Thursday’s Fed decision was one of the most anticipated ever, with much potential to really change the global financial market dynamics going forward. But thanks to the Fed’s incredible market distortions of recent years, Fed meetings spawning exceptional volatility is nothing new. Fed decision impacts on gold and stocks have been vast. And this next tightening cycle should reverse their Fed-imparted directionality.

The elite group within the Federal Reserve that actually makes the monetary-policy decisions is the Federal Open Market Committee. The FOMC includes ten voting members, and is led by the Fed Chair Janet Yellen herself. Four other members are from the Fed’s Board of Governors, while the remaining five are regional Fed presidents. The New York Fed has a permanent seat, while the four others rotate annually.

No other ten men and women in the world wield such enormous power over the fortunes of economies and markets, which is why investors and speculators are forced to so closely follow the Fed. The FOMC meets eight times per year for monetary-policy-setting purposes, about every six weeks or so. These meetings usually wrap up on Wednesdays with a statement outlining their decision published at 2 PM EST.

Every other meeting is followed by a press conference by the chairman. The FOMC usually saves major policy changes for that half of its meetings, since they give it an opportunity to explain its actions and calm down traders. The press-conference-followed meetings also include a summary of the economic and interest-rate projections of the ten FOMC members as well as the remaining regional Fed presidents.

As a lifelong speculator and student of the markets, I anticipate Fed days with great interest and dread. Volatility is what makes the markets fascinating and tradable, and the FOMC spawns big market moves in spades. But the anxiety comes from volatility being a sharp double-edged sword. When you get stuck on the wrong side of a trade after an FOMC decision, it’s certainly painful to weather the resulting tumult.

As I’ve thought intently about Thursday's epic Fed decision in recent weeks, I wanted to gain a better grasp of the outsized impact of recent years’ FOMC decisions on the two main markets I trade. They are gold and the stock markets. So this week I went through and analyzed the gold and stock-market action as represented by the flagship S&P 500 stock index immediately after ever FOMC decision since early 2013.

I certainly remember many volatile Fed days and their immediate aftermaths, but I was surprised at just how ubiquitous extreme FOMC-sparked volatility has been! Starting at every 2 PM FOMC decision, I looked at those trading days and the couple immediately following. In both gold and the stock markets, any single-day or several-day move beyond 1% is noteworthy. So I analyzed all net moves exceeding that.

Amazingly I found the results a bit shocking. Since I trade and write newsletters for a living, I am very blessed to watch the markets all day, every day. So I not only lived through all 21 FOMC decisions since early 2013 in real-time, but I wrote about them extensively in our following weekly and monthly newsletters. So I remember all kinds of Fed-spawned volatility, but all those Fed days blend together to mask their magnitude.

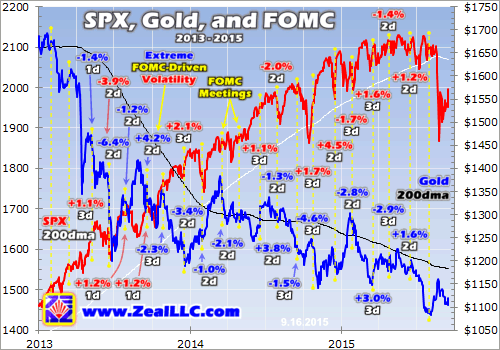

This first chart looks at the SPX and gold since early 2013. That date is important because that’s when the Fed’s wildly unprecedented open-ended third quantitative-easing campaign ramped up to full speed. QE3 has radically distorted global markets, spawning an extraordinary stock market levitation that all but obliterated demand for alternative investments led by gold. The Fed has utterly dominated recent years.

The FOMC’s decisions, along with the associated Fed-official jawboning and resulting psychology among traders, have been the overwhelmingly dominant driver of gold and stock markets since early 2013. The Fed’s actions eclipse all secondary drivers combined by an order of magnitude, they are truly the entire market story since early 2013. There’s never been another market era where the Fed had more influence!

