EUR/USD: Focus On Fed Speakers

- The Conference Board says that U.S. consumer confidence index rose to 104.1, up from 101.8 in August. It was the strongest reading since the index stood at 105.6 in August 2007. The reading was much better than the market had expected. The September gain was propelled by an improvement of consumers' views about the labor market.

- Fed Vice Chairman Stanley Fischer said the Federal Reserve should avoid raising interest rates too much, adding that gains in U.S. incomes are a sign that workers are benefiting from a tighter labor market.

- The U.S. central bank left rates steady at a policy meeting last week, but policymakers including Fed Chair Janet Yellen signaled a hike was likely by the end of the year. Money market futures price in a less than 50% chance of a rate increase by December, compared to over 60% after the Fed's policy meeting last week. In our opinion the Fed will raise interest rates in December.

- Yellen will give her semi-annual testimony before a Congressional committee today, and while it is set to be focused on financial regulation, traders said she is likely to asked questions about the Fed's outlook on rates and the economy.

- Cleveland Fed President Mester and Kansas City Fed President George are also due to speak on the economy and monetary policy at separate events. Both are seen as hawks by the market after they dissented at the last meeting and voted to raise rates.

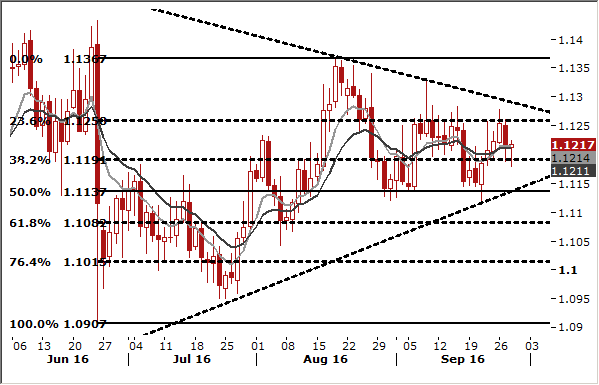

- The EUR/USD is fluctuating near 14-day exponential moving average. We expect stronger volatility after today’s comments from Yellen. We stay long for 1.1320.

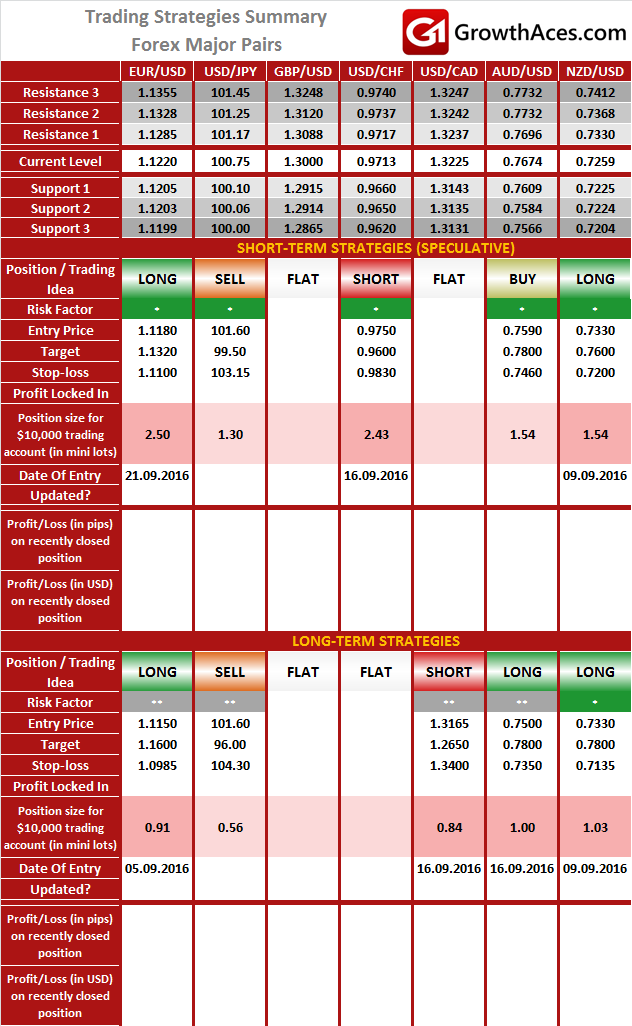

FOREX - MAJOR PAIRS:

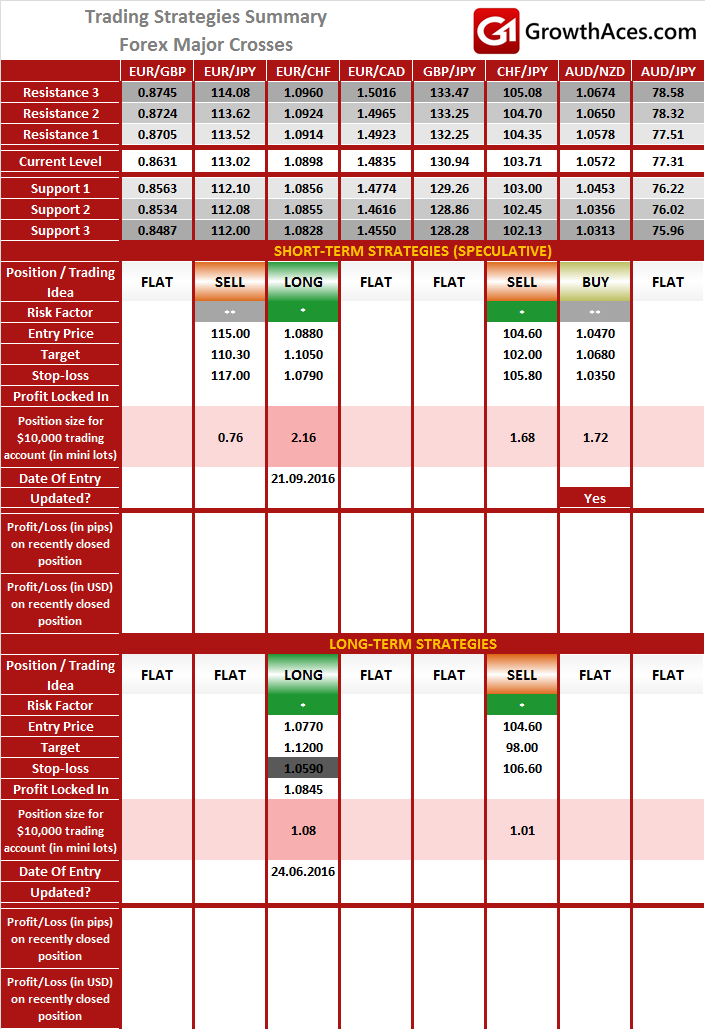

FOREX - MAJOR CROSSES:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.