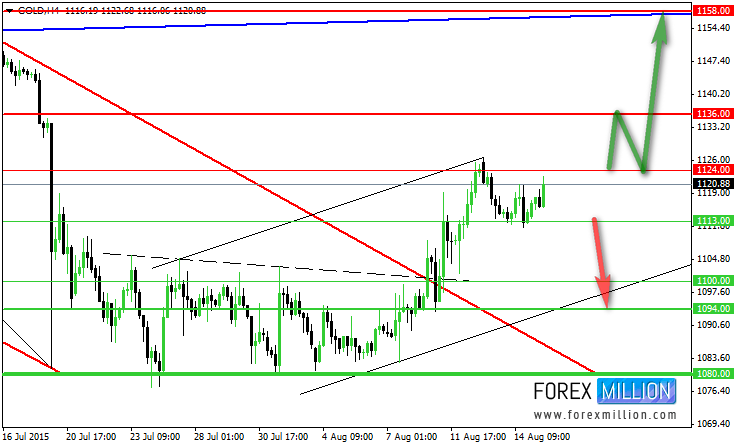

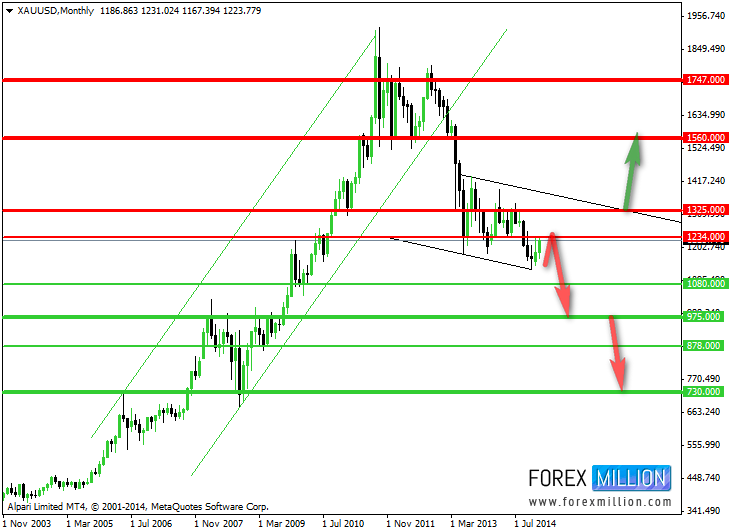

Main scenario:

The pair is trading along an uptrend.

The uptrend may be expected to continue while pair is trading above support level 1124, which will be followed by reaching resistance level 1158.

Alternative scenario:

An downtrend is not expecting today.

Previous forecast:

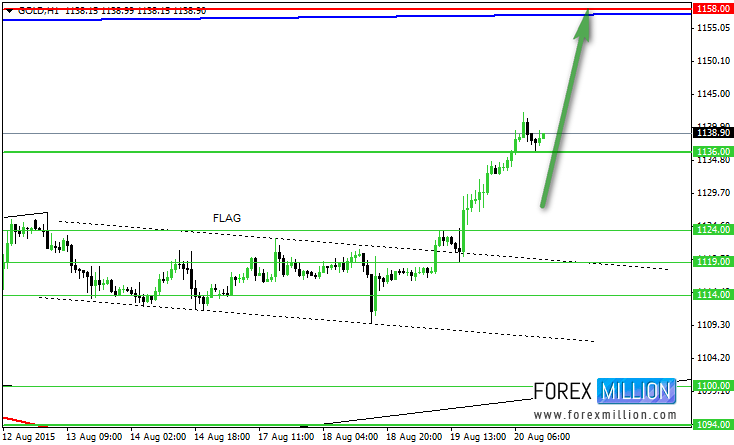

Weekly Forecast, 17 - 21 August

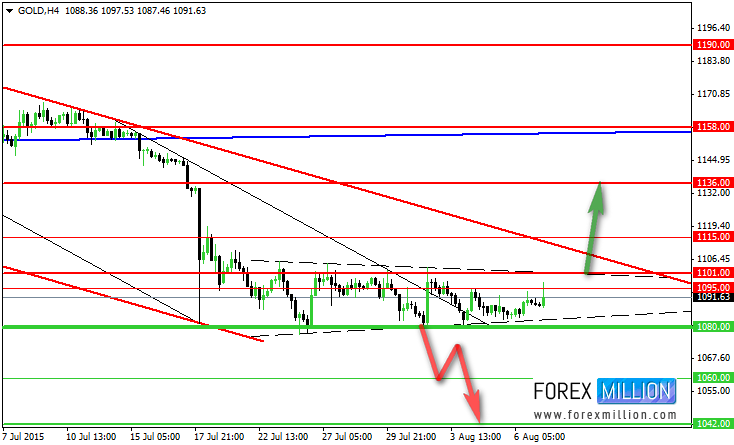

Main scenario:

The pair is trading along an uptrend.

The uptrend may be expected to continue in case the market rises above resistance level 1124, which will be followed by reaching resistance level 1136 and then to 1158.

Alternative scenario:

An downtrend will start as soon, as the pair drops below support level 1113, which will be followed by moving down to support level 1094.

