Saxo Bank CIO and chief economist Steen Jakobsen pinged me via email with some of his thoughts on who to believe and which assets to hold.

Steen says “gold long, weak US growth, Fed is lost, and negative interest rates make no sense.”

Email from Steen:

I have been doing this job for close to 30 years now. Through that time I have worked with some of the best talents in trading in the world, I have also had the pleasure of meeting many great business people, but in my world there is two or three people who I:

- ALWAYS listen to

- ALWAYS respect

- ALWAYS need to check my world view against

Some of these are private, but the most public one, and the only person I am a “fan” of is Stanley Druckenmiller.

He is not only one of modern history’s best fund managers, but his analysis is crisp, clear and open minded. He is far more diplomatic than me – and better – in expressing those views, but tonight’s speech by Druckenmiller at Sohn Conference confirms to me my long held view:

- Gold is the superior asset in present part of cycle

- Fed is lost – totally lost and nothing they say match their action

- Negative interest is worst policy mistake ever

- Debt is and remains the elephant in the room

Here is a quick note from Druckenmiller’s speech:

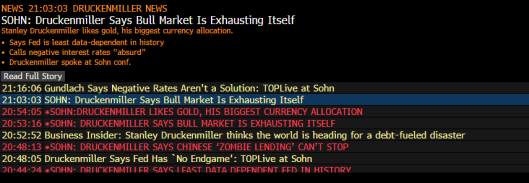

Stanley Druckenmiller warned on Wednesday that the Federal Reserve’s low-rate policy is creating vast long-run risks for the US economy.

Mr Druckenmiller, a billionaire former hedge fund manager, said at the Sohn Conference in New York that Fed policymakers are “raising the odds of the economic tail risk they are trying to avoid”, such as spurring credit bubbles, by keeping interest rates near historic lows.

Mr Druckenmiller reckons current economic conditions suggest the Fed’s benchmark interest rate should be closer to 3 per cent. “This is the least data-dependent Fed in history,” he said.

Mr Druckenmiller said the “longest period ever of easy monetary policies” has caused groups to borrow at a quick clip and then use the funds in ways that are not economically productive. For instance, he noted that “most of the debt today has been used for financial engineering,” in the form of stock buybacks and other methods that provide a boon to corporate profits and are often cheered by investors.

He said that contrasts with other periods, such as the 1990s, when debt was used to craft the building blocks of the Internet.

Stanley Druckenmiller: Corporate America, China And The Fed Are Stuck – Buy Gold

“I have argued that the myopic policymakers have no endgame,” billionaire Stanley Druckenmiller said towards the end of a scathing twenty-minute romp through all of the world’s economic problems.

The U.S. debt is out of control, China is even worse and the worst offender is the Federal Reserve, Druckenmiller said. Corporations in the United States are stuck in the mud, forelorn of growth, unwilling to invest and addicted to share buybacks to gin up their stocks.

It is a sentiment Druckenmiller has had for years, but at the Sohn conference the famed hedge fund manager indicated he means it this time.

Eleven years ago, Druckenmiller warned the Sohn audience of then Federal Reserve chair Alan Greenspan’s blunders in inflating an epic mortgage bubble that was sure to crash.

On Wednesday, he said the bubble inflated by former chair Ben Bernanke and current chairwoman Janet Yellen is many magnitudes worse. The Fed, Druckenmiller said, is using low interest rates to ease borrowing costs and smooth over problems in the global economy.

This radical central bank accommodation is leading to unproductive investment, and is an issue that is even worse in China, an engine of global demand.

Whether it is S&P 500 Index corporations, U.S. households or the state-managed economy in China, Druckenmiller believes cheap money is borrowing from future growth, and will backfire spectacularly.

“While policymakers have no endgame, markets do,” he said. Druckenmiller is increasingly nervous about risk assets and recommended investors take refuge in gold.

Bull Market Exhausting Itself

Reckless Behavior

ZeroHedge offers this commentary - A Very Bearish Stanley Druckenmiller Blows Up At The Fed; Reveals His Biggest “Currency” Position:

The Fed “causes reckless behavior” said Druckenmiller, adding “the Fed has no endgame and the end objective seems to be preventing the S&P from having a 20% decline.”

“Some regard it as a metal, we regard it as a currency and it remains our largest currency allocation” he said, without naming the metal.

We know what he was talking about. Gold.