GBP is showing some fluctuation on Tuesday, as the pair trades just below the 1.53 line early in the European session. Taking a look at economic releases, British CPI slipped into negative territory for the first time in 5 months, coming in at -0.1% in the September report. This was a disappointment for the markets, although the reading was within expectations.

There are no major events out of the US on Tuesday. Traders should keep a close eye on Wednesday’s key releases, all of which are market-movers. The UK releases Average Earnings Index and Claimant Count Change, and the US will release Core Retail Sales, Retail Sales and PPI.

The Fed minutes are now behind us, but the key question remains – will the Federal Reserve press the trigger and raise rates in 2015? The markets had circled September as a likely candidate for a rate hike, but the Federal Reserve remained on the sidelines yet again. The Fed released the minutes of its September policy meeting last week, and indicated that the Fed does not feel that the timing is appropriate for a rate hike, but provided few clues as to when the Fed might take action. Policymakers cited concerns that the sluggish global economy could affect the US economy.

This sentiment was underscored on Monday by FOMC member Lael Brainard, who stated that the Fed should not raise rates before global economic conditions improve. Brainard noted that the Chinese slowdown has caused economic turmoil worldwide, and the US economy could lose steam due to weaker exports and weak global economic conditions. Clearly, Brainard is of the view that the Fed should take its time and proceed with caution. With global economic conditions unlikely to change anytime soon, a rate move may be on hold unless the US posts some key releases, such as GDP or employment numbers, which match or beat expectations.

A very different view was put forth on Monday by another FOMC member, Dennis Lockhart. Lockhart, considered a centrist on monetary policy, sounded more optimistic about a rate hike before the end of 2015. Lockhart did not rule out a rate hike in October, and added that the Fed would have more data to evaluate before its December policy meeting. With FOMC members sending out such conflicting messages, it is no wonder that the markets have been unable to get a handle on the timing of a rate hike, and this failure of the Fed to communicate a clear message to the Fed has hurt the US dollar, as we saw after the release of the Fed minutes last week.

Britain’s September inflation indicators were released on Tuesday, pointing to low inflation levels. CPI, the primary gauge of consumer inflation, came in at -0.1%, shy of the estimate of 0.0%. Most of the other inflation indicators were within expectations. The UK economy has been performing well and wage growth has risen, but a rate hike in the near future remains unlikely, given the persistently weak inflation levels. With a rate hike still a possibility in the US before the end of 2015, monetary divergence between the US and the UK continues to favor the dollar and will likely weigh on the pound.

GBP/USD Fundamentals

Tuesday (Oct. 13)

- 8:30 British CPI. Estimate 0.0%. Actual -0.1%.

- 8:30 BOE Credit Conditions Survey.

- 8:30 British PPI Input. Estimate 0.2%. Actual 0.6%.

- 8:30 British RPI. Estimate 1.0%. Actual. 0.8%.

- 8:30 British Core CPI. Estimate 1.1%. Actual 1.0%.

- 8:30 British HPI. Estimate 5.5%. Actual 5.2%.

- 8:30 British PPI Output. Estimate -0.2%. Actual -0.1%.

- 9:00 BOE MPC Member Gertjan Vlieghe Speaks.

- 10:30 BOE MPC Member Ian McCafferty Speaks.

Upcoming Key Events

Wednesday (Oct. 14)

- 8:30 British Average Earnings Index. Estimate 3.1%.

- 8:30 British Claimant Count Change. Estimate -2.3 thousand.

- 12:30 US Core Retail Sales. Estimate -0.1%.

- 12:30 US PPI. Estimate -0.2%.

- 12:30 US Retail Sales. Estimate 0.2%.

*Key releases are highlighted in bold

*All release times are GMT

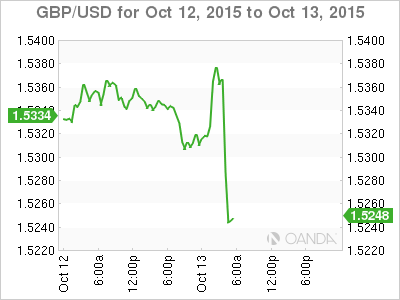

GBP/USD for Tuesday, October 13, 2015

GBP/USD October 13 at 8:35 GMT

GBP/USD 1.5296 H: 1.5387 L: 1.5281

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.5026 | 1.5163 | 1.5269 | 1.5341 | 1.5485 | 1.5590 |

- GBP/USD posted slight losses in the Asian session and is showing fluctuation early in the European session.

- 1.5269 is a weak support level.

- 1.5341 has switched to resistance as a result of the pound’s losses.

- Current range: 1.5341 to 1.5485

Further levels in both directions:

- Below: 1.5269, 1.5163 and 1.5026

- Above: 1.5341, 1.5485, 1.5590 and 1.5660

OANDA’s Open Positions Ratio

GBP/USD ratio has shown slight movement towards short positions on Tuesday. Long positions continue to retain a majority (58%). This is indicative of trader bias towards the pound moving higher.