Rising uncertainty about the global economy continues to boost demand for US Treasuries. “It’s all a global growth fear trade,” Priya Misra, head of global rates strategy at TD Securities, tells Reuters. Expectations that China will continue to slow, coupled with forecasts of weaker growth in the US and Europe relative to recent projections, are inspiring new purchases of safe-haven Treasuries. Adding to the demand for safety and a hedge against more disinflation/deflation is the continued outlook for low inflation in the US and elsewhere.

No wonder that the current climate doesn’t inspire expectations that a Fed rate hike is near. Two voting members of the FOMC have recently raised doubts about the Phillips Curve—the theory that inflation and unemployment are inversely related and so a falling jobless rate is linked with higher inflation. But that relationship appears to have broken down. Here’s Fed Gov. Lael Brainard speaking on CNBC this week:

To be clear, I do not view the improvement in the labor market as a sufficient statistic for judging the outlook for inflation. A variety of econometric estimates would suggest that the classic Phillips Curve influence of resource utilization on inflation is, at best, very weak at the moment. The fact that wages have not accelerated is significant, but more so as an indicator that labor market slack is still present and that workers’ bargaining power likely remains weak.

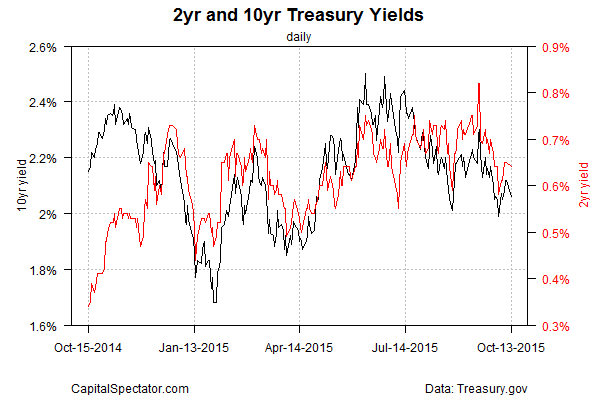

Meanwhile, Treasury yields continue to trend lower. The 2- and 10-Year yields slipped yesterday, the first day of trading after the three-day holiday weekend that shuttered the US bond market on Monday. Helping juice the demand for Treasuries was Fed Governor Daniel Tarullo’s comment yesterday: “I wouldn’t expect it would be appropriate to raise rates.”

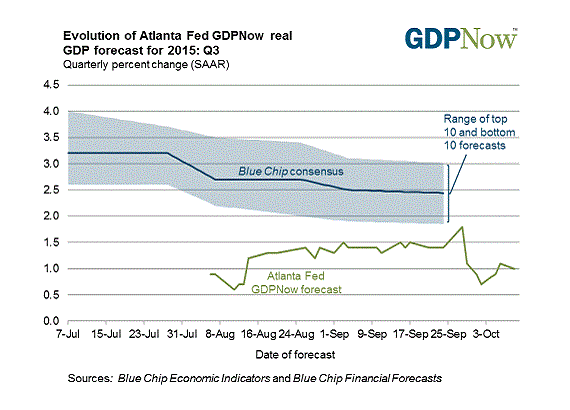

The Atlanta Fed’s GDPNow model is currently anticipating that US economic growth will be a tepid 1.0% in the third quarter report that’s due later this month. That’s a hefty slowdown from Q2’s strong 3.9% rise (seasonally adjusted annual rate).

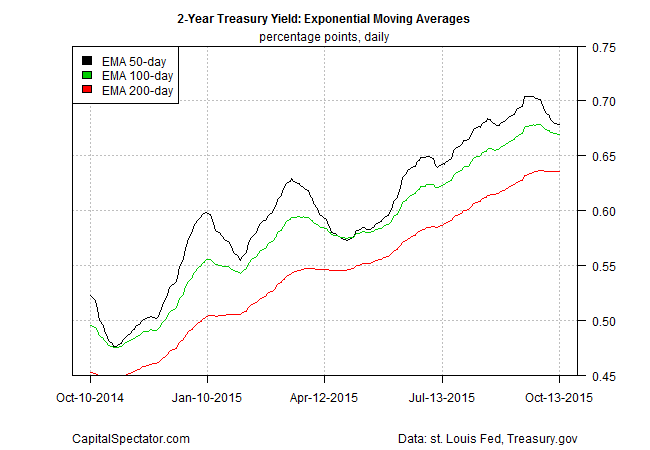

The Treasury market’s trend of late certainly doesn’t conflict with the outlook for weak growth. The path for the 2-year yield—said to be the most sensitive for rate expectations—has been slipping lately, based on the 50-day exponential moving average (EMA) for daily data via Treasury.gov.

