From Bloomberg:

U.S. stocks rebounded from a two-day selloff as optimism over corporate earnings and jobs growth overshadowed central-bank concern that investors may be growing complacent about the economic outlook. Alcoa Inc. jumped 6.1 percent after kicking off earnings season with better-than-forecast results. American Airlines Group Inc. rallied 4.2 percent after raising its margin forecast. Facebook Inc. advanced 3.3 percent to pace gains among a gauge of technology shares.

Thursday brings a report on weekly jobless claims. The market will also be monitoring the comments from several Fed speakers, including Charles Evans on Friday afternoon. Never a dull moment.