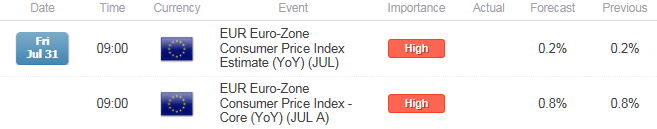

- Euro-Zone Consumer Price Index (CPI) to Expand Another 0.2% in July.

- Core Inflation to Hold Steady at Annualized 0.8% for Second Consecutive Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) may spur a bullish reaction in EUR/USD as sticky price growth in the monetary union dampens the European Central Bank’s (ECB) scope to implement more non-standard measures.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the ECB retains its pledge to ‘fully implement’ its quantitative easing (QE) program, the diminishing threat for deflation may encourage central bank President Mario Draghi to adopt a more upbeat tone over the coming months, and the Governing Council may start to discuss a potential exit strategy going into 2016 amid signs of a more sustainable recovery in the euro-area.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

M3 Money Supply (3M) (JUN) | 5.1% | 5.1% |

Retail Sales (MoM) (MAY) | 0.1% | 0.2% |

Construction Output (MoM) (MAY) | -- | 0.3% |

Increased consumption paired with the pickup in private-sector credit may encourage faster price growth across the euro-area, and an unexpected expansion in the CPI may heighten the appeal of the single currency as the region gets on a more sustainable path.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Consumer Confidence (JUL A) | -5.8 | -7.1 |

Producer Price Index (YoY) (MAY) | -2.0% | -2.0% |

Unemployment Rate (MAY) | 11.1% | 11.1% |

However, European firms may continue to offer discounted prices amid high unemployment along with lower input costs, and a dismal inflation report may produce further headwinds for the euro as the ECB retains a very dovish outlook for monetary policy.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish EUR Trade: CPI Highlights Sticky Price Growth

- Need green, five-minute candle following the release to consider a long EUR/USD trade.

- If market reaction favors a bullish Euro trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish EUR Trade: Euro-Zone Inflation Exceeds Market Forecast

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bullish Euro trade, just in opposite direction.

Read More:

Price & Time: Big Moment For Kiwi

Dollar Forecast Improves, Indicator Shows it May Rally Across the Board

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Failure to hold above the Fibonacci overlap around 1.0970 (38.2% expansion) to 1.0990 (50% retracement) raises the risk for a further decline in EUR/USD as the pair continues to search for support, with the July low (1.0807) on the radar.

- DailyFX Speculative Sentiment Index (SSI)shows the retail crowd remains net-short EUR/USD since March 9, but the ratio continues to narrow ahead of August as it sits at -1.43, with 41% of traders long.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Impact that the Euro-Zone CPI report has had on EUR during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JUN 2015 | 06/30/2015 09:00 GMT | 0.2% | 0.2% | +45 | 0 |

June 2015 Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) slowed to an annualized rate of 0.2% in June from 0.3% the month prior, while the core rate of inflation also matched market expectations as it slipped to 0.8% from 0.9% during the same period. Despite the slowdown, it looks as though the monetary union is largely moving away from a disinflationary environment after facing negative price growth earlier this year, and the Europe Central Bank (ECB) may turn increasingly upbeat towards the economy as President Mario Draghi sees a moderate recovery in the euro-area. The Euro bounced back following the in-line prints, with EUR/USD working its way above the 1.1200 handle, but the pair struggled to holds its ground during the North American trade as it closed the day at 1.1140.