Previous forecast:

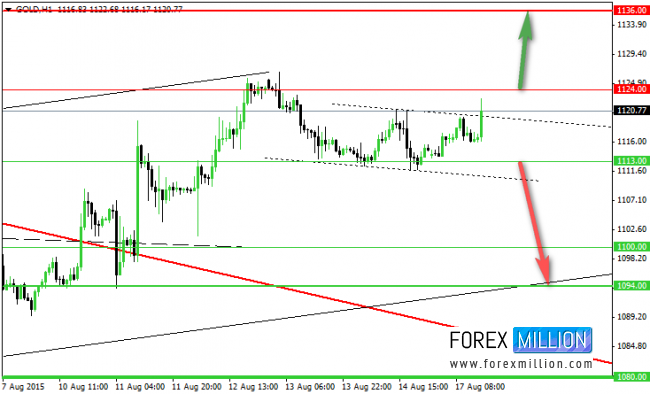

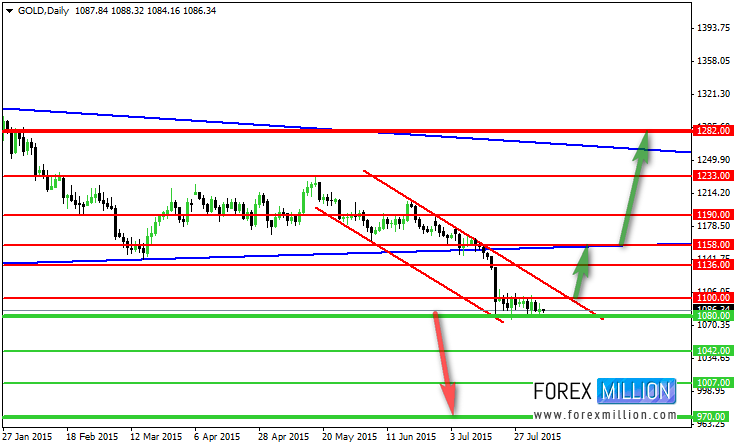

Monthly forecast, August 2015

Main scenario:

The pair is trading along an downtrend.

The downtrend may be expected to continue in case the market drops below support level 1080, which will be followed by reaching support level 1042, 1007 and to 970.

Alternative scenario:

An uptrend will start as soon, as the pair rises above resistance level 1100, which will be followed by moving up to resistance level 1158.

Previous forecast:

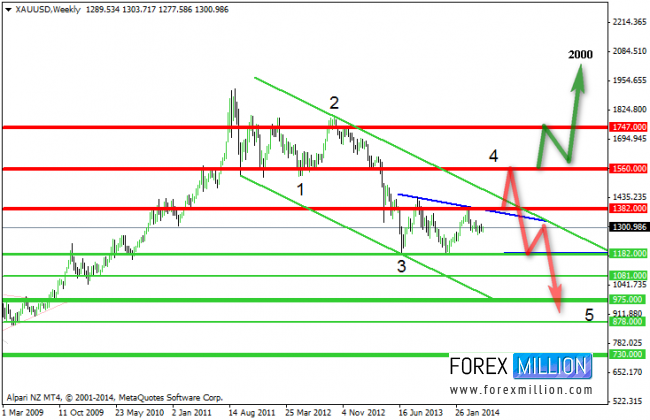

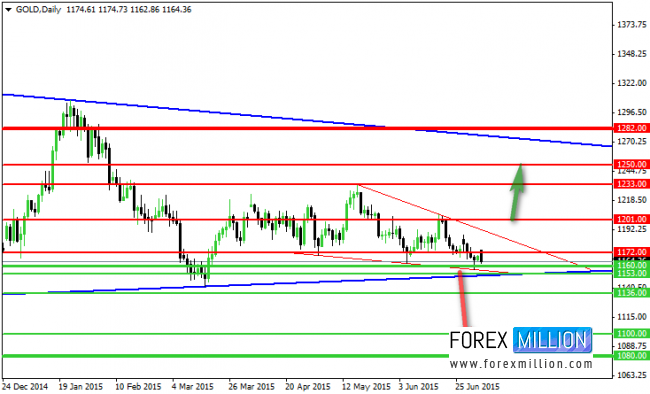

Long-term Forecast: January - June 2015

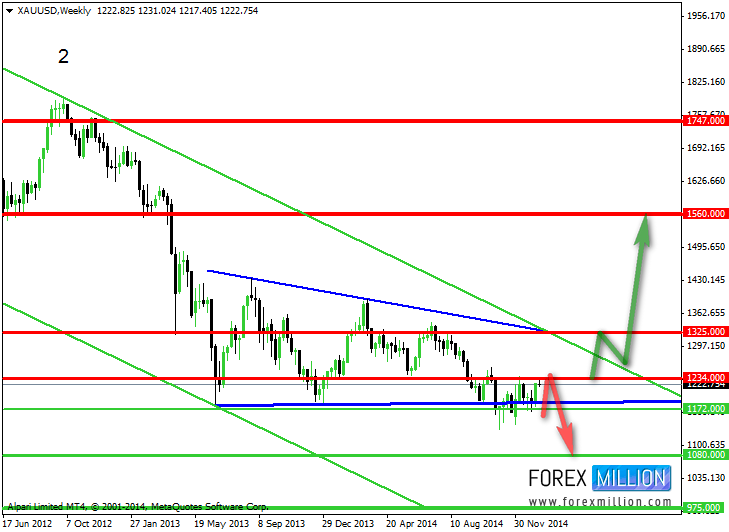

Main scenario:

The pair is trading along an downtrend.

The downtrend may be expected to continue while pair is trading below resistance level 1325, which will be followed by reaching support level 1080 and 975.

Alternative scenario:

An uptrend will start as soon, as the pair rises above resistance level 1325, which will be followed by moving up to resistance level 1560.

Previous forecast: