European majors depreciated sharply last week as markets were shocked by ECB's easing. Sterling was indeed the weakest one as it also pressured by the increasing support for Scottish independence. While the greenback jumped on weakness of Euro, it's slightly overshadowed by Aussie on firmness of risk markets. Also, the dollar pared back some gains after weaker than expected non-farm payroll. Canadian dollar closely followed in spite of weak job data. In other markets, stocks were firm with European indices boosted by ECB announcement. USD indices were stuck in tight range as markets digest recent bullish run.

To have a quick recap of last week's central bank activities. ECB announced to start purchasing asset-backed securities and covered bonds in October. to increase liquidity to the financial system and stimulate growth. Also, the central bank cut the main refi rate by -10 bps to 0.15%. Correspondingly, it also lowered the bank overnight deposit rate to -0.2% and the marginal lending rate to 0.3%. More in ECB Announces QE - ABS and Covered Bond Purchases. BoE left interest rate unchanged at 0.50% and maintained asset purchase target at GBP 375b. Only a brief statement is released and focus will turn to meeting minutes to be published on September 17. BoJ left policies unchanged. Interest rate was held near zero and the target of monetary base expansion was kept at an annual pace of JPY 60-70T. BoC left interests unchanged at 1.00%. RBA left rates unchanged at 2.50%.

Technically, here is a quick review on euro pairs. EUR/USD might have some brief consolidations above 1.2919 temporary low this week but recovery should be limited below 1.3159 and bring fall resumption. EUR/USD is expected to target 1.2755 medium term support next. EUR/JPY stayed well in medium term falling channel and would likely extend recent down trend through 135.72 low. But we'd prefer to see decisive break of 135.50 key support level to confirm bearishness. EUR/GBP was stuck in range of 0.7873/8035 last week and we'd possibly see more consolidation this week first. But overall outlook stays bearish for a test on 0.7755 key support level in a latter stage.

We've pointed out euro's broad based weakness last week but was cautious in euro commodity pairs. Nonetheless, both EUR/AUD and EUR/CAD took out key medium term support level, which affirmed the bearishness. EUR/AUD took out 1.4050 key support level decisively last week and extended the fall from 1.5831. The sustained trading below 55 weeks EMA now opens up the case for deeper fall to 61.8% retracement of 1.1602 to 1.5831 at 1.3217 before making a bottom below there.

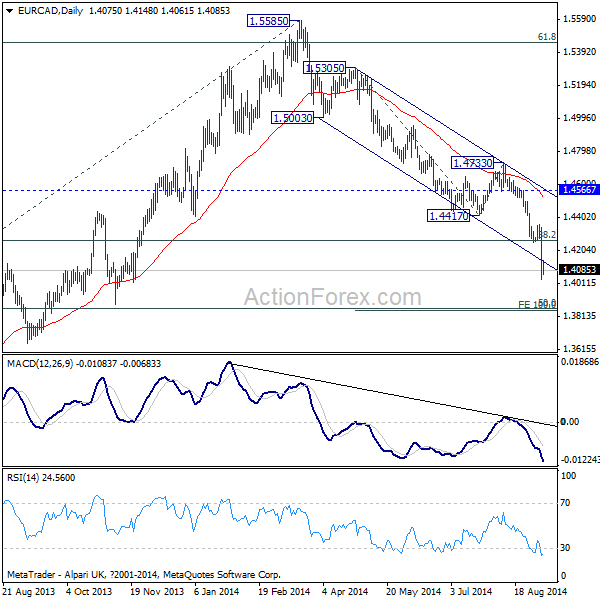

EUR/CAD dropped sharply to as low as 1.4035 last week and broke 38.2% retracement of 1.2126 to 1.5585 at 1.4264 decisively. The break of the falling channel support also suggests downside acceleration. The fall from 1.5885 should now head to 50% retracement level at 1.3856, which is close to 100% projection of 1.5305 to 1.4417 from 1.4733 at 1.3845.

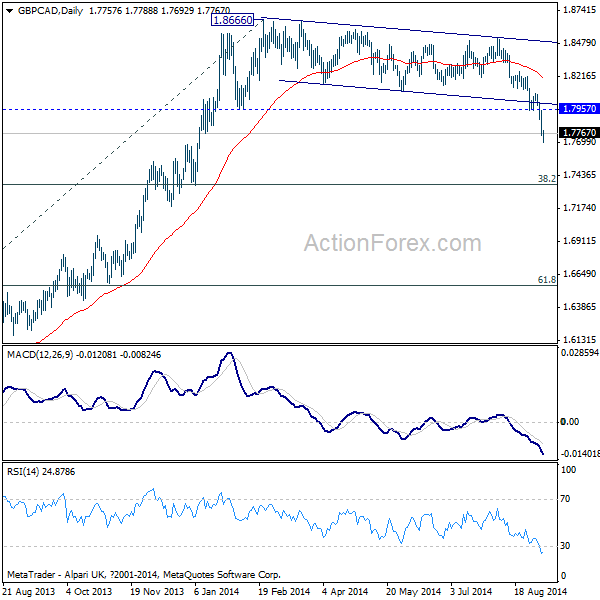

The outlook in Sterling was similar to that of Euro. GBP/CAD took out 1.7957 key support level last week, which confirmed medium term topping at 1.8666. The fall from there should now extend towards 38.2% retracement of 1.5424 to 1.8666 at 1.7428 next.

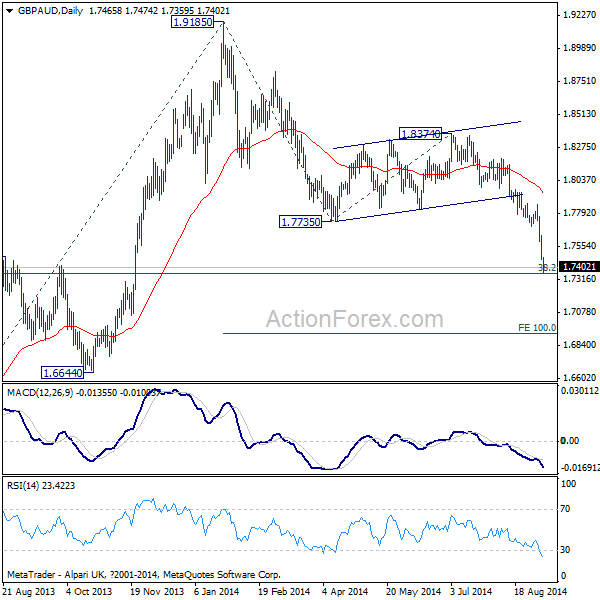

GBP/AUD also dropped sharply to as low as 1.7359 as decline from 1.9185 medium term top extended. 38.2% retracement of 1.4380 to 1.9185 at 1.7349 was just missed. There is no sign of bottoming yet and we'd expect such fall to extend through 1.7349 to 100% projection of 1.9185 to 1.7735 from 1.8374 at 1.6924.

So, overall, we'd expect USD, CAD and AUD to continue to strengthen against EUR and GBP. The question is which