So every FOMC decision in this surreal span is marked with a yellow line. And starting the trading day of each 2 PM FOMC-statement release, and continuing for the following two trading days, any outsized reactions above 1% net are noted in gold and the SPX. Once again even after experiencing all of these events at a deep professional level, I was surprised at their potency and consistency considered as a whole.

The outsized gold and stock market reactions immediately following FOMC meetings were so common that this chart got busier than I expected. Let’s start on the stock-market side since the Fed’s QE3-driven stock-market levitation has dominated sentiment in all markets. Of the 21 FOMC meetings before this week’s since early 2013, fully 13 or 62% saw outsized stock-market reactions as seen in the benchmark SPX.

And a whopping ten or 77% of these were positive, with the SPX rallying on the Fed day, the Fed and the subsequent trading day, or the Fed day and the next two trading days. The average gain after an FOMC decision on these upside reactions was 1.6% within several trading days including the Fed day. This further illustrates how the Fed has bent over backwards to appease stock traders since early 2013.

The SPX experienced two massive reactions to FOMC days in recent years, which I define as monster 3%+ moves off an FOMC decision within that three trading day span including the Fed day. The first was a huge 3.9% loss the stock markets suffered after the FOMC’s mid-June 2013 meeting. While the Fed didn’t act that day, Ben Bernanke chose his post-meeting press conference to drop a bombshell on the markets.

That day he simply laid out a best-case scenario, a hypothetical timeline, of when the Fed might start to taper its QE3 bond-monetization purchases later that year. The resulting violent downward reaction of the stock markets on the mere hint of less aggressive extreme Fed easing is a damning indictment of the artificial nature of stock markets’ QE3-driven rally. Without the Fed surges never would’ve happened in recent years!

The second massive reaction of the stock markets to an FOMC decision came with the SPX’s colossal 4.5% gain after the mid-December 2014 meeting. Provocatively that wasn’t a highly-anticipated Fed day, with the FOMC expected to do nothing but remove two words from its statement. It had promised a “considerable time” between the end of QE3’s bond buying and the first interest rate hike since June 2006.

But when the FOMC released its statement with the dovish “considerable time” still in there, computers parsed it instantly and went on a bidding frenzy. That day and the next, the SPX rocketed 4.5% higher on traders’ view that the Fed was still backstopping the stock markets! The FOMC was afraid of rocking the boat with the stock markets so lofty, and traders took advantage of this to recklessly flood back into stocks.

Both statistically and visually in this chart, there’s no doubt that FOMC meetings during recent years’ period of the most-extraordinary easing in the Fed’s history have proved very bullish for stock markets. The SPX not only surged in an outsized fashion far more often than not after FOMC decisions, but it often climbed to major new secular highs soon after the Fed spoke. The Fed literally levitated the stock markets!

This overwhelmingly upside SPX behavior during the latest years of the Fed’s extreme easing has very ominous implications for the Fed’s first tightening cycle in over nine years. If the uber-dovish FOMC decisions and jawboning in recent years was so darned bullish for stocks, odds are stellar that the Fed starting to unwind its record easing is going to be bearish. Indeed higher rates hurt stock markets in a variety of ways.

Directly they make yields on new bonds relatively more attractive, enticing investors back out of dividend-paying stocks into bonds. This puts lots of selling pressure on stock markets. But higher rates have a big indirect impact too. They slow the overall US economy by raising debt service costs, weighing on national consumption which soon translates into lower corporate sales and profits. That’s a big problem.

Lower earnings make already-overvalued stock markets look even more expensive, catalyzing more selling. So just as the most-easy Fed ever seen provided a monumental tailwind for the stock markets in recent years, a new tightening cycle shifts that to a major stock headwind. Investors and speculators alike need to realize a Fed-levitated stock market won’t fare well as the punch bowl is finally taken away.

