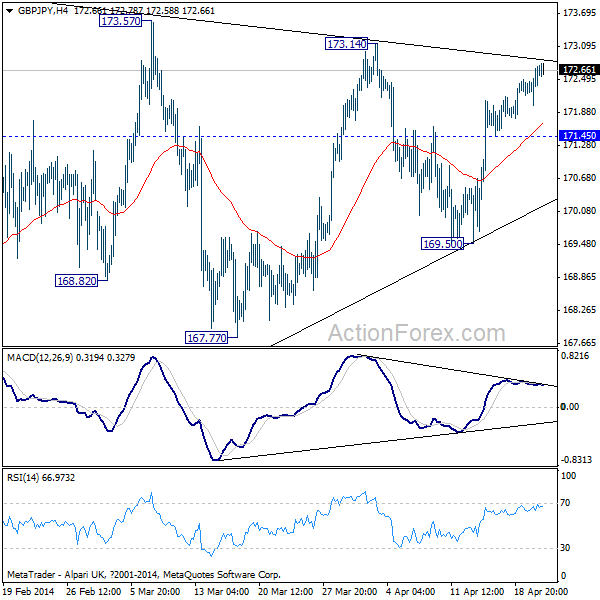

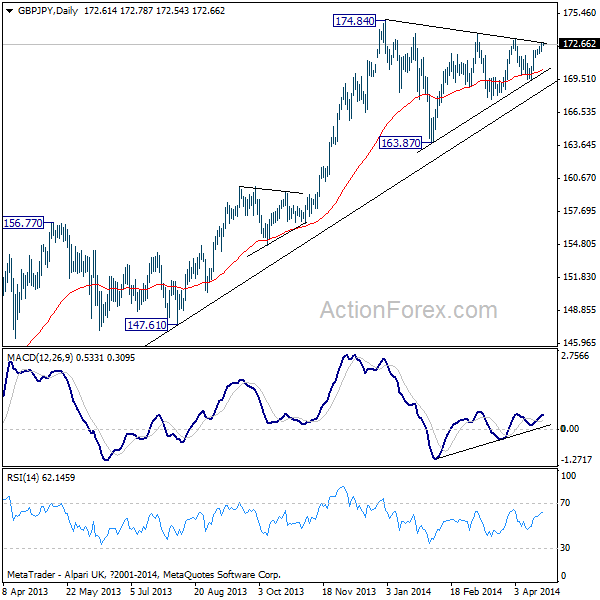

GBP/JPY

Daily Pivots: (S1) 172.17; (P) 172.45; (R1) 172.90;

No change in the GBP/JPY's outlook. While further rally cannot be ruled out, strong resistance would likely be seen at 173.14 to limit upside to bring reversal. Overall, price actions from 174.84 are viewed as a consolidation pattern with rebound from 163.87 as the second leg. Below 171.49 minor support will turn bias to the downside. Break of 169.50 will suggest that the third leg of the consolidation has started and would target 167.77 support and below. Above 173.14 will extend the second leg but we'd expect strong resistance from 174.84 to bring reversal to extend the consolidation pattern.

In the bigger picture, the up trend from 116.83 (2011 low) might still extend to above 174.84. Nonetheless, upside momentum is rather unconvincing as seen in weekly MACD. Thus, even in that case, we'd expect strong resistance from 50% retracement retracement of 251.09 to 116.83 at 183.96 to limit upside. Meanwhile, sustained break of 163.87 support should confirm medium term topping at 174.84 and bring deeper decline to 147.61/156.77 support zone next.

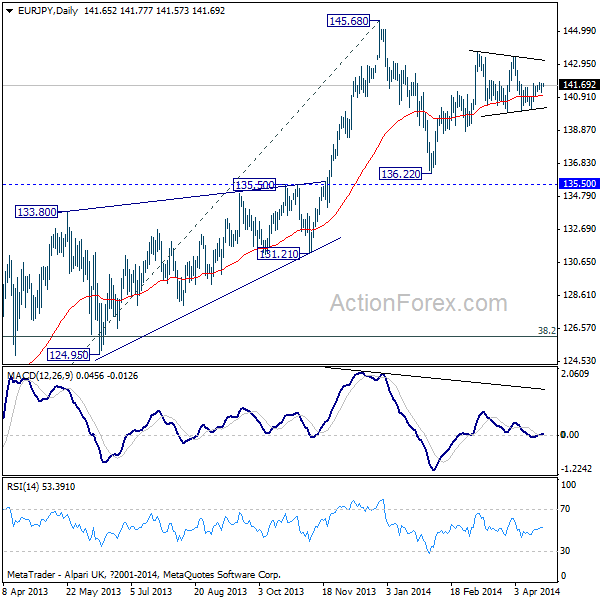

EUR/JPY

Daily Pivots: (S1) 141.32; (P) 141.54; (R1) 141.88;

The EUR/JPY continues to stay in range of 139.95/143.78. Intraday bias stays neutral and outlook is unchanged too. Price actions from 145.68 are viewed as forming a consolidation pattern with rise from 136.22 as the second leg. Break of 139.95 will revive that case that such second leg has completed. In such case, outlook will turn bearish as the third leg should have started for 136.22 support and below. Above 143.78 will extend the second leg but in that case, we'd expect strong resistance below 145.68 to limit upside and bring reversal.

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in daily and weekly MACD. However, EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.