The U.S. dollar traded lower against a number of majors on Tuesday, as market traders awaited the release of economic announcements in order to gain insight into the health of the U.S. economy. Traders remained guarded as recent releases were somewhat disappointing, which reignited worries that U.S. economic recovery has cooled off. But many economists believe the situation is mostly due to unusually harsh winter conditions which have contributed to dampening growth. Meanwhile, China reported that the Yuan fell dramatically, a factor that fueled demand for safety. The greenback erased some of its losses after the Standard & Poor’s with Case-Shiller revealed that the House Price Index went up 13.4 percent in December from the previous year. And with greater appeal for harbor assets, Gold benefitted. The shiny metal traded very close to a 16-week high in London.Sentiment was impacted by the crisis in the Ukraine and the possibility that demand for Gold could decline as price increases. After falling the most since 1981, gold is expected to sustain the first consecutive monthly advance. Contracts for April delivery slipped 0.2 percent but still reached $1,335.90 on the Comex Division, and bullion for immediate delivery traded at $1,335.83 in London.

The euro traded higher against the U.S. dollar after official reports confirmed that the German economy grew 1.3 percent on a year-over-year basis, and expanded by 0.4 percent in the last three months of 2013. The euro was weighed down by concerns over the possibility that the european Central Bank may need to step in to ensure deflation does not become a problem in the euro-zone. Recent numbers showed that the rate of inflation for the year came in slightly higher than predicted, at 0.8 percent, but still below the bank’s target 2 percent. Policy makers have indicated that they may opt for an expansion of stimulus if the next releases don’t allay the deflation prospects. This means that investors will pay close attention to this Friday’s news on CPI since it might be the piece of information that helps the central bank reach a decision. The British pound continued its advance versus the greenback as domestic releases showed that Mortgage Loans reached a six-year high, signaling further that the economy remains strong. However, Ian McCafferty, a policy maker from the Bank of England, suggested that if the Sterling continues to rally it could become a problem that the central bank may have to address. A higher pound could mean that the British economy is experiencing inflationary pressures.

The yen strengthened the most in one week against its U.S. peer on the likelihood that the lower Yuan could have an impact on global growth, increasing demand for the yen as a harbor asset. The yen sustained an advance versus most of the Forex majors on news that China’s Yuan plummeted the most in over three years. Domestic announcements indicated that the Corporate Services Price Index declined in the month of January. Lastly, in the South Pacific, the Australian and New Zealand dollars inched lower versus their U.S. peer as the markets were nervous about the reporting of U.S. macroeconomic fundamentals. And in New Zealand, the Reserve Bank stated that it expects Inflation to remain unchanged and post at 2.3 percent for the last quarter of 2013.

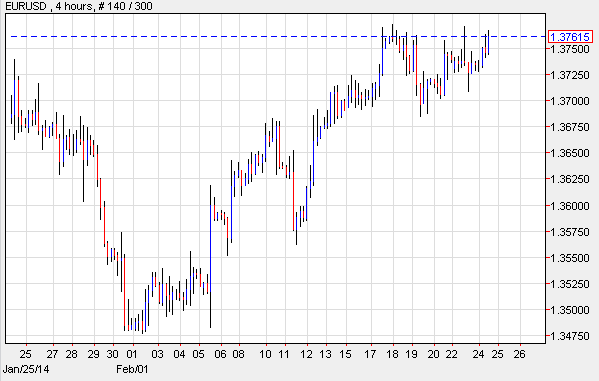

EUR/USD: Germany Showed Growth

The EUR/USD gained on Tuesday and remained supported even though market investors traded cautiously ahead of U.S. Housing and Consumer Confidence data. The EUR/USD was bolstered by news indicating that the european Commission modified its growth predictions for the region from 1.1 percent to 1.2 percent. But the announcement was not entirely positive, as the Commission indicated that Inflation in 2014 could slip to 1 percent, and not to the previously estimated 1.5 percent. Early metrics revealed that the German economy expanded 0.4 percent in the months of October to December, 2013, and on a yearly basis it posted a 1.3 percent in growth.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

