EconMatters has been critical of Fed's new found dovishness. Judging from the FOMC statement released on Wednesday Dec. 17, Fed made a concerted effort (to keep Wall Street happy) keeping a spot for that infamous "considerable time" language. However, technically speaking, the phrase is actually a reference of timing, not exactly part of FOMC current policy statement. Below is the exact language:

Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

In the Q&A session of the press conference, Chairwoman Yellen said "The committee considers it unlikely to begin the normalization process for at least the next couple of meetings.” So the general consensus interpretation is that Fed is in no hurry to raise rates till at least April of 2015 unless the economic condition takes a drastic turn (better or worse).

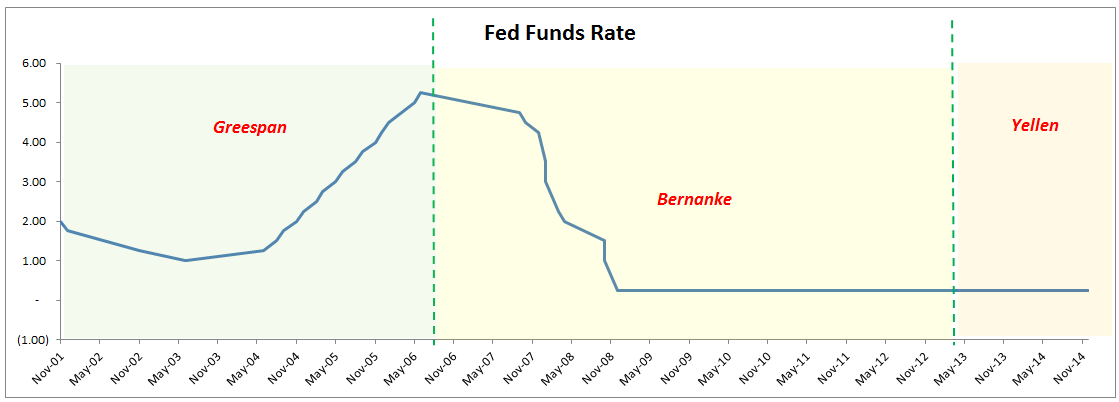

Nevertheless, Fed is running out of excuse to keep rates at near zero beyond 8 years. Employment is up, inflation is moderate (enhanced by the recent lower oil/fuel prices), and corporate profits are up.

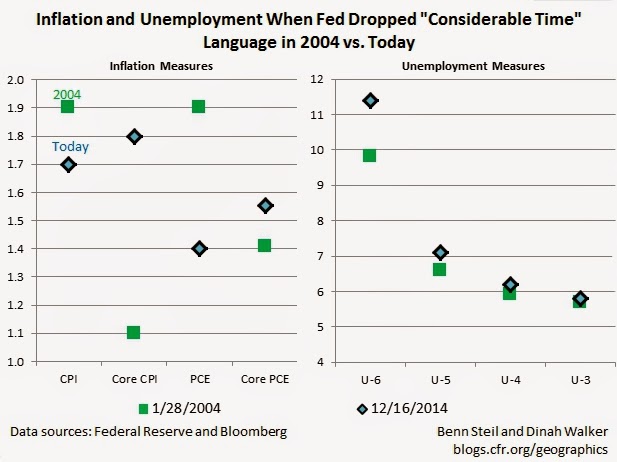

Council on Foreign Relations (CFR) published an interesting graph (see below) just before this Dec. FOMC meeting comparing various inflation and unemployment measures in 2004 (Greenspan era) and 2014. CFR at the time predicted that Yellen would drop the "considerable time" language from the policy statement, just like Greenspan did in Jan. 2004, and it looks like CFR was right.

|

| Source: Council on Foreign Relations, Dec. 16, 2014 |

Now the more intriguing question for markets is when the Yellen Fed will start raising rates? The Greenspan Fed started gradually raising rate in June 2004, roughly 5 months after dropping the "considerable time" language in Jan. 2004. So if we continue the train of thought by CFR, we probably could expect a rate raise somewhere in Q2 of 2015.

Greenspan was criticized by some for keeping the loose monetary policy far too long leading to the housing bubble, which was a main contributing factor to the 2008 financial crisis. When it comes to the Federal Reserves, past performance could have more relevance to future results. Ms. Yellen would be prudent to learn from history and not to repeat the similar missteps.