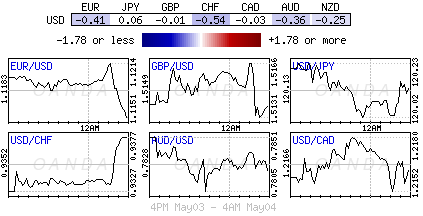

Holiday thinned markets (Japan’s Golden week holiday Monday-Wednesday and today’s U.K May Day celebrations) are managing to keep forex action relatively tight ahead of the open stateside this morning. Nevertheless, this is a big week for capital markets with event risk coming from various directions that is sure to have a major impact on forex moves.

U.S non-farm payroll is expected to dominate the week, especially after last months disappointing release that has pressured the dollar ever since. The market is looking for a rebound to +215k jobs and an unemployment print to dip to +5.4% from +5.5%. Before NFP, U.S March durable goods/factory orders this morning and trade tomorrow is expected to shape final Q1 GDP forecasts. With the Fed looking beyond Q1, April’s ISM services Tuesday will be key (56.5 e). On Wednesday, the U.S releases labor costs that will be scrutinized, especially after last weeks Employment Cost Index pickup.

RBA: Rate cut speculators fever pitch

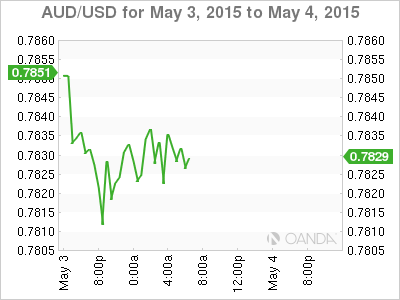

The RBA meets tomorrow and the market is pricing in a +72% chance of a -25bps cut to +2%. Last week’s AUD move above AUD$0.80c would have alarmed the RBA. If the RBA cuts, watch whether the statement leave the door ajar for further cuts. If it does, the AUD outright should make tracks back down towards AUD$0.75c, its old stomping ground. Any hesitation by the RBA and the Aussie bears should come under considerable pressure, especially after last weeks selling interest that has established ‘hot’ money short positions north of AUD$0.80c. The upcoming decision is providing a headwind for the AUD currency with AUD/USD at 0.7830 just ahead of the NY morning.

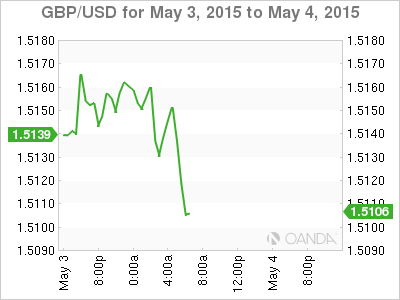

UK Hung Parliament not priced in

Investors are not very fond of uncertainty and there seems to be plenty of it heading into the May 7 U.K elections where a hung parliament is likely. Sterling (£1.5130) is expected to be vulnerable and volatile over the coming day’s, more so than what we have witnessed up to this point. According to the latest commitment of traders report the market is short the pound, but perhaps not all that short given the uncertainty of Thursday’s result. Markets have been longer of sterling than they are now about +75% of the time. This would suggest that there is room for the market to go shorter even yet.

GBP/USD saw recent gains evaporate ahead of Thursday UK election which continued to show outcome uncertainties of a likely coalition govt. GBP/USD is currently straddling £1.5120 ahead of the European session handover mid-session after approaching the £1.55 handle late last week. The election uncertainty still does not seem to be significantly priced by the FX markets with the USD correction of last week making it difficult to justify Cable shorts with any degree of confidence.

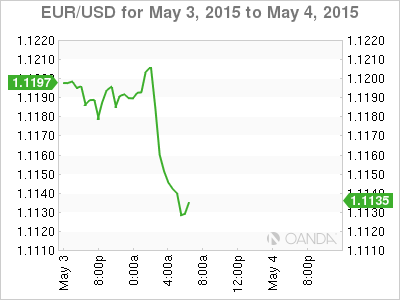

Major European Manufacturing PMIs come in mixed

There were mixed results on the Euro PMI front this morning, which is never too much of a surprise to the market. The overall Eurozone final manufacturing PMI has come in slightly better than the flash estimate of 51.9. The 52 final reading for April reveals some good gains on new export orders as well as manufacturing employment but the key focus will be on prices. Input prices rose for the second consecutive month and were up in all eurozone countries except Austria. The ECB needs to feel confident that the deflation trend is turning, although not a trend, this morning’s release is positive. The ECB will not get an accurate picture until much later in the year and that will involve a lot of uncertainty between now and then.

The EUR (€1.1129) has moved into the lower end of recent range in thin trading with U.K dealers out for a bank holiday. The range €1.1070 to €1.1300 area continues to hold.

China manufacturing on the ropes

China’s April final HSBC Manufacturing PMI data missed expectations overnight to register its worst reading in a year (48.9 v 49.4e). The miss is leading to more speculation of pending rate cuts from the PBoC. It’s the lowest level since last April, as demand faltered and deflationary pressures persisted. This confirms that China’s manufacturing sector is having a weak start to Q2. The market is now pricing in further stimulus measures to prevent the world’s second largest economy from not slowing too much further from the +7% growth rate seen in Q1. Data like will always have a direct impact on Australasian currencies, especially the AUD, which is generally used as a proxy for China risk.

Greece’s liquidity constraints

This is a big week for Greece when it comes to liquidity. Concerns of a deteriorating liquidity situation seem to be forcing the government to cave into some, but not all, of the demands from its creditors.

Greece has a payment due to the IMF (€200m) on May 6 as well as on May 12 (€750m). On Wednesday, the Government will hope to conduct a €6m T-bill auction to rollover a +€1.4b 6-Month T-bill maturing on May 8. On that day the ECB will be holding its non-policy meeting where haircuts for the ELA collateral is expected to be discussed.

A deal is not necessary for the ECB to release payments. The market believes that the cap on the T-bill issuance could be lifted if a Greek deal is on the horizon with its creditors.