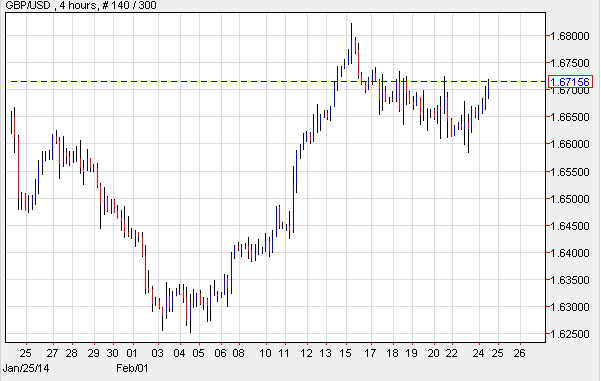

GBP/USD: Home Loans Increase

The GBP/USD advanced as news by the British Bankers Association confirmed that approvals for Home Mortgages climbed 57 percent in the initial month of 2014, reaching the highest level in six years. Approvals jumped to 49,972, while economists predicted they would rally to 47,150. Meanwhile, policy maker Martin Weale suggested that an increase in wages could prompt the Bank of England to raise the costs of borrowing money. But Ian McCafferty, a fellow policy maker, spoke about the dangers that a higher Sterling could create for the economy and its exports. The British monetary unit has gained 12 percent in the last year; he added that speculation over a rate hike by 2015 is “not unreasonable.”

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

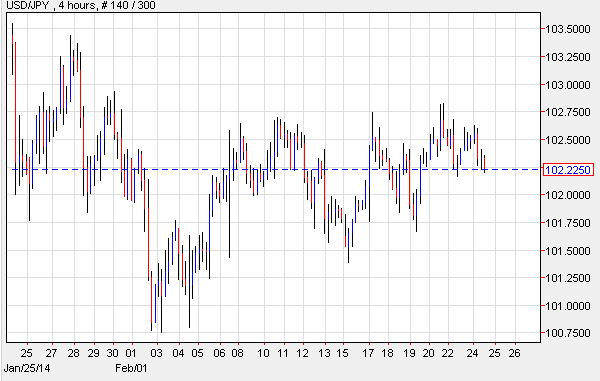

USD/JPY: Haven Appeal Benefits Yen

News out of China indicated that the Yuan plummeted the most in over 36 months on speculation that the People’s Bank of China would like to put an end to the monetary unit’s devaluation. This prompted investors to seek refuge, benefitting the yen, causing a drop of the USD/JPY. In Japan, the central bank announced that the index which measures Corporate Services Prices increased 0.8 percent last month, while economists had predicted it would post at 1.2 percent. Sources say that the administration is concerned that if the deficit in the Current Account continues to grow while the Trade Deficit widens, it may signify that the country will not be able to cover the fiscal shortfall with solely its domestic assets. According to analysts, this could wreak havoc with Japan’s government bonds, a factor that may have a major impact on the world’s financial markets.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

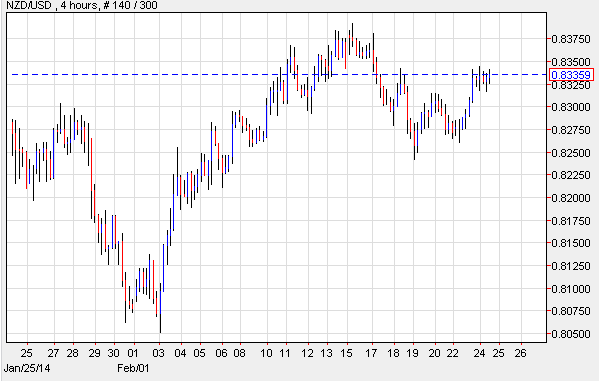

NZD/USD: Inflation Unchanged

The NZD/USD remained weak as the markets waited to see how the day’s economic reports out of the U.S. would fare. Meanwhile, news confirming that New Zealand’s Inflation stayed at 2.3 percent bolstered the pair. The announcement caused a brief spike of the NZD/USD allowing speculators to capture profits. The advance was also supported by news that the Ukraine will be able to obtain financial assistance from the international community.

NZD/USD 4 Hour Chart" title="NZD/USD 4 Hour Chart" width="474" height="242">

NZD/USD 4 Hour Chart" title="NZD/USD 4 Hour Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the U.K. will report on GDP and Business Investment. The U.S. will issue data on New Home Sales and MBA Mortgage Applications. New Zealand will publish metrics on the Trade Balance. Australia will release Private New Capital Expenditure.