Perhaps it’s a blessing in disguise that today’s economic calendar is essentially barren, because it feels like just one weekend was not enough to digest Friday’s robust Non-Farm Payroll report. As a result of the strong jobs report, the USD tested multi-year highs against the euro and Swiss franc, as well as the Canadian, Australian, and New Zealand dollars. The focus of today’s piece though is GBP/USD, which peeked below a psychologically critical support level at 1.60 in the wake of the report.

From a fundamental perspective, the Federal Reserve and Bank of England are arguably two of the most hawkish of the developed market central banks. Beyond the strong US jobs report, signs of hesitation about raising interest rates among the BOE members also contributed to GBP/USD’s fall last week. Now, forward-looking traders are starting to speculate that the Fed may actually raise interest rates before the BOE, and if the data continues to bolster this case, GBP/USD may fall further in the coming weeks and months.

Technical View: GBP/USD

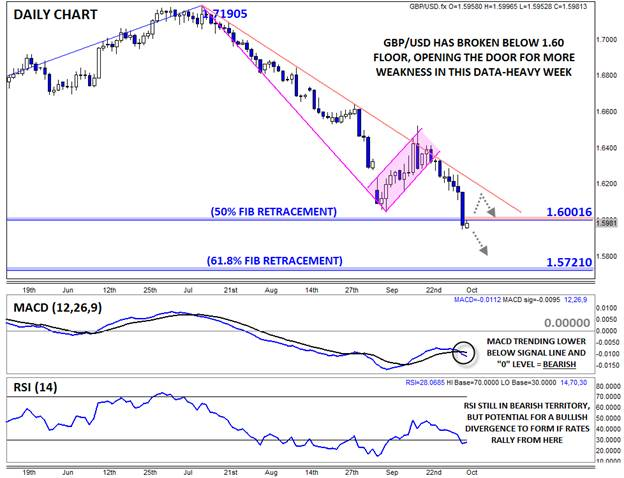

Turning our attention to the chart, we can see that cable has broken below the 50% Fibonacci retracement of its July ’13 to July ’14 rally, potentially opening the door for another leg lower from here. This drop follows on the back of the breakdown from the bearish flag pattern in late September, suggesting that rates could easily extend their drop from here.

The secondary indicators also support a continued drop, with one potential caveat. The MACD has rolled over and is once again trending lower below both its signal line and “0” level, whereas the RSI indicator remains mired in bearish territory (<60). However, despite GBP/USD’s drop to a new 11-month low, the RSI indicator remains above its early September lows, raising the potential for a bullish divergence to form if rates bounce from here.

In all, the bias in GBP/USD will remain to the downside as long as rates remain below two key levels. First, key psychological resistance at 1.60 could cap near-term rallies this week. Even if the pair breaks above that barrier, traders may still look to fade bounces toward the bearish trend line off the mid-July highs (currently near 1.6200). To the downside, there are few support levels beyond the round 100-pip handles (1.5900, 1.5800) and the longer-term 61.8% Fibonacci retracement (1.5721).

Key Economic Data / News that May Impact GBP/USD This Week (all times GMT):

- Tuesday: UK Halifax HPI (tbd – either on Tue. or Wed.), UK Manufacturing Production and Industrial Production (8:30), BOE Credit Conditions Survey (8:30), UK NIESR GDP Estimate (14:00), US JOLTS Job Openings (14:00), Speech by FOMC Member Kocherlakota (17:20), Speech by FOMC Member Dudley (19:00)

- Wednesday: U.S. 10-Year Bond Auction (17:00), FOMC Meeting Minutes (18:00)

- Thursday: BOE Monetary Policy Decision (11:00), US Initial Unemployment Claims (12:30)

- Friday: UK Trade Balance (8:30), Speech by FOMC Member Plosser (13:00)

Source: FOREX.com