For the 24 hours to 23:00 GMT, the EUR rose 0.2% against the USD and closed at 1.1283.

Macroeconomic data released in Germany indicated that, the Ifo business climate index unexpectedly fell to a six-month low level of 106.2 in August, raising concerns that the historic Brexit vote has clouded growth prospects for the Euro-zone’s power house. The index had registered a reading of 108.3 in the previous month. Additionally, the nation’s Ifo business expectations index surprisingly eased to a level of 100.1 in August, defying market expectations for an advance to a level of 102.4 and compared to a revised reading of 102.2 in the previous month. Further, the Ifo current assessment index unexpectedly declined to a level of 112.8 in August, compared to market expectations of a rise to a level of 114.9 and following a revised level of 114.8 in the previous month.

In the US, preliminary durable goods orders rebounded more-than-expected by 4.4% in July, rising for the first time in three-months, indicating that downturn in business investment is easing in the second quarter. Markets expected for an advance of 3.4%, following a revised drop of 4.2% in the prior month. Additionally, the nation’s initial jobless claims unexpectedly dropped to a level of 261.0K during the week ended 20 August 2016, hitting its lowest level in five-weeks, thus hinting that the nation’s labour market was continuing to gain momentum. Initial jobless claims had recorded a reading of 262.0K in the prior week whereas markets envisaged for a rise to a level of 265.0K. On the other hand, the nation’s flash Markit services PMI surprisingly eased to a six-month low level of 50.9 in August, defying market expectations for an advance to a level of 51.8 and following a level of 51.4 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1289, with the EUR trading marginally higher against the USD from yesterday’s close.

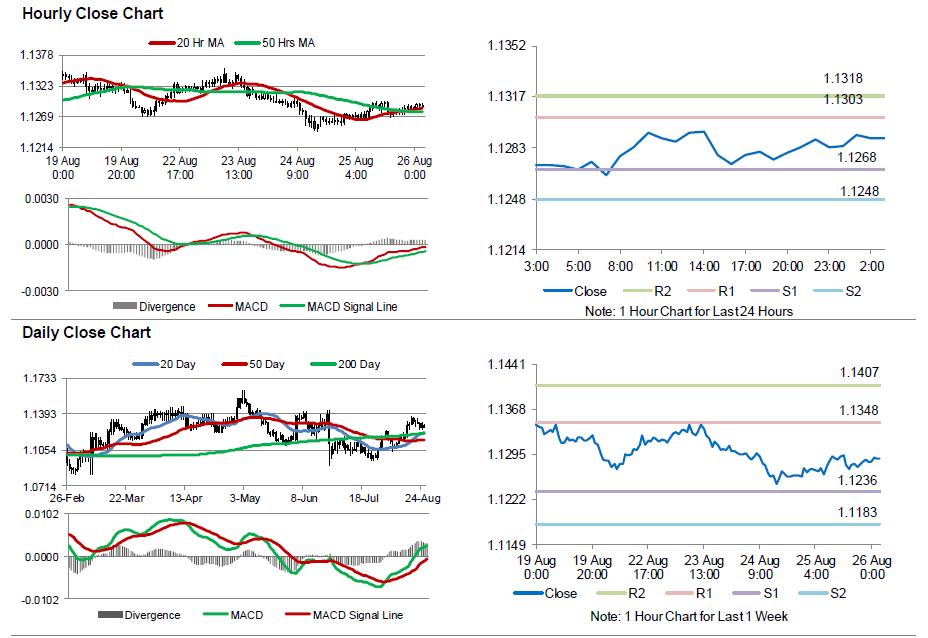

The pair is expected to find support at 1.1268, and a fall through could take it to the next support level of 1.1248. The pair is expected to find its first resistance at 1.1303, and a rise through could take it to the next resistance level of 1.1318.

Moving ahead, market participants would look forward to Germany’s GfK consumer confidence survey for September, due to release in a few hours. Additionally, the much awaited speech from the Federal Reserve Chairwoman, Janet Yellen along with the US annualised GDP for the second quarter, advance goods trade balance and final Michigan confidence index, all due to release later today, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.