Most of the major currencies continued to consolidate ahead of FOMC but in a few hours, volatility should pick up quickly and aggressively. At 2pm ET / 19 GMT, we will learn if the Federal Reserve thinks it is time to start tapering asset purchases and shortly thereafter we will be listening for their forward guidance. Post FOMC trades should not be placed until the Fed's forward guidance is clear. Over the past few days, we have written various pieces about what to expect from the Fed and how it could impact the dollar. Today, we are compiling all of those views into one report to give our readers a thorough preview of the FOMC meeting.

Over the past week, the dollar appreciated against many of the major currencies but the gains have been small. Since the surprisingly strong labor market numbers, the dollar strengthened against the AUD, GBP and NZD but weakened against the EUR, JPY, CAD and CHF. This price action reflects the level of uncertainty and lack of conviction for the central bank's actions this month.

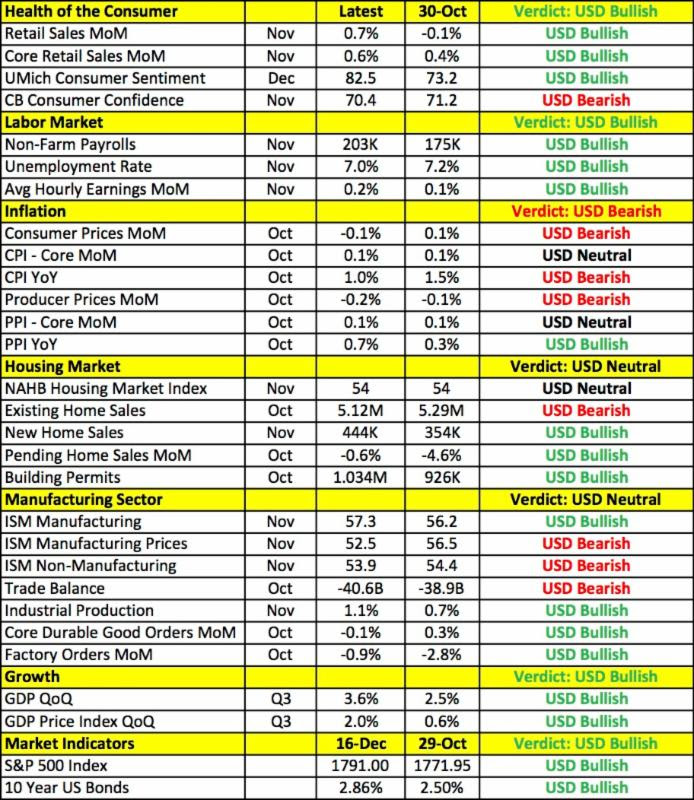

The decision to taper or not to taper is a close one. For the Federal Reserve, the greatest motivation for December tapering is the strength of U.S. data. Since the last FOMC meeting, we have seen a significant recovery in consumer spending and the labor market but there are still pockets of weakness in other parts of the economy. To get a sense of what the central bank could do, lets start by putting ourselves into the shoes of the Fed by looking at how economic data has changes since the last FOMC announcement on October 30th. Non-farm payrolls averaged 204k over the past 4 months and this strength drove the unemployment rate down to 7%. Retail sales also rebounded in November after contracting in September and according to the latest consumer sentiment survey, Americans are feeling more optimistic. Unfortunately housing market activity has been uneven, inflation is low and while manufacturing activity accelerated, service activity slowed. Strong arguments can made to wait or to press forward with tapering.

With USD/JPY and the EUR/USD hovering right below multi-year highs, the big question on everyone's minds is which direction these pairs will move after Wednesday's FOMC announcement. We have seen USD/JPY and EUR/USD rise simultaneously when stocks responded positively to the non-farm payrolls report but the FOMC announcement is significant enough that we could also see a uniform reaction in the dollar. It all boils down to how clearly Ben Bernanke lays out its plans for ending Quantitative Easing before he leaves office. While it may be exciting for the outgoing Fed Chairman to outline his vision for ending a program he started in 2008, he won't be the one that has to deal with the consequences of withdrawing stimulus too slowly or quickly. It is important to remember that when it comes to the FOMC decision, one of the top priorities of the central bank is minimize the volatility from their announcement. This is the whole function of the press conference - to explain their decision and manage expectations so Bernanke's comments will be just as important as the decision on tapering.

Our base case scenario is for a small amount of tapering this month ($5 to $10 billion) followed by a noncommittal outlook for further reductions that would minimize the market's reaction and give Janet Yellen the flexibility to design her own strategy for unwinding stimulus. Here are the 4 highest probability scenarios for tomorrow's announcement and their potential impact on the dollar.

