Fundamental Forecast for Gold:Neutral

- Gold Price: Trying to Resume Long-Term Down Trend

- US Dollar Once Again in Control versus British Pound, Gold Prices

Gold prices plummeted this week with the precious metal off by more than 2% to trade at 1137 ahead of the New York close on Friday. The decline snaps a 2-week winning streak for bullion prices after reversing sharply off technical resistance on Monday. The pullback eyes near-term support ahead a key U.S. data print that may largely dictate the outlook for September.

Much of gold’s advance has been driven by fears that a slowdown in China coupled with a strengthening dollar and subdued inflation may limit the Fed’s scope for a September lift off. However commentary out of committee members this week suggests that the central bank may yet still be on pace with Fed Vice-Chair Stanley Fischer largely arguing that a rate hike is still on the table as the central bank remains ‘data dependent.’ In contrast, recent remarks from New York Fed President William Dudley may be pointing at a growing rift within the committee as the permanent voting-member sees a ‘less compelling’ case for higher borrowing-costs.

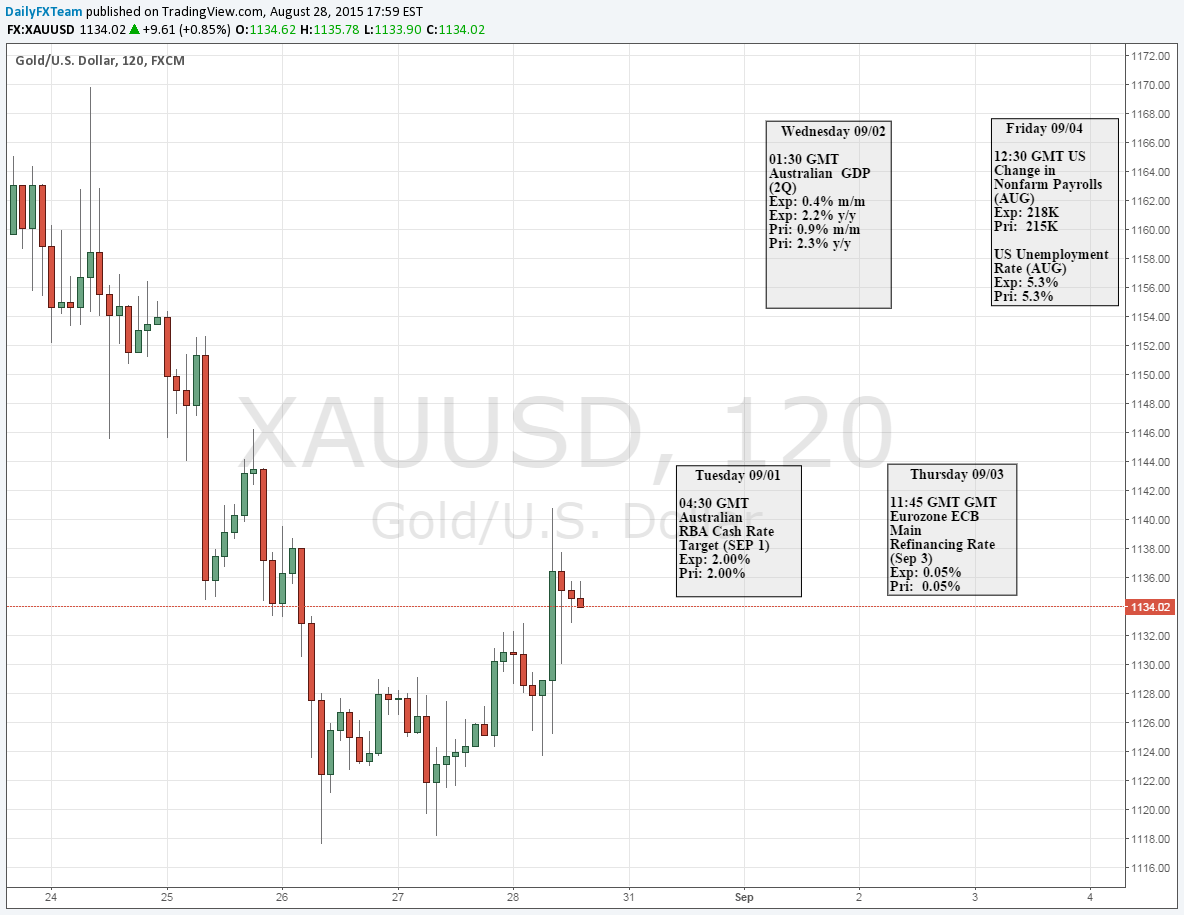

Looking ahead to next week, traders are likely to eye the August Non-Farm Payroll report with greater importance especially as consensus estimates calling for another 220K expansion along with a downtick in the unemployment to an annualized 5.2%. Signs of a further reduction in labor market-slack may boost interest rate expectations as the central bank remains largely upbeat on the economy, and a positive reaction in the greenback could dampen the appeal of the precious metal and fuel the recent selloff.

We noted last week that from a technical standpoint, “rallied nearly 8% off the lows with the advance eyeing a resistance confluence just higher at 1170 where the 61.8% retracement of the May decline converges on the upper median-line parallel extending off the 2014 high.” Indeed the gold advance fizzled just pennies shy of the 1170 barrier before plummeting more than 4.4% before paring a portion of the losses into the close of the week. Interim support stands at 1.1120 backed by key support at 1095/98 where the monthly open converges on the low-week & low-day closes. A break below this level puts the resumption of the broader bear trend back in focus targeting the 1067. Resistance now stands at 1154 with a breach above 11170 needed to invalidate the broader downside bias. We’ll be looking for the monthly opening range to offer more clarity with NFPs on Friday likely to spur added volatility in bullion prices.