As the Swiss referendum on gold draws ever nearer with polls suggesting that the nation is favoring a NO vote, it’s time to revisit the gold chart ahead of what is likely to be seminal period for the precious metal, with the final decision due on the 1st December next week.

From a fundamental perspective, with regard to the poll, the latest surveys suggest the yes vote is currently around the 38% – 40% level, but with at least 15% of the population yet to decide. One major bank has already expressed a view that this proposal is unworkable for two reasons. First it is unsound financially for the SNB to invest 20% of its assets in a single commodity or asset, and secondly, the referendum makes it illegal for the bank to sell any of the gold it acquires, now or in the future. In other words, there are strings attached, and perhaps even more profound would make it almost impossible for the bank to sell this asset in the future, undermining the principle concept of a bank’s reserve. Whilst the prospect at present is of a no vote, should this reverse, trading in the foreign exchange markets could see some extreme and volatile price action with the SNB selling it reserves of euros to start the asset buying programme. Ahead of the vote we have already seen moves in the EUR/CHF with the implied volatility rising to reflect this uncertainty, and with the SNB also defending the 1.20 floor for the EUR/CHF, this would add further pressure to the pair, and a dramatic increase in volatility.

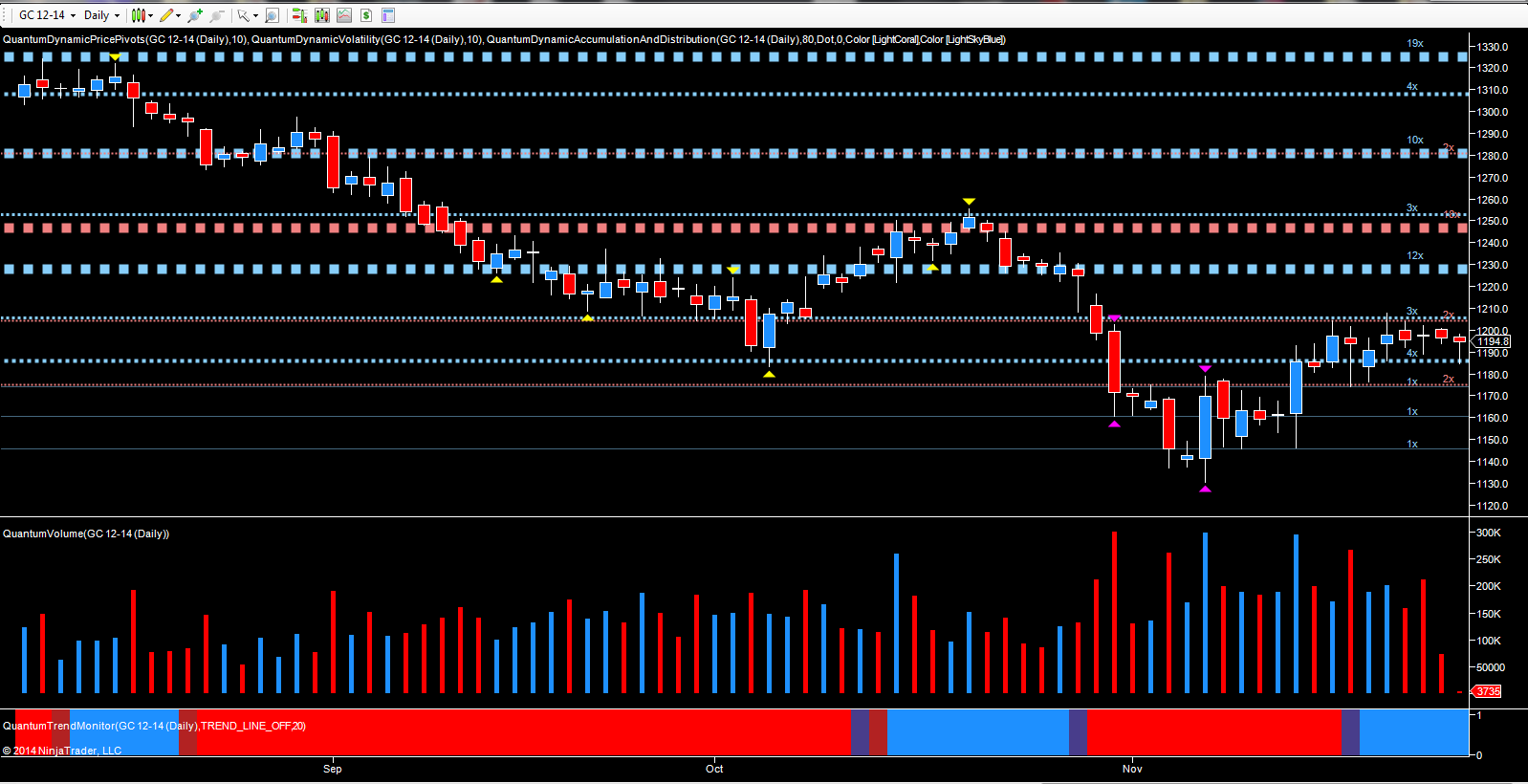

For the metal itself, November has been a month of modest recovery following the sustained and relentless selling pressure that has seen gold fall steadily throughout 2014, punctuated with attempts to reverse this trend, all of which have failed to date. The current move higher was initially signalled with the ultra high volume on the 7th November and also confirmed with the volatility indicator, which was duly validated a week later with the wide spread up candle supported with high volume once more and confirming the short term bullish sentiment. Since then, its progress has been halted as the deep resistance overhead in the $1205 per ounce region has capped further gains, with gold now struggling to breach this level. Now with the imminent vote and the US markets closed for a long weekend, we are unlikely to see any significant moves in the next 48 hours. That may all change once the Swiss people have given their answer, and Monday is likely to be an interesting one both for gold, and the related currency markets, and particularly the EUR/CHF. As always it will be volume that signals the buying and selling in all these markets, confirming the price action and validating any moves. Gold bugs will be hoping for a happy end to this dismal year, but for them, much now hinges on the Swiss people themselves.