As the only major asset class that generally moves contrary to stock markets, gold suffered the opposite fate in the Fed’s record zero-interest-rate-policy-and-quantitative-easing-fueled market anomaly of recent years. With the Fed choosing to effectively backstop stock markets, investors pulled vast sums out of other assets to deploy into the strong stocks. Gold was the major casualty of this mass exodus.

The FOMC meetings impact on gold in recent years was vastly greater than their impact on stocks. Gold saw outsized moves immediately after fully 16 of the 21 FOMC meetings before this week’s, or 76%! And the impact was overwhelmingly bearish and negative, with 12 of those 16 meetings seeing losses over 1% in the immediate aftermath of FOMC decisions. And gold’s losses far exceeded the SPX’s gains.

Gold plunged 2.6% on average on the Fed day, the Fed day and the subsequent trading day, or the Fed day and the next couple trading days! That’s a really big move. And an amazing six of these 16 episodes where gold reacted strongly right after FOMC decisions exceeded that 3% threshold necessary to qualify as massive moves. The biggest one was gold’s astounding 6.4% two-trading-day plunge in June 2013.

Once again that was that same FOMC meeting followed by Bernanke’s press conference where he very carefully laid out the possibility that the Fed would start reducing the size of its mammoth monthly bond monetizations. The prospect of less monetary inflation led gold to promptly collapse. Before that fateful Fed-conjured distortion changed everything, gold had held strong around $1375 to $1425 for a couple months.

Gold had suffered a panic-grade selloff back in mid-April that year after a major secular support zone failed. Gold sentiment was damaged, but psychologically traders could’ve rebounded from a single extreme selling event. But the subsequent plunge on that June-2013 QE3-taper-scare FOMC meeting drove the final nail into the coffin of gold sentiment. It was that Fed event that led gold to become hated to this very day.

The really sad part was that reaction was ridiculously absurd! The FOMC first announced QE3 back at its mid-September-2012 meeting, and subsequently expanded it to full steam shortly later at that year’s December meeting. Gold shot up 1.9% the day of that first meeting to $1766 on the Fed promising to create more money out of thin air to buy bonds, pure inflation. And after the second, it was still way up at $1712.

The day before that June-2013 QE3-taper-scare meeting, gold was at $1368. So not only had this metal not rallied at all during QE3, it had fallen 23% over that timeframe where the Fed’s balance sheet had ballooned from $2779b to $3418b. Gold had paradoxically lost 23% over the same short span where the Fed’s inflation had grown its balance sheet 23%! If gold didn’t rally in QE3, why should it reverse on QE3 ending?

Anyway, the overall impact on gold during the Fed’s extraordinary easing of recent years was powerfully negative. Even though record-low interest rates and currency created out of thin air to monetize bonds are super-bullish for gold historically all over the world, gold was crushed by FOMC dovishness in the last few years. Why? The Fed was actively enticing money out of everything else to chase levitating stocks.

So just as a tightening cycle is going to reverse the Fed’s massive upside impact in stock markets, it is also going to reverse the Fed’s massive downside impact in gold. Today with gold bearishness universal, traders all assume the next Fed tightening cycle is going to doom gold. Gold yields nothing, so higher rates leave it far less competitive. The problem is market history thoroughly refutes this popular argument.

A couple weeks ago, I published the results of my comprehensive study on how gold fared in every Fed rate hike cycle since 1971. It not only rallied through 6 of those 11 cycles, performing better the bigger and longer the rate-hike cycle, but saw massive average gains of 61% in these exact Fed rate hike cycle spans! Gold soared 50% higher during the Fed’s last rate-hike cycle between June 2004 and June 2006.

Even though the Fed more than quintupled its federal-funds rate from 1.00% to 5.25% over that span, making bond yields far more attractive, gold surged. Why? Because higher rates really damage stocks and existing bonds, renewing investors demand for prudent portfolio diversification through gold. Fed rate hike cycles have proven very bullish for gold historically, especially when gold is low going into one.