- Scenario #1 - No Taper, No Guidance, Decision Pushed to 2014

Bearish USD (-USD/JPY, +EUR/USD)

If the Fed refrains from tapering, keeps their asset purchase program unchanged and simply says they are watching incoming data, the dollar will fall aggressively against the euro and Japanese Yen. By standing down completely and providing zero forward guidance, Bernanke would effectively be telling us that he is relegating the decision to his successor. The market would expect Janet Yellen, who is one of the most dovish members of the FOMC to prolong Quantitative Easing and delay tapering. Based on the price action in currencies and Treasuries, investors have priced in tapering in December or January, so if there is reason to believe that it will delayed to March or April, they will need to adjust their positions accordingly which would mean a sell-off in the dollar, rise in U.S. stocks and decline in yields.

- Scenario #2 - No Taper, Signals Plan to Reduce Purchases in Early 2014

Mildly Bearish USD (-USD/JPY, +EUR/USD)

The Fed could also refrain from tapering but strongly signal plans to reduce purchases in early 2014, which would mean either January or March. This is actually one of the highest probability scenarios supported by many economists who think Bernanke won't risk halting the Santa Claus rally. While there have been broad based improvements in the labor market and consumer spending, this morning's consumer price report shows that inflation is low giving policymakers the option to wait because inflation is not a major risk. The housing market has also been mixed but more importantly, stronger manufacturing activity is offset by slower growth in the service sector. U.S. yields have increased significantly over the past 7 weeks and by tapering, the central bank risks driving 10-year yields to 3%. We expect the dollar to sell-off initially when the FOMC announcement is made but depending on the strength of the forward guidance provided by Bernanke, the dollar could end up recovering part or all of its initial losses.

- Scenario #3 - Taper $5 - $10B, No Guidance

Mildly Bullish USD (+USD/JPY, -EUR/USD)

Our base case scenario is for a small amount of tapering this month ($5 to $10 billion) followed by a noncommittal outlook for further reductions that would minimize the market's reaction and give Janet Yellen the flexibility to design her own strategy for unwinding stimulus. As mentioned earlier, for the Federal Reserve, the greatest motivation for December tapering is the strength of U.S. data. Since the last FOMC meeting, we have seen a significant recovery in consumer spending and the labor market. Non-farm payrolls have averaged 204k over the past 4 months and this strength drove the unemployment rate down to 7%. Retail sales rebounded in November after contracting in September and according to the latest consumer sentiment survey, Americans are feeling more optimistic. Considering that it is only a matter of time before the Fed starts reducing its monthly bond buys, it may be strategically sensible to begin tapering this month so they can spread the reductions over a longer period of time. Tapering by a small amount and saying that further reductions would be data dependent could be one of the most palatable options for the Fed. It would allow Bernanke to begin the process of unwinding stimulus but leave Yellen with the flexibility to adjust the program as she sees fit. It would also limit the reaction in equities and currencies, allowing for a more moderate rally in the dollar and sell-off in stocks.

- Scenario #4 - Taper $15B - $20B, Strong Forward Guidance

Bullish USD (+USD/JPY, -EUR/USD)

If the Federal Reserve tapers in December and lays out a clear plan to reduce asset purchases over the next few months, we expect the dollar to soar and equities to fall quickly and aggressively. Committing the central bank to a detailed plan would be decision that needs Yellen's consent that would suggest the incoming Fed Chairwomen is onboard with reducing asset purchases immediately. This is the lowest probability scenario but an option that would be extremely positive for the dollar and U.S. yields but negative for stocks.

Risk Of Disappointment

As one of the most anticipated events of the year expectations are running high for the first reduction in asset purchases since Quantitative Easing was first introduced in 2008. Even if the Fed refrains from tapering, investors expect them to reduce monthly bond buys in January or March at the very latest. The problem is that when the bar is set high, there is always the risk of disappointment. According to the latest CFTC IMM reports, speculators hold massive amounts of long dollar positions against the JPY, AUD and CAD. If the central bank fails to be as hawkish as the market expects, profit taking on those positions could drive the dollar quickly and aggressively lower even if the Fed ends up being one of the few central banks unwinding stimulus next year.

Looking beyond the initial reduction in asset purchases, the real question will be quickly the central bank ends QE. Originally the Fed had planned to begin reducing its monthly bond buying in the third quarter of 2013 and end the program by mid-2014. Its now December and its not even clear whether the central bank will slow purchases this month which means there is a good chance QE may not end until 2015. The pace at which bond purchases will be halted next year will determine how much upside there is for the dollar next year.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.