Deutsche Bank (NYSE:DB) and Commerzbank (LON:CZB) are discussing merger talks. The fact that these meetings are occurring is a signal that Germany’s banking troubles are indeed accelerating.

The banks are desperately seeking ways to cut costs and improve profitability. Their plans include restructuring and job cuts using highly unconventional measures. In June, Reuters cited anonymous sources saying that Commerzbank was exploring the option of hoarding billions of euros as a way of avoiding paying a penalty to the European Central Bank, thanks to negative interest rates.

Their main problems derive mostly from low and negative interest rates. These lenders are used to depending on interest-rate margins for income while offering some services to depositors at either low or no cost. Low interest rates have significantly eroded their ability to make money. It has become difficult for German banks to incentivize customers to deposit their money in their vaults. These inefficiencies -- and the intense competition within the German banking sector -- have already led to serious financial difficulties. If one combines these factors with the new challenge of declining interest rates, what possible positive impact can they expect to incur?

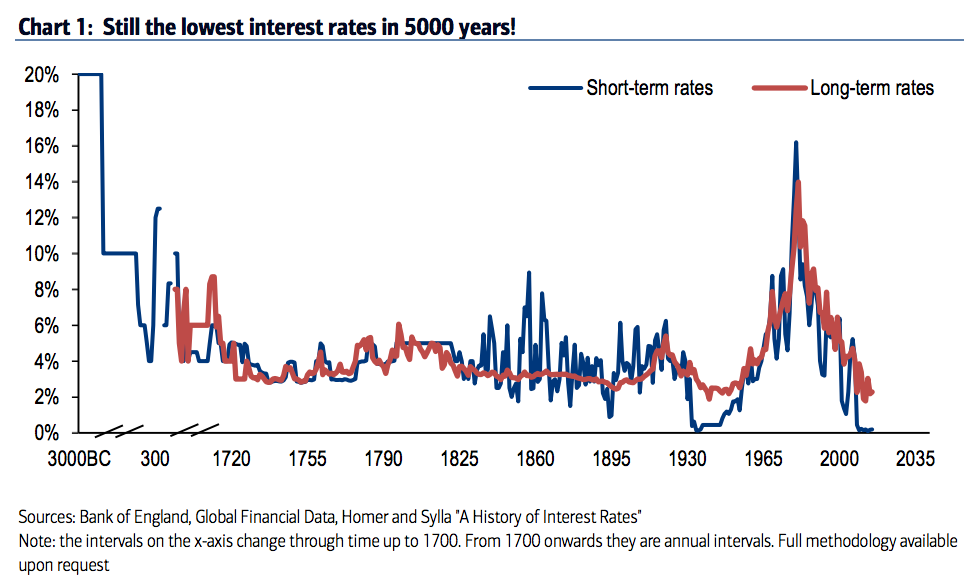

Interestingly, rates are not just low within the context of American history but they also happen to be at their lowest levels ever in over 5,000 years of civilization.

That's 5,000 years of interest rates, which are currently lower than the 1930’s Depression Era.

Deutsche Bank is not merely Germany’s biggest bank but the political role that it plays in Germany is unique compared to other countries. Deutsche Bank’s importance to Germany is many times greater than that of an investment bank like Lehman Brothers was to the U.S. in 2008. Deutsche Bank is technically a private bank, however it is informally tied to the government and formally tied to most major German corporations. The bank's fate will have an impact on the entire country.

And then there's Italy, whose banking crisis is not just confined to its borders.

Italy's non-performing loan issues are common knowledge. Who will be forced to deal with settling Italy's impaired debt? That's a political question and the answer depends, in large measure, on who holds Italian bank debt.

The U.S banks are not shielded from Europe's banking problems. There is a substantial amount of uncertainty and risk.

The consequences of these failures pyramid the crisis due to the European Unions’ regulations. The European Central Bank and the central banks of member countries cannot bail out failing banks by recapitalizing them. The bail-in strategy is, in theory, a mechanism for ensuring fair competition and stability within the financial sector across the Eurozone.

The bail-in process can potentially apply to any liabilities of the institution that is not backed by assets or collateral. The first 100,000 euros ($111,000) in deposits are protected in the sense that they cannot be seized, while any money above that amount can be.

Germany insisted on the bail-in process.

The Bank for International Settlements stated that German banks are the second-most exposed to Italy, after France, with a total exposure of $92.7 billion. Is it any wonder that gold demand has increased?

Italy’s ongoing banking crisis is presenting yet another threat to the stability of the ECB.

Commerzbank’s financial statements revealed that its Italian sovereign debt exposure was 10.8 billion euros ($12.1 billion).

Deutsche Bank’s net credit risk exposure to Italy is 13.3 billion euros as of the end of December 2015. Its gross position in Italy is 35.4 billion euros. Deutsche Bank is sitting on $41.9 trillion worth of derivatives.

The Consequences Are Significant

Gold is the only safe haven left in the world. Indeed, the metal has been a form of currency for centuries. Whenever countries followed a strict gold standard and used it as their currency, their economies were stable. But governments have always surpassed their means with costly spending, causing them to abandon the gold standard to fund their inefficiencies. I think gold is beginning a multi-year bull market as it's the only asset class that will be able to maintain its’ ‘store of value’ during this impending crisis. In fact 'gold mania’ is about to take off as global central banks implement negative interest rates, which is an ideal environment for gold to surge higher.

Gold does have a historical store of value. central banks and institutions horde it as a reserve. And they do not want to sell it. On the contrary, many want to accumulate even more. Therefore, gold’s characteristic role in regard to sovereign reserves is still intact even amid the fascinating evolution of central banking and institutional finance.