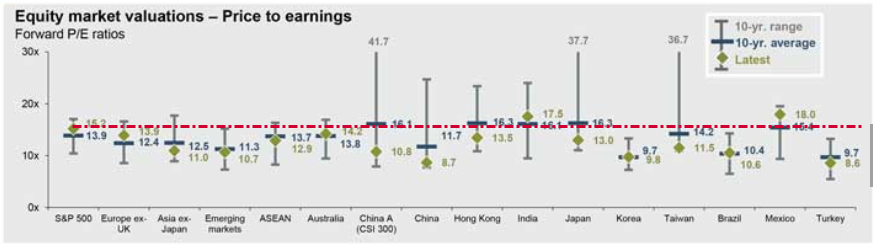

Forward PE Estimates

I don't have any faith in forward PE estimates. They tend to be overly optimist and subject to numerous "one-time" writeoffs.

Instead, I recommend watching 10-year smoothed PE ratios. See discussion below.

Nonetheless, please note that even on a forward-basis, the S&P 500 ratio is well above most other markets.

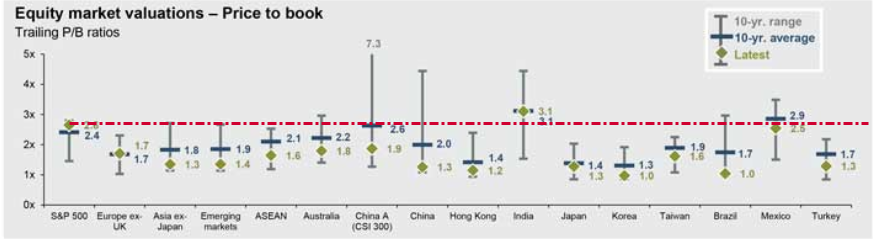

Price to Book Valuations

On a price-to-book basis, US equities are twice as expensive as numerous other markets.

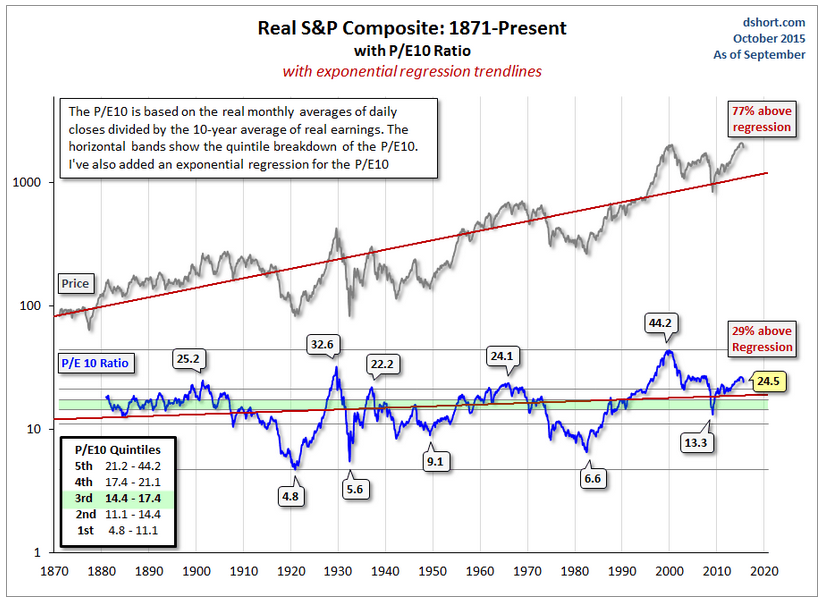

Case-Shiller Smoothed PE

The Case-Shiller PE is a Cyclically Adjusted Price-to-Earnings ratio, commonly known as CAPE, Shiller P/E, or P/E 10 ratio.

To calculate "CAPE," you divide the current price by the inflation-adjusted average of the last ten years of earnings.

Here is a link to the Current Shiller PE, updated daily. A better-looking chart is shown below.

Bubble Debate Revisited

Doug Short at Advisor Perspectives does periodic updates to the Shiller PE. His latest was on October 1 in Is the Stock Market Cheap?

On a PE/10 basis, stocks are in the fifth quintile range, signalling extreme overvaluation. Higher smoothed PEs happened in 1929, the dot-com bubble, 1902, and earlier this year.

The historic P/E10 average is 16.6. After dropping to 13.3 in March 2009, the ratio rebounded to an interim high of 23.5 in February of 2011 and then hovered in the 20-to-21 range. It began rising again in late 2013 and hit a new interim high of 27 in February of this year. It has now dropped below that high.

Of course, the historic P/E10 has never flat-lined on the average. On the contrary, over the long haul it swings dramatically between the over- and under-valued ranges. If we look at the major peaks and troughs in the P/E10, we see that the high during the Tech Bubble was the all-time high above 44 in December 1999. The 1929 high of 32.6 comes in at a distant second. The secular bottoms in 1921, 1932, 1942 and 1982 saw P/E10 ratios in the single digits.