ROWTHACES.COM Forex Trading Strategies

Trading Positions

EUR/USD trading strategy: long at 1.1325, target 1.1550, stop-loss 1.1325

GBP/USD trading strategy: long at 1.5400, target 1.5580, stop-loss 1.5460

USD/CAD trading strategy: short at 1.2620, target 1.2370, stop-loss 1.2480

EUR/JPY trading strategy: long at 134.60, target 137.50, stop-loss 134.60

AUD/JPY trading strategy: long at 92.60, target 94.30, stop-loss 93.10

Pending Orders

AUD/USD trading strategy: buy at 0.7805, if filled – target 0.8020, stop-loss 0.7710, risk factor **

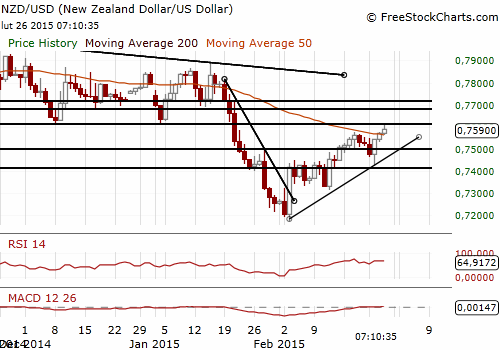

NZD/USD trading strategy: buy at 0.7505, if filled - target 0.7700 stop-loss 0.7405, risk factor **

GBP/JPY trading strategy: buy at 182.70, if filled – target 186.20, stop-loss 181.70, risk factor ***

EUR/CHF trading strategy: buy at 1.0690, if filled - target 1.0990, stop-loss 1.0590, risk factor *

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies.

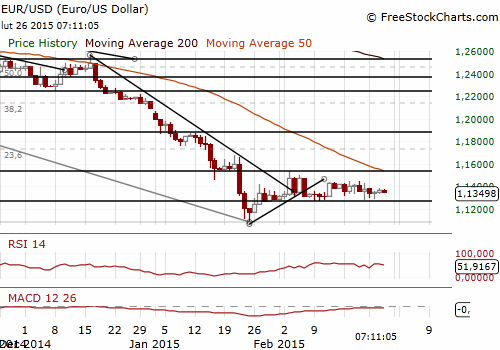

EUR/USD: Bullish Outlook Remains Intact

(long for 1.1550)

- European Central Bank President Mario Draghi said the ECB could reverse an earlier decision that makes it harder for Greece and its banks to access finance. The Governing Council of the ECB decided to lift the waiver affecting marketable debt instruments issued or fully guaranteed by Greece on February 4. The waiver allowed these instruments to be used in Eurosystem monetary policy operations despite the fact that they did not fulfil minimum credit rating requirements.

- Draghi also said that confidence in Europe was improving after the ECB announced that it would embark on a programme to buy government bonds to buoy the economy from next month.

- A European Commission report showed that economic sentiment in the euro zone's economy strengthened for the second straight month in February. Some very good macroeconomic data from German economy were released today. German unemployment rate stayed at a record low of 6.5% for a third straight month in February and remains the lowest since German reunification in 1990. Separately, a German survey by market research group GfK showed sentiment among shoppers jumping to its highest level since 2001.

- The volatility on the EUR/USD is low today. Investors are waiting for next-week ECB meeting and U.S. non-farm payrolls data. We stay EUR/USD long as we expect further improvement in the euro zone macroeconomic figures and slight slowdown in the U.S. economic activity that may delay monetary tightening by the Fed.

Significant technical analysis' levels:

Resistance: 1.1400 (psychological level), 1.1430 (high Feb 20), 1.1450 (high Feb 19)

Support: 1.1288 (low Feb 24), 1.1278 (low Feb 20), 1.1270 (low Feb 9)

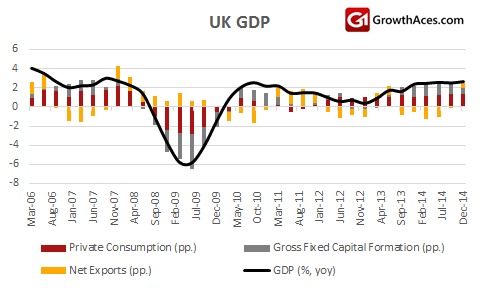

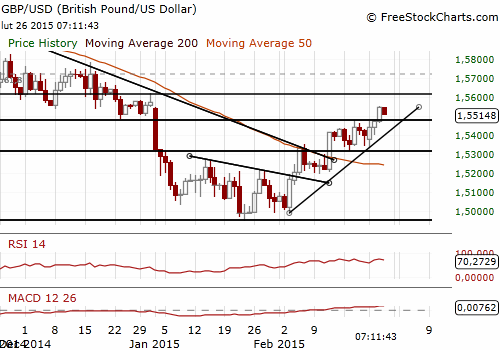

GBP/USD Broke Above Strong Resistance Of 1.5480

(we stay long for 1.5580)

- The Office for National Statistics said that British GDP in the fourth quarter grew by a quarterly 0.5%, as estimated in a preliminary reading, slowing from 0.7% in the third quarter. In yoy terms, growth was 2.7%, also unchanged from preliminary estimate.

