It’s been a bumpy year for biotech stocks.

Industry index funds are down by double digits. The main culprit? A rash of bad PR.

2016 has seen a number of scandals and botched clinical trials from big names like Theranos and Valeant Pharmaceuticals International Inc (NYSE:VRX). Most recently, Mylan (Nasdaq: NASDAQ:MYL) made headlines when it hiked EpiPen prices by 400%... while at the same time raising salaries for top executives.

These negative stories have put the healthcare market in a sour mood. But believe it or not, there’s still plenty of upside in the sector.

You just have to know where to look.

In truth, biotechnology isn’t a single industry. It’s made up of several distinct fields of medical research and development. Most of the pessimism is centered around the field of treatment drugs.

But many other areas, like genomics, surgical tech and vaccines, have been doing just fine.

We’re going to look at some biotech stocks that aren’t focused on the more volatile pill-making industry. These three companies have actually seen double-digit gains over the course of this year.

Genomics

Thanks to advances in technology, it’s a great time to study DNA. The genomics industry has seen impressive growth in recent years. And looking forward, it has a forecasted compound annual growth rate of more than 15%.

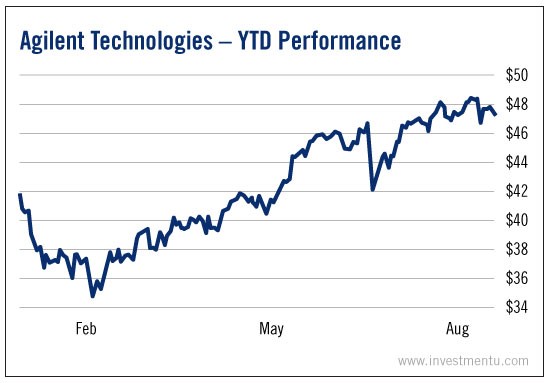

One company that’s pushing the field forward - and rewarding shareholders in the process - is Agilent Technologies (NYSE:A).

The company was spun off from HP Inc (NYSE:HPQ) in 1999. Since then, it has grown into a market leader in genetic analysis, cloning and lab equipment.

Agilent is up by more than 14% from the beginning of the year, and it’ll likely push higher.

In the last year, it has had newsworthy breakthroughs in two areas: lab-grown meat production and heart disease research. (It’s an elegant business model - one project feeds the other.)

On top of that, Agilent has beaten earnings estimates for two quarters running.

Surgical Tech

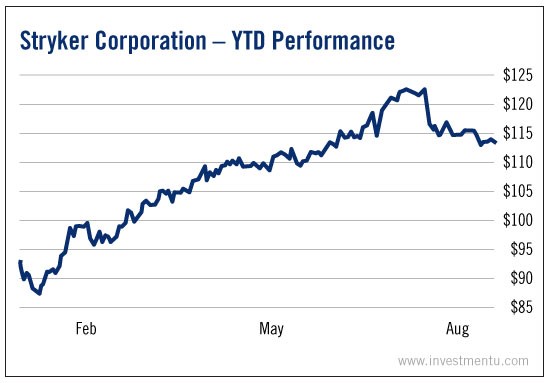

With an aging population like ours, there’s high demand for safe and effective surgical technology. One of the biggest makers of joint replacements, operating room supplies and neutrotechnology devices is Stryker Corporation (NYSE:SYK).

The company has led the S&P 500 in terms of relative strength. And, despite a skittish earnings report last quarter, Stryker shares are up by more than 22% this year.

As long as there are bad knees and hips to be replaced, Stryker should continue to grow.

Vaccines

The Zika outbreak in Florida is scary stuff. But for investors, there’s a silver lining. Recent public health scares have meant big gains for the vaccine industry.

It’s certainly been a good year for Inovio Pharmaceuticals Inc (NASDAQ:INO).

Several of its vaccines and immunotherapy products have passed Phase I trials. Some of Inovio’s most ambitious projects include prophylactics for Zika, Ebola and Hepatitis B. They’re a big part of why shares are up more than 38% year to date.

To learn more about investing in the race for a Zika vaccine, check out our article here.

It’s easy to feel gloomy about the biotech market’s prospects. Industry headlines are dominated by controversy from a few “bad apple” companies. But the treatment drugs industry is just one component of this multifaceted sector.

Many biotech stocks are doing better than ever. And unless we cure death itself, there will only be more opportunities to profit.