Gold may be in the first stage of a significant rally.

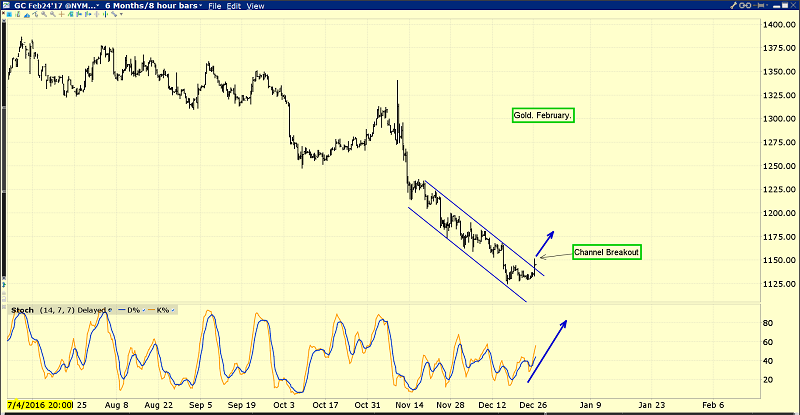

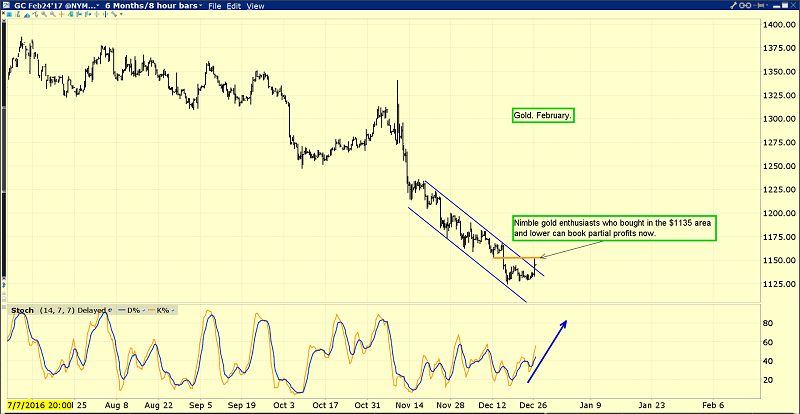

Gold has burst out of the short-term down channel, and the recent action of the “smart money” commercial traders is very positive.

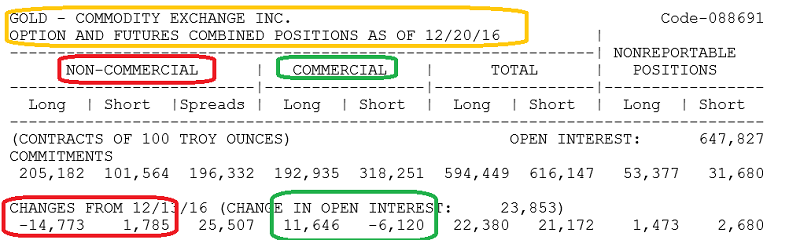

This COT report for gold shows the commercial traders not only covering short positions in the latest reporting period, but also adding a nice number of longs.

This is very encouraging news. Regardless, amateur gold enthusiasts need to buy dips and sell rallies, to mimic the smart-money professional traders.

Gold has already rallied about $25 from the $1125 area lows, and the commercial traders are almost certainly booking partial profits now. As the saying goes, the early bird gets the golden worm.

I have been getting emails from some gold community investors who are worried that the Indian government is conducting a“war on gold.” To a degree, that’s true, but all governments tend to prefer debt and fiat to gold.

Gold empowers citizens and debt and fiat money allow governments to present themselves as grandiose “people helpers”.

Narendra Modi is India’s prime minister. In my professional opinion, he’s obsessed with turning India into what is really best described as a giant GDP growth factory.

Individual freedom in India doesn’t seem very important to Modi. His focus is on achieving double-digit GDP growth and creating an enormous middle class.

Modi clearly embraces the “end justifies the means mantra,” but I don’t think it’s negative for gold demand, except perhaps in the very short term.

In the big picture, Modi’s actions are very supportive for higher gold demand. Simply put, as citizens get higher incomes, they buy more gold. Some is bought in the open market, and some is bought in the black market.

The short-term picture for India-focused gold investors is starting to look better as well. While nobody should celebrate before there is an actual duty cut, where there is smoke, there is fire.

Modi looks like a hypocrite if he talks about reducing black money while keeping high gold import duty policies that promote smuggling. The upcoming February budget could see India’s finance ministry finally unveil a cut of the duty.

Meantime, from a geopolitical perspective, tensions may be set to increase between Japan and China, with US debt being the catalyst.

Some analysts note that Japan has now surpassed China and is the largest holder of US T-bonds.

The term “surpassed” is a bit misleading. Japan actually sold Treasuries recently, although China sold more.

China and Japan have a longstanding dispute over a military issue that has never been resolved. I’m not concerned about Donald Trump causing a deterioration in US-China relations, but I’m very concerned that he could ignite a significant rise in China-Japan tensions. That’s good news for gold.

A crash in the US stock market is possible early in 2017, and it could happen soon after Trump is inaugurated as president. That crash would create an institutional surge out of the US dollar and into the yen and gold.

That crash could cause Japan and China to sell even more Treasuries, as their stock markets would follow the US market.

The current time frame may turn out to be the calm before a major 2017 global markets storm.

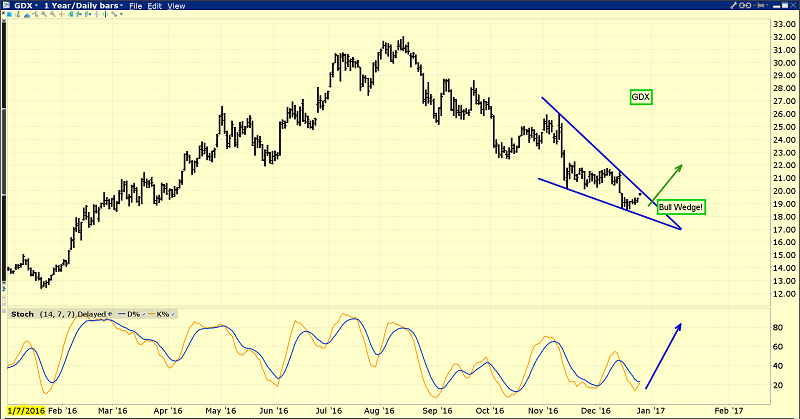

With inflation starting to perk up while mine reserves dwindle, gold stocks are poised to become a highly sought after asset for the rest of this decade.

From both a fundamental and technical perspective, GDX looks superb. There’s a bull wedge in play, and the price is gapping higher in early morning trading.

GDX looks set to make a beeline straight for $22. The bottom line is that there’s really no better way for a global community investor to start their day, than by watching gold stocks move higher!

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?