- Business investment fell by 1.4% qoq in the fourth quarter after 1.2% fall in the third quarter. The quarterly fall in investment was the biggest drop since the second quarter of 2009. Household spending grew a quarterly 0.5% in the October-December period, slowing from 0.7% in the third quarter. Net trade gave a boost to GDP too, contributing 0.6 percentage points to the quarterly growth rate.

- Britain's dominant services industry remained the big driver of growth, rising 0.8%. Industrial output rose 0.1%, revised up from an original estimate that the sector contracted 0.1% in the fourth quarter.

- The GBP traded firm near an eight-week high against the USD. Recent soft economic data out of the USA was prompting a pull back in the USD. On the other hand, recent data on the UK economy, in particular wage growth, has been solid although inflation remains close to zero. Moreover, some Bank of England policymakers are the opinion that rates could rise soon if inflationary pressures pick up quickly.

- The GBP/USD broke above the key resistance level of 1.5480 and is on the way to the target of our long position at 1.5580. Many investors are shifting their positions from shorts to longs now, which may lead to acceleration of rises in the GBP/USD.

Significant technical analysis' levels:

Resistance: 1.5588 (high Jan 2), 1.5621 (high Dec 31, 2014), 1.5753 (high Dec 17, 2014)

Support: 1.5448 (low Feb 25), 1.5403 (low Feb 24), 1.5333 (low Feb 23)

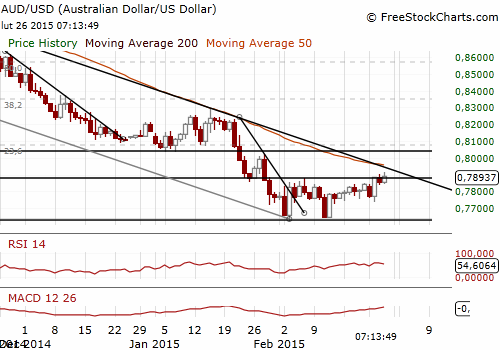

AUD/USD Remained Strong Despite Weak Investment Numbers

(looking to get long on dips)

- Figures from the Australian Bureau of Statistics showed investment fell 2.2% qoq to AUD 37.47 billion in the fourth quarter of 2014, the lowest result since late 2011. Early spending plans for 2015/16 were also on the weaker side of expectations at AUD 109 billion, with sectors outside of mining reluctant to invest.

- The Reserve Bank of Australia cut rates to a record low of 2.25% and interbank futures imply a 52% probability of an easing next week (on Tuesday). We should note that forward interest rates had not moved to price in any more likelihood of a cut in borrowing costs after weak data. In our opinion the RBA will keep rates on hold next week.

- The AUD/USD fell after business investment numbers but recovered quickly and traded near 0.7900. We maintain our trading strategy to buy AUD/USD on dips.

Significant technical analysis' levels:

Resistance: 0.7907 (high Jan 29), 0.8026 (high Jan 28), 0.8049 (high Jan 23)

Support: 0.7836 (hourly low Feb 26), 0.7824 (low Feb 25), 0.7822 (10-dma)

NZD/USD Is Getting Stronger In Line With Our Expectations

(looking to get long on dips)

- New Zealand posted a small trade surplus in January, the first in seven months, as imports declined more than exports. The surplus for the month was NZD 56 million.

- Exports fell 16% mom and 9.1% yoy on lower dairy prices which offset record volumes being sold. Dairy milk powder, butter, and cheese exports fell 30% yoy, as international commodity prices fell. Logs and aluminium exports were also lower, offsetting a rise in meat. Imports fell 21% mom and 3.8% yoy on lower crude oil and petroleum products..

- New Zealand dairy co-operative Fonterra held the price it pays to its milk suppliers at an eight-year low on Thursday, and said the recent rise in global dairy prices was largely due to a cut in global supply while demand from China remains weak.

- The NZD/USD gained after data showed a surprise surplus on trade and is at its highest level since January 21. We wrote in our Tuesday’s Market Overview that the medium-term outlook for the NZD/USD is positive and we do not change our opinion. Our trading strategy is to buy NZD/USD at 0.7505. If the order is filled, the target will be 0.7700.

Significant technical analysis' levels:

Resistance: 0.7619 (low Jan 5), 0.7709 (high Jan 21), 0.7781 (high Jan 20)

Support: 0.7526 (10-dma), 0.7476 (low Feb 25), 0.7422 (low Feb 24)

Source: Growth Aces Forex Trading Strategies