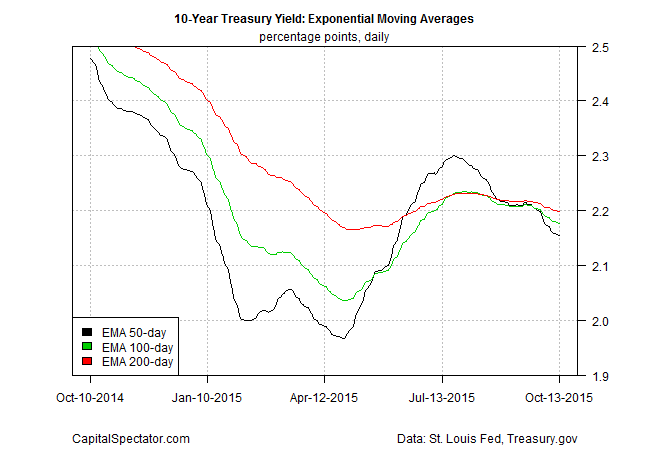

The recent shift to a downward bias is especially stark for the benchmark 10-year yield, a maturity where the 50-day EMA is now well below the 100-day EMA, which has recently fallen below the 200-day EMA.

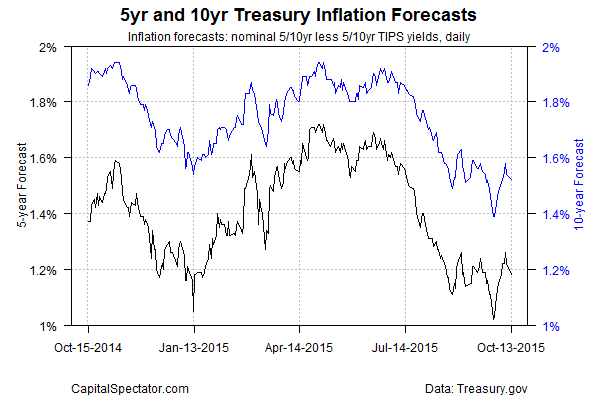

Meanwhile, the Treasury market’s inflation forecasts (based on yield spreads between nominal and inflation indexed maturities) appear to be headed lower again after a brief bounce in recent weeks.

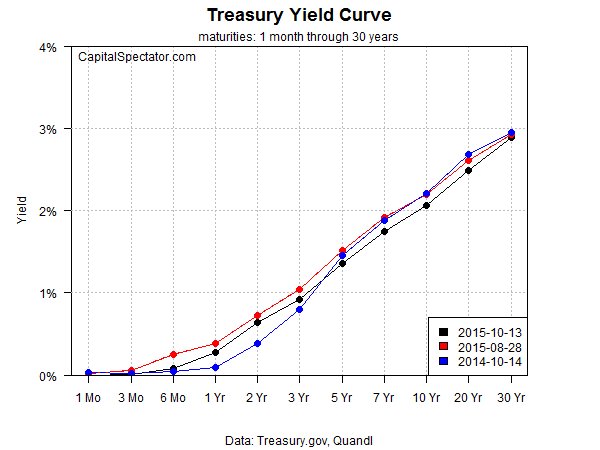

Given the current outlook, it’s no surprise to find that the Treasury yield curve overall is a bit flatter relative to rates in late-August.

Gavyn Davies of Fulcrum Asset Management, writing in the FT recently, advanced the case that the US economic slowdown is “not yet very severe” and will probably be temporary—“some of it is the result of the temporary inventory correction, and some to the rising dollar. Unless it grows worse in the next few weeks, it is unlikely to dislodge the Fed from the path it has now firmly chosen,” i.e., higher rates. He goes on to reason that

Inventory adjustments are, in general, self-correcting, except in the most severe of economic downturns, when they can exacerbate the contractionary forces early in a recession. With the risk of an outright [US] recession still very low, according to the Fulcrum models, it would be surprising if the present inventory correction developed into something more disastrous. Instead, it is quite likely to depress the GDP growth rate for a short while before its effects are reversed.

That, anyway, is what the Fed seems predisposed to conclude.

The final arbiter, of course, is the data, starting with today’s update on US retail sales for September. The crowd’s looking for another round of deceleration. Econoday.com’s consensus forecast sees retail spending ticking down to a weak 0.1% monthly increase from 0.2% previously. Yet that translates into a slightly higher year-over-year increase of 2.5% vs. 2.2% previously. In short, a mixed bag.

Clarity about the state of the US economy, it seems, may have to wait for another day (or week or month). As a result, erring on the side of caution when it comes to risky assets will remain a popular trade until the data inspires an attitude adjustment.