Gold Preserves June Range- Watch Greece, U.S. NFP Report for Cues

Fundamental Forecast for Gold: Neutral

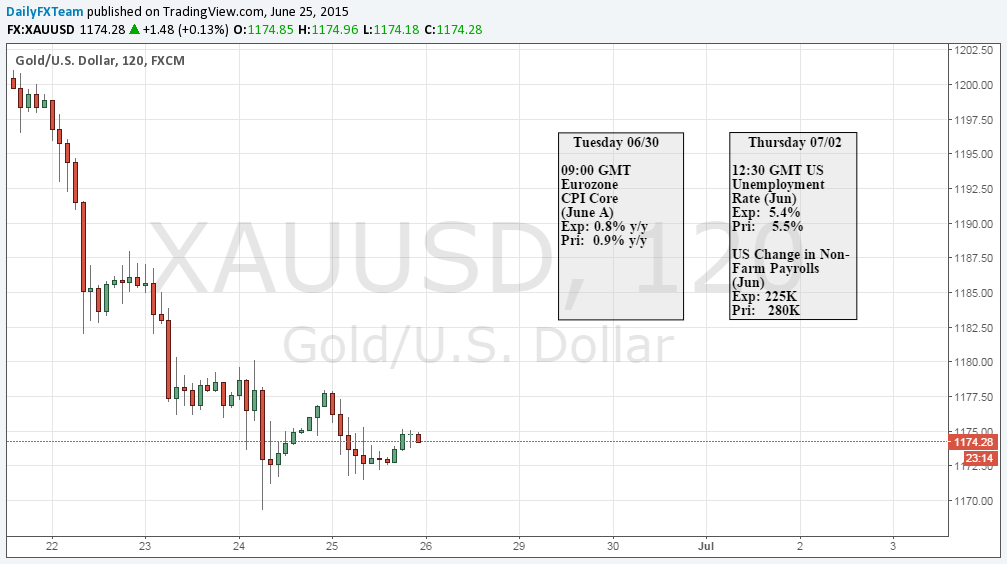

Gold prices plummeted this week with the precious metal down 2.2% to trade at 1174 ahead of the New York close on Friday. The losses amounted to a 5 day losing streak with prices breaking back below the 2015 open early in the week. Bullion is down just 1% on the year as lackluster price action drags on volatility expectation with a stronger dollar, improving US data and expectations for higher rates from the Federal Reserve continuing to sap demand for the yellow metal.

Looking ahead to the shortened holiday week, the June U.S. Nonfarm payroll release on Thursday will be central focus with consensus estimates calling for a print of 230K as unemployment ticks lower to 5.4%. Aside from the headline figure, market participants will be closely eyeing the wage inflation figures as subdued price growth remains a growing concern among Fed officials. Look for strong data to continue to weigh on gold prices as interest rate expectations are adjusted. In addition, European headlines & key PMI data out of China next week may also impact prices amid the ongoing concern surround the outlook for the global economy.

The lackluster price action has been the symbol of indecision for the markets with the ongoing turmoil in Europe surrounding the Greek crisis offering little upside for gold. From a technical standpoint, prices have held within the initial monthly opening range with gold rebounding off basic trendline support extending off the 2015 low on Friday. Note that momentum has been coiling up since the start of the year and we’ll look for a breakout in both momentum and price from the recent range for further guidance on our medium-term directional bias. Although the broader bearish outlook is back in focus, we’ll take a neutral stance heading into next week / July trade with a break below this month’s range targeting critical support down into 1150/51.