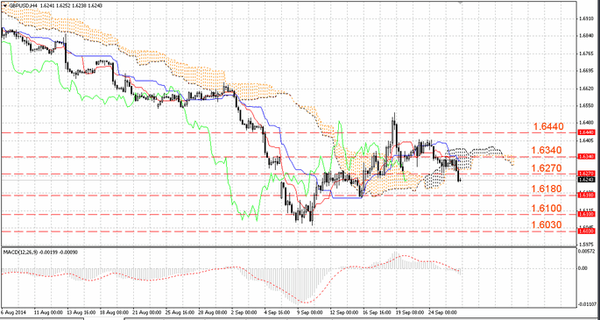

Analysts say about the heavy mood pound. GBP/USD was back under pressure as last week, the market has exhausted short-term uptrend and upward correction observed in September, continues unabated. Is expected to decrease in the direction of 1.6163 / 54 and further to the recent low 1.6053. In the long term decline could reach 1.6015 / 00 (200-week MA and 50% retracement of the growth from 2013) and 1.5721 (61.8% retracement of the move). On the daily chart noticeable downward trend (at 1.6442), and while he holds a pair, it will be sold. Key resistance at 1.6644 / 46, the September high and 200-month MA. This area, together with the 200-day MA at 1.6689 should contain the bulls, said the analysts of the Forex Broker Company Fort Financial Services.

Late last week, the pound fell. Earlier, the pair GBP/USD is consolidating around 63 pieces. Thanks to the comments of the British regulator demand for pound for the day was maintained. Carney said that the rise in interest rates have to wait a short time and is not worth the long pull with it, as for the UK property market it will be critical.

Overview and trading recommendations

At the end of last week, GBP/USD pair fell. However, to this reduction in his speech, the British regulator Carney made it clear that in the near future, possibly interest rates will be raised. After his speech, a further decline in the pair GBP/USD has been suspended and the pair managed to briefly recover to 1.6340, followed by a decline. However, it should be noted that the prospects of further rate hikes are no longer supported by the sterling as before, and it gives the bulls reason to guard. In the area of 1.6180 is the first support below - 0.6100. In the area of 1.6270 is the first resistance is higher - 1.6340.

A sell signal is strong and unconfirmed. The price is below the Ichimoku cloud and Chinkou-Span is above the price level. Tenkan-sen shows the downward movement and Kijun-sen - horizontal. The urgency of the downward movement will continue until the price is below the Ichimoku cloud. The MACD histogram is at zero. Price reduced. Price on currency instruments continues to move south, the prospects for growth remain limited. This pair are supporting his cross pairs, but probably around the pound will not be able to avoid losses. It is necessary to keep the shorts, open earlier, at the same time look for points to build a Target 1.6100 and 1.6030, said the experts of the Fort Financial Services (rated among the TOP Forex Brokers Masterforex-V World Academy http://www.masterforex-v.com/).