In many ways, this week won’t be as exciting as the last when investors were waiting with bated breath to see if the September nonfarm payrolls report would push the Fed over the edge and drive them to raise interest rates in October. However between 3 central-bank announcements, a number of Fed speeches and manufacturing/employment reports from a few countries, it can and should be be an active trading week.

Our focus is on AUD, CAD and GBP. The USD started the new trading week firm but there’s not enough on the calendar to take USD/JPY out of its 118.25-121.75 trading range and EUR/USD out of its 1.10-1.14 range. An October rate hike from the Federal Reserve is off the table and the most important piece of U.S. data this week – the non-manufacturing ISM report failed to incite big moves in the greenback. According to ISM, U.S. service-sector activity grew at its slowest pace in 3 months. However this report isn’t necessarily a reflection of weakness in the U.S. economy because the slowdown came after very strong growth in July. The service sector expanded at its fastest pace in nearly 10 years this summer. The rally in the dollar along with the rise in stocks and Treasury yields tells us that investors are hopeful that the U.S. economy is still on track and the Fed will raise interest rates before the end of the year. The minutes from the September Fed meeting are scheduled for release on Thursday but since the meeting was held before the latest NFP report, which caught many policymakers by surprise, the impact on the dollar should be limited.

Fed speak will be the central focus for U.S. dollar traders but only 3 of the 6 policymakers scheduled to speak this week are voting members of the FOMC and all are doves. Therefore the chance of USD/JPY extending Monday’s gains to break out of the triangle pattern remains slim. We heard from Rosengren (nonvoter) in the early hours and he felt that the weak jobs report showed that the Fed was right to delay its hike in September and 2% growth is needed for rate liftoff this year. December is a close call and even if some policymakers believe it is still possible, none of them will vote to raise interest rates until there is a significant improvement in labor data.

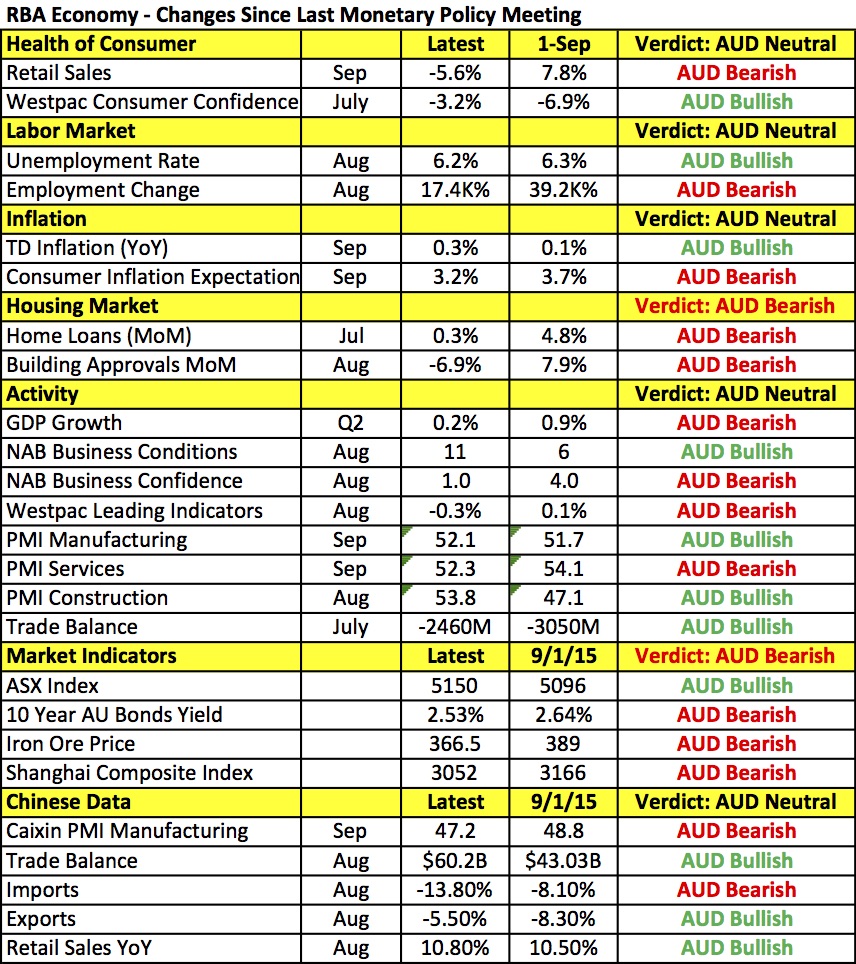

So that leaves our focus on the 3 central bank rate decisions and Canadian manufacturing and employment numbers. The Reserve Bank of Australia was widely expected to leave interest rates unchanged at 2% Monday night. The last time the RBA cut interest rates was in May and while the Chinese economy and their stock market struggled since then, Australia’s central bank did not feel enough concern to lower rates. They maintained a dovish bias that is not likely to have changed significantly this month because according to the table below, there have been just as much improvement as deterioration in Australia and China’s economies since the September meeting. On balance, we believe the RBA should be a bit more concerned about their economic outlook and if the RBA lets out a tinge of pessimism, AUD/USD could erase Monday’s gains.

The Bank of England also has more to be worried about. The latest PMI reports show weaker manufacturing and service-sector activity. Sterling sold off in response to the latest reports and while we are still looking for a reversal in GBP/USD, on a technical basis, sterling looks poised to test 1.51. Whether this level holds will hinge upon the minutes from the Bank of England’s monetary policy decision. If the central bank is still concerned about wages, which increased further since the last meeting, it could ignite a stronger recovery in sterling.

After rising strongly in the last 2 weeks of September, USD/CAD reversed fast and hard last week. The sell-off in the currency gained traction Monday and if this week’s Canadian economic reports are weak, we could see USD/CAD test 1.30. The change in trend was driven by a combination of weaker U.S. data and a rebound in oil prices. Canada’s trade balance and IVEY PMI numbers are scheduled for release Tuesday followed by the employment report on Friday. With economists looking for a larger trade deficit and weaker manufacturing activity, USD/CAD could settle above 1.30.

The Japanese yen traded lower against all of the major currencies on Monday. While part of the move was driven by the improvement in risk appetite, demand for the yen was also hit by weaker data. Service-sector activity slowed and labor cash earnings grew at a weaker pace. The Bank of Japan meets this week and with data taking a turn for the worse, the central bank could grow more dovish and warn that further easing in Q4 is possible.

The euro also lost ground versus the greenback following softer data. Service-sector activity in September was revised down with Germany experiencing slower growth. We are beginning to see a major disconnect between the Eurozone’s 2 largest economies. France is starting to recover at a faster pace while Germany is beginning to slow. If the weakness deepens, the Bundesbank could pressure the ECB to increase stimulus (though the chances now are still very low).

Finally, NZD/USD rose nearly 1% to its strongest level in more than a month, making the New Zealand dollar the day’s best performer. No economic reports were released from New Zealand but there are high hopes for Tuesday’s Global Dairy Trade Auction. Dairy prices rose sharply at the last 3 auctions and if this momentum is sustained, investors will look at 62 cents as the bottom in NZD/USD.