Weekly CFTC Net Speculator Gold Report

Gold speculative positions boosted higher last week

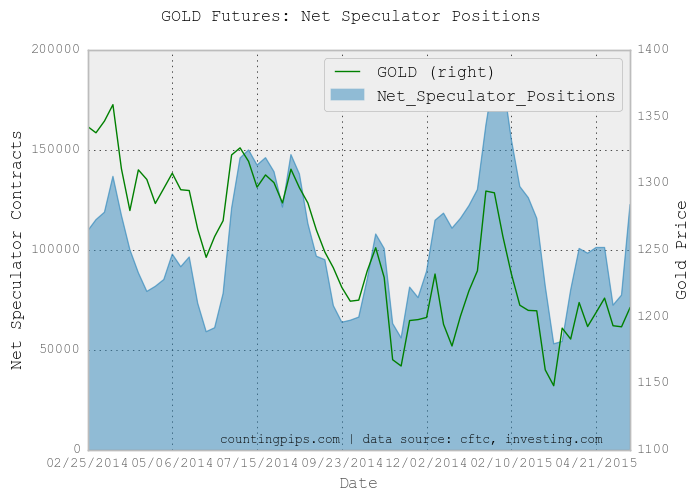

GOLD Non-Commercial Positions:

Gold speculator and large futures traders pushed their gold bullish positions sharply higher last week to advance for a second straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +122,621 contracts in the data reported through May 19th. This was a weekly change of +45,181 contracts from the previous week’s total of +77,440 net contracts that was registered on May 12th.

The results in the weekly net speculator positions (+45,181 net contracts) was due to a rise in the weekly bullish positions by +22,933 contracts combined with a decline in the weekly bearish positions by -22,248 contracts.

Over the weekly reporting time-frame, from Tuesday May 12th to Tuesday May 19th, the gold price advanced higher from approximately $1,192.40 to $1,206.70 per ounce, according to gold futures price data from investing.com.

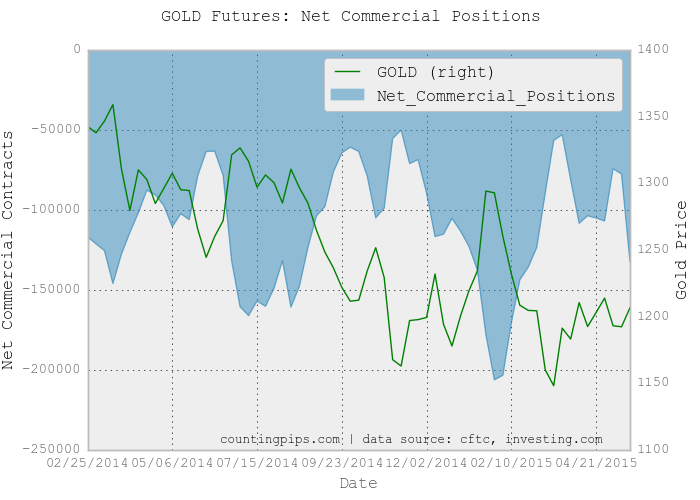

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) increased their overall bearish positions to a net total position of -132,334 contracts through May 19th. This was a huge weekly change of -54,832 contracts from the total net of -77,502 contracts on May 12th.

COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).