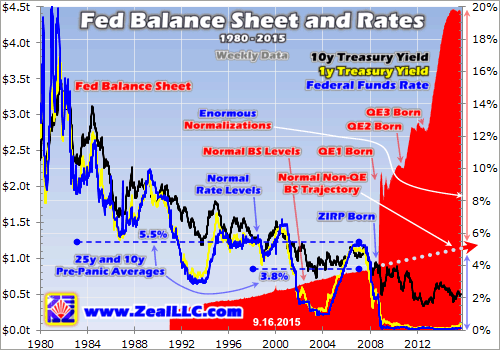

And no matter what Yellen said yesterday, the initial rate hike is merely the first step on the long road to normalization. This last chart looks at the Fed’s balance sheet and federal funds rate over the past 35 years or so. The full normalization of the Fed’s extreme zero interest rate policy and quantitative-easing campaigns is going to take many years. It’s not a trivial little one-hike-and-done scenario like widely hoped.

The epic once-in-a-century stock panic in 2008, the first in the Federal Reserve’s entire history, changed everything. The Fed panicked, implementing both ZIRP and QE. In the 25 years before that panic, the federal-funds rate averaged 5.5%. Returning to there is what a full normalization entails on the rate side. At a quarter point per hike, it would take 22 rate hikes to restore the FFR to its modern historical norms!

And that’s not impossible or even improbable. Between June 2004 and June 2006, the Fed hiked by a quarter point 17 FOMC meetings in a row to bring the FFR back near its historical average. So don’t take this one-and-done nonsense seriously, a rate hike cycle is not a one-time event. And the Fed hasn’t even started unwinding its gargantuan bond purchases yet, as its exploding balance sheet indicates!

If the Fed hadn’t panicked and implemented QE in response to that stock panic after ZIRP burned all its conventional monetary-policy ammunition, a normal growth trajectory would have taken the Fed’s balance sheet up near $1.2t today. Yet thanks to QE it’s a staggering $4.4t! So the Fed somehow has to sell, or more likely roll off, $3.2t in bonds before we will know how this extreme monetary experiment turned out.

Make no mistake friends, the fat lady hasn’t sung on the extreme Fed policies since late 2008 until rates and the Fed’s balance sheet are fully normalized! The ultimate impact of both ZIRP and QE in both the markets and economies won’t be known until they are fully unwound. So no matter what gold and the stock markets are doing in the immediate aftermath of this latest FOMC decision, it’s only the tiniest start.

Since this extraordinary Fed-easing era was so friendly to stocks and hostile to gold, its unwinding is almost certain to bring about the exact opposite outcome. Rising rates, and the threat of more rate hikes for years to come, will weigh on lofty overvalued Fed-levitated stock markets. And as stock markets suffer, capital will return to gold. Investors and speculators ought to sell stocks and buy gold to ride this.

The easiest way is through their leading ETFs, the SPY SPDR S&P 500 ETF (NYSE:SPY) for the stock markets and the GLD SPDR Gold Shares ETF (NYSE:GLD) for gold. For investors who want far more bang for their buck in gold upside potential, check out the left-for-dead gold miners. These companies are all trading down near fundamentally-absurd price levels today not reflecting their quite-profitable operations even at today’s gold prices.

The bottom line is FOMC decisions have had vast impacts on both gold and stock markets in recent years, yesterday’s was nothing new. The Fed’s wildly-unprecedented zero-interest-rate policy and quantitative-easing debt-monetization campaigns provided a powerful tailwind for stocks, fueling an extraordinary stock-market levitation. FOMC decisions tended to reinforce this bullish Fed-conjured upside bias.

Conversely gold was beaten to a pulp as the Fed seduced investors into forgetting prudent portfolio diversification. With the Fed shifting from record easing to a years-long tightening cycle, the fortunes of the markets are due to reverse. The stock markets are going to face a stiff headwind for years, forcing investors to diversify back into alternative investments led by gold. Is your portfolio ready for this monumental shift?