A busy day. Lots and lots of bad news hit the market since last night. There were some really poor earnings reports from the likes of Wynn Resorts Limited (NASDAQ:WYNN), Panera Bread Company (NASDAQ:PNRA), Stratasys Ltd (NASDAQ:SSYS), Buffalo Wild Wings Inc (NASDAQ:BWLD), Twitter, Inc. (NYSE:TWTR), United States Steel Corporation (NYSE:X) to name just a few. I mean some major league slaughters here. All saying business is bad and getting worse. Like I said, there were many, many more than just those. Enough bad reports from everywhere, it seemed, to kill the market. Now, if you add in the action in Europe, such as we saw from Germany, down over 3%, that double-barreled action with earnings could have taken our market and spit it out in a way that would have made everyone feel like all hope is lost in terms of breaking out. The worry would shift to a bear market. But wait, there's more. The GDP came in well below expectations. The number at 0.2% was less than the 1.0% expected, and, let's face it, was basically recessionary. Hold on, there's more.

The bull-bear spread has to be talked about when you get a number on the spread of 43.5%. Super dangerous territory. Froth, earnings, Germany and GDP. A quadruple of events that can annihilate the market when that all comes together, thus, it's a miracle when you consider how amazingly well the market held up today. Stunning is the best word I can think of at the moment. If the Dow had been down 500 points today I would have said that made sense. I don't think anyone would argue with a 3% pullback in the averages. So what saved us? You bet. The Fed, who said she's removing dates. Will stop talking about June or September, or anything like that. She'll focus solely on the data. When it's good enough she'll start raising rates. For now it's not. She said economic growth slowed some due to weather, etc. So she told us no hikes for a while and the market recovered. a + b does = c. No hikes equal no fear from investors overall. Not an easy market, but no worries about a collapse. Simple math. Crazy, but who said Disneyland made sense.

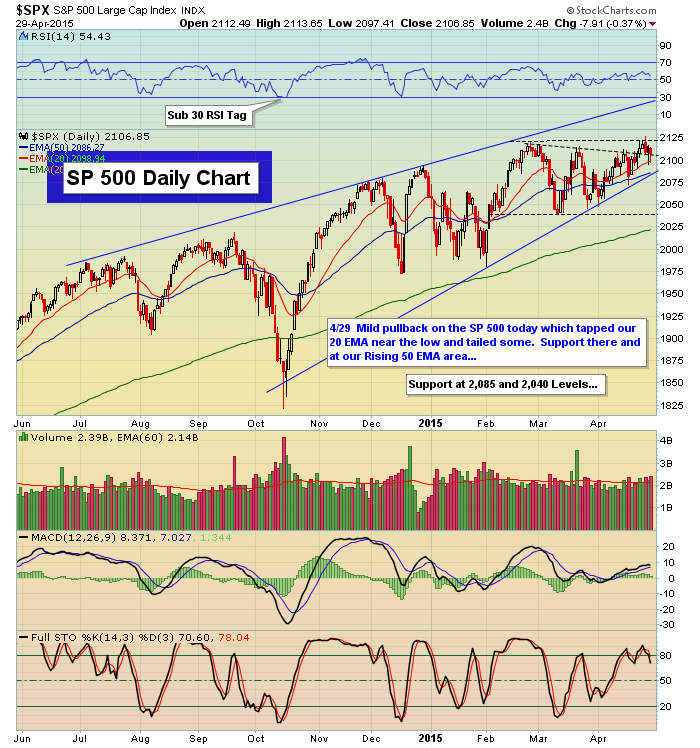

We remain nowhere when looking at the big picture. The market has proven to both bulls and bears alike that making the big move up and out, or down and out is not happening. It's not easy to understand since both sides keep looking as if the move will occur at different points in time except no matter how good it looks, it just doesn't take place. The market keeps sucking folks in when it looks ripe for the move only to see those folks get disappointed. They panic, and get out with losses only to see things come back up. In other words, the market is very good at creating frustration these days. The answer to it all is quite simple but not an answer people like to hear. Keeping it light or cash is truly best. No fun but markets aren't always fun nor are they supposed to be. There are extended periods of time when you should be mostly, if not completely, a spectator, but that's so hard to do, and I get that. Maybe we'll get more clarity in the days ahead. Until we blow through 2119 on a closing basis it's best to keep it light.