The big economic number this week will be the Q1 Second Estimate for GDP on Friday at 8:30 AM ET.

With the BEA's Advance Estimate of 0.2% behind us, what do economists see in their collective crystal ball for Q1 of 2015? Let's take a look at the latest GDP forecasts from the latest Wall Street Journal survey of economists conducted earlier this month.

Here's a snapshot of the full array of WSJ opinions about Q1 GDP with highlighted values for the median (middle), mean (average) and mode (most frequent). In the latest forecast, the median (middle) and the mode (16 of 59 forecasts) was for a negative print at -0.5%. In fact, 43 of the respondents, that's 73%, expect Q1 GDP to have been in contraction. The mean (average) forecast of 0.3% was the result of a few rather bizarrely optimistic outliers.

The Investing.com consensus is for -0.8%. The Briefing.com consensus is fractionally higher at -0.7%, but its own estimate is for -1.0%.

GDP in 2015

Friday's release of the Second Estimate for Q1 GDP is, of course, a rear-view mirror look at the economy. The WSJ survey also asks the participants to forecast GDP for the four quarters of 2015. Here is a table documenting the median, mean and extremes for those forecasts.

Not surprisingly, the median and mean for the next five quarters both hover in a tiny 0.4% range, the average median at 3.0% and the average mean at 3.1%.

About that Optimism About a Q2 Rebound ...

Q1 was a temporary contraction; that is certainly the view of the WSJ survey participants. Even the most pessimistic of the lot sees a 1.0% print in Q2, and the median and mean see a return to the 2.6%-2.8% range. That's better than the 2.4% annual GDP for 2014.

On the other hand The Atlanta Feds' GDPNow™ forecasting model, which currently puts Q2 GDP at 0.8%

GDP: A Long-Term Historical Context

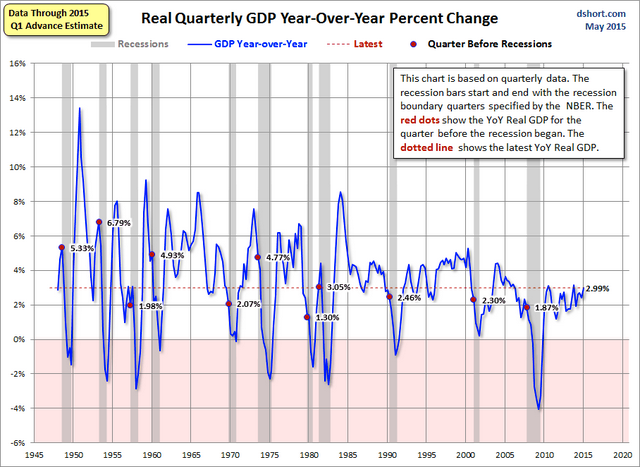

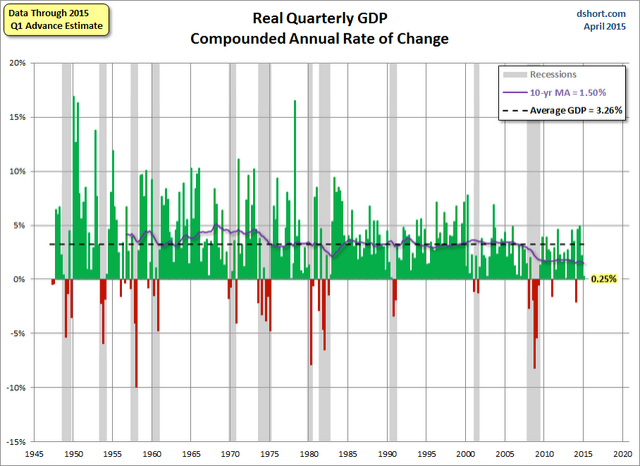

For a broad historical context for the latest forecasts, here a snapshot of GDP since Uncle Sam began tracking the data quarterly in 1947.

A More Intuitive Look at Quarterly GDP

Let's take one more look at quarterly GDP -- the year-over-year percent change, which is certainly more intuitive than the conventional practice of the Bureau of Economic Analysis of calculating GDP by compounding the quarterly percent change at annual rates (which they explain here). Consider: the four quarters of 2014 GDP using the BEA's preferred method are -2.1%, 4.6%, 5.0% and 2.2%. The year-over-year change in the three quarters is a much less attention-grabbing 1.9%, 2.6%, 2.7% and 2.4%. When we use the more intuitive percent change from a year ago, we get a somewhat disturbing long-term perspective on where we are in the grand scheme of things, one the more closely resembles the moving average in the chart above.