Canada has a new Prime Minister. His name is Justin Trudeau.

“Trudeau has pledged to run small budget deficits and spend on infrastructure to stimulate economic growth, which has been anemic for years. He has also promised to raise taxes on high-income Canadians and reduce them for the middle class.” – Reuters News, October 20, 2015.

I have sarcastically suggested that US President Obama’s most successful program has been “Obombacare”. Horrifically, the United States government has borrowed trillions of dollars that it could not afford to borrow, and wasted it on endless wars in the Mid-East.

In contrast, China has spent and committed enormous amounts of borrowed money to infrastructure spending, and so has India.

Canada has now clearly chosen to follow the Asian model, leaving America and Europe to fall even further by the “new era wayside”.

As a result, I’m immediately issuing a prediction for the Canadian dollar to begin a major rising trend in 2016.

Chinese demand for commodities related to domestic consumption (like oil) is not falling. It’s relentlessly rising.

Oil is not a huge play for me, but it is a decent asset, and it is on sale. I expect oil to rise 50% to 100% over the next 18 months, and I’m a very enthusiastic buyer of oil stocks.

Chinese oil companies are poised for a big rebound, but most US oil companies should also take part in the coming “upside fun”.

China is staging a planned and highly successful transition from an exports oriented economy, to one focused on domestic consumption.

In my professional opinion, China is going to accomplish in three years, what it took the empires of the past (including America and England) to accomplish in thirty years, in similar transitions.

Over the past several years, numerous statements and documents have been released by the PBOC (Chinese central bank), about the internationalization of the yuan, and the key role of gold in making that happen.

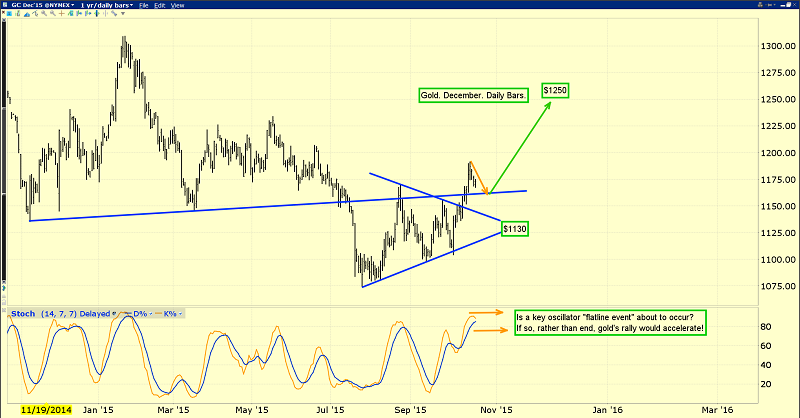

That’s the daily gold chart, and it looks magnificent.

After a breakout from a triangle pattern, a pullback to the apex (about $1130 in this case) is always likely. That’s another look at the same gold chart.

It’s clear that a possible bull pennant pattern is forming, with fairly dramatic upside implications for the price of gold.

I realize that I was pretty much alone in the Western gold community, in predicting that a massive rally would begin when the last jobs report was released at 8:30AM on October 2nd, but that’s exactly what happened.

Now, I’m going to go out on a second limb, and ask the community to be open to what is best termed as, “a momentum-fuelled phase transition”, to an even stronger rally.

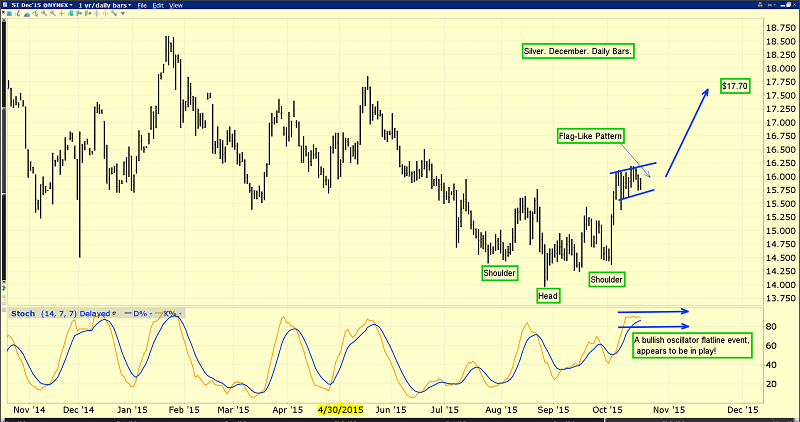

That’s the daily silver chart. The flag-like pattern in play now, comes after a key breakout from an inverse head and shoulders pattern.

I’m a keen owner of silver and silver stocks, which are now poised to begin outperforming gold. Silver enthusiasts don’t need to own more silver than gold to benefit from a period of outperformance by silver. They just need to own a decent amount of this mighty metal.

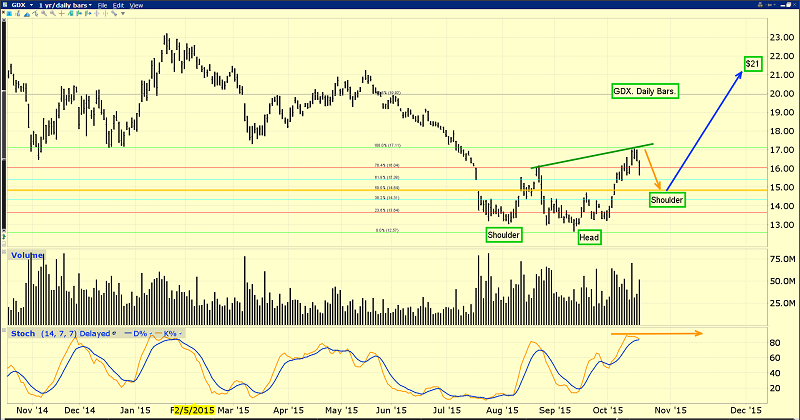

If gold’s rally does extend now, gold stocks should also extend their rally. That’s the daily (N:GDX) chart.

Many gold stocks have rallied 100% and more, from the September lows, and GDX itself is up significantly. A pullback is welcome, expected, and adds to the positive technical picture.

Using Fibonacci retracement lines, a 50% pullback would put GDX at just under $15.

More importantly, that pullback would create a bullish right shoulder of an inverse head and shoulders bottom formation.

Note the enormous volume that has occurred since mid-July. It’s clear to me that GDX and its underlying gold stocks are moving directly from weak hands to very strong ones. If GDX does trade under $15 this week, I’d like to see the entire Western gold community pressing their gold stock buy buttons, in unison!

Thanks!

Cheers

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?