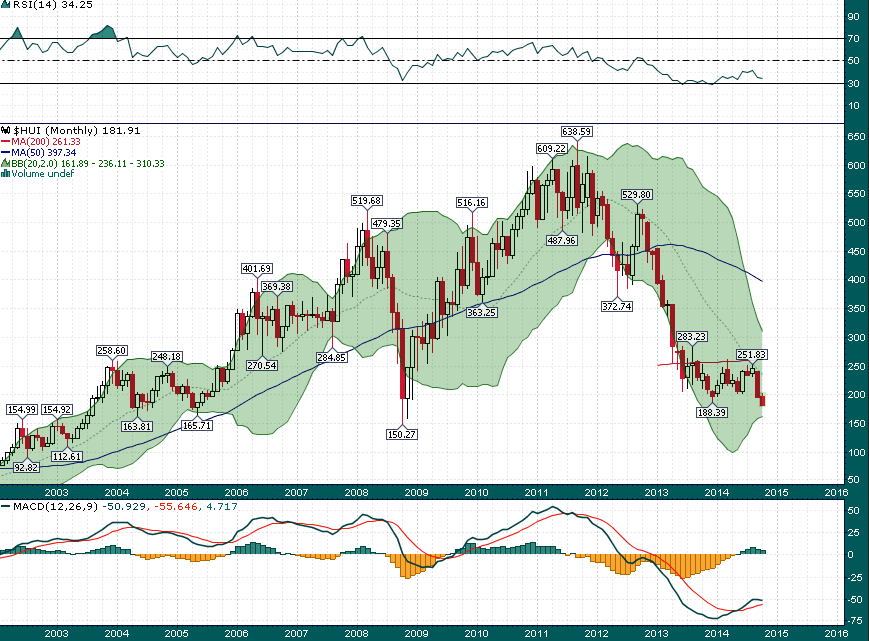

An especially brutal round of hedge fund/mutual fund tax-loss selling this week -- most fund companies have fiscal years ending October 31 -- has sent gold-mining shares tumbling to levels not seen since the 2008 Global Financial Crisis (GFC):

Gold shares have performed poorly since Tuesday even as the price of gold rose above $1250/ounce in a clear indication that much of the liquidation was prompted by portfolio rebalancing and/or tax planning purposes. In a bull market such uneconomic liquidations would not leave much of a footprint. However, many stocks have fallen 5-10% in the past 3 trading sessions, reflecting the current morose climate for the sector.

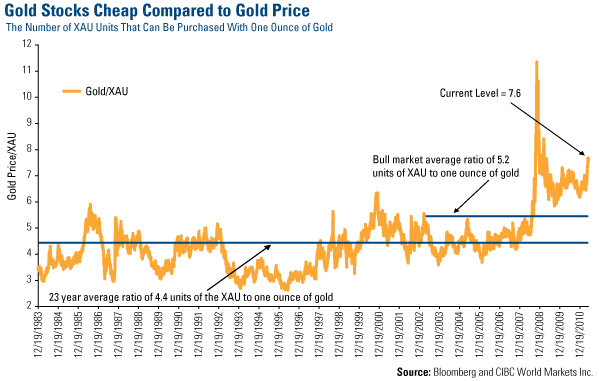

This has left gold-mining shares trading at the lowest relative valuation to the price of gold in history:

The above chart goes back to 1993, however, during the 70s and 80s gold stocks traded at lofty valuations relative to gold as illustrated by the below chart of one ounce of gold divided by the Philadelphia Gold/Silver index:

The fact is that gold stocks are cheap on a historical comparison basis. This relative cheapness begs two questions:

- Why are gold stocks so cheap?

- Is this the buying opportunity of a lifetime?

The first question is easier to answer than the second question – gold stocks are cheap for a number of reasons:

- Investors have lost confidence in the gold mining sector after many years of disappointing performance both in terms of corporate profitability and share prices

- The consensus opinion is that gold prices will fall over the coming years with many analysts targeting $1,050-$1,100 over a 12-month time frame (a price that would make many mines uneconomic from an all-in cost perspective)

- Rising costs of mining both in terms of exploration & production

- Enormous challenge of finding new high-grade mines of economic scale in safe jurisdictions

- Several big name investors (Einhorn, Paulson) have lost huge amounts investing in gold miners in recent years, further adding to public disgust toward the sector

- Textbook cyclical sector rotation out of materials and mining during the final stage of the stock market bull cycle

The answer to the second question is more nuanced. All of the evidence still indicates that gold is currently undergoing a cyclical bear market correction (less than 40% from its high) within the context of a secular bull market that has not reached its ultimate peak. However, gold mining shares are undoubtedly in the throes of a painful secular bear market that has taken valuations to historic lows.

This quote from famous hedge fund manager Barton Biggs is apropos:

Secular bear markets in the past have always taken valuations back to the levels at which the preceding bull market started, or even lower. Price to book value is the most stable measure of value, because it is not sensitive to the cyclical swings of the economy as all measures of earnings are.

Given that many senior gold producers are currently trading below book value (share price/book value <1.0) and sentiment couldn’t be worse on the sector, all the ingredients are in place for a bear market bottom. The 2008 GFC took valuations in the sector right down to a price/book value of 1.0 before sharply reversing back above 3.0 twelve months later.

The difference between now and late-2008 is that while valuations are cheaper than ever before, in late-2008 there were several major bullish catalysts that were on the verge of coming to the fore (China stimulus, US stimulus, global central bank balance sheet expansions, etc.). In the current climate it is difficult to foresee the catalysts that will ignite gold shares to rise from the ashes. It is more likely that this bottoming process, which began last summer has another 6-9 months left in it.

The current dynamic in the gold mining space reminds us of one of our favorite investing quotes from legendary investment manager Howard Marks:

Make no mistake, fortunes will be made by those who invest wisely in the gold space during this period. However, investors will need time and patience.