The stock market never has never been easy. The emotion machine keeps chugging along making sure all of you have a difficult time understanding it. It doesn't want you to ever think it's easy, and it wants to make sure you struggle. Just about everyone does. When you look at the recent volatility it's easy to understand. Tremendous day-to-day moves off the recent top as the VIX exploded. The bulls and bears alike are more used to small grinding moves for several months, with the direction mostly higher. Now things have swung around, and the market is playing a different tune. Slow dance nights are over. The doji is playing rock music these days, and most folks just can't dance well to that music. Most folks simply get used to the new pattern in place and never adapt to what's taking place in the moment.

They're now used to a down trend since we fell two-hundred points on the S&P 500 in just twenty trading days, thus, they won't trust that we're now in the counter-trend portion of this correction and it should last a couple of weeks even though the gains may not be huge. Any selling off the top on an up-day makes them feel like we're about to crater lower. That shouldn't be the case. You know what's next. Just when they feel it's fine again to get aggressively long, the market will pull out the carpet and we'll head lower again. All in good time as, for now, we should be going up slowly but surely for a week or two or maybe even three but be reminded that it won't be up every day with some days not feeling good at all. It's still a market that begs for appropriateness. Nothing heavy or aggressive, and if you're going long, ETF’s are probably the safest way to proceed. Day to day for now.

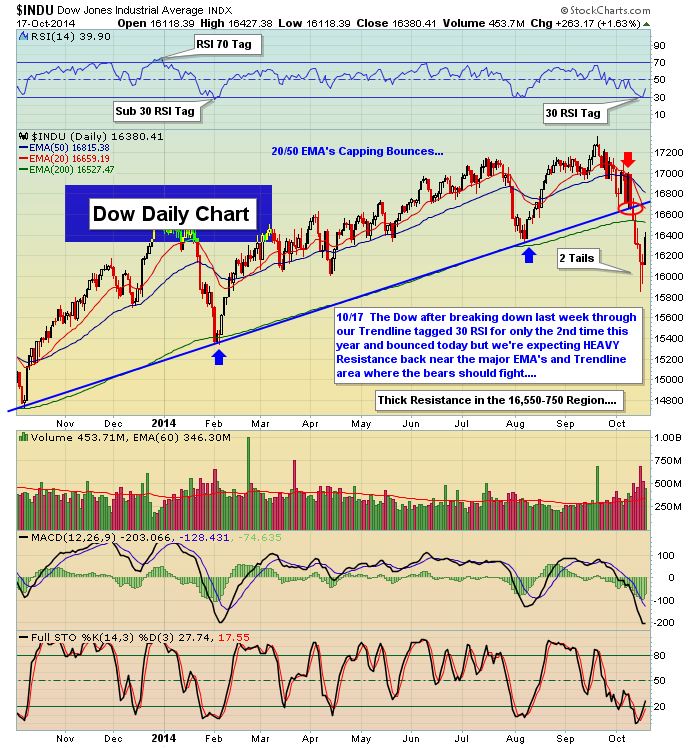

The real question on the mind of all traders is how high can this retrace rally go. There are no exact answers. Quite often they do a 50% retrace back up off the first strong leg lower. The S&P 500 fell two-hundred points, so if we go back up half of that we would see S&P 500 1920. It just so happens that a few points above that is the 200-day exponential moving averages at 1927, along with gap resistance at 1925, thus, I'm thinking we see that area in time, even if there are down days in between the overall move higher. When markets want a level they will find a way to get there, regardless of what has happened prior. There are no exact answers, and it's quite possible we'll retrace more than 50%, or somewhat less, but I'm using 50% due to the proximity of such solid resistance there. We'll know more as things unwind.

I do not believe the correction is over. I, of course, could be very wrong. Here's my thinking. I said once we hit the 1800's we would hear from Fed Yellen about the potential for more QE to be injected in to the banks. Right on cue, she didn't disappoint. My next crazy prediction is if, and when, we hit the 1700's on the S&P 500, she'll actually institute a new QE program. It will become a reality. She will do whatever it takes to stop the market bleeding. It will work ultimately. It’s hard to know if it'll stop the selling at that point, but she will be there to announce it by the time we see those 1700's. She shouldn't do anything as the market is already doing the dirty deed as the selling has been the prefect medicine to unwind froth. We will be below 20% on the bull-bear spread when we get the new readings next Wednesday. If she stays away, we should be at, or near, inverted. We hope she leaves herself out of the game, but it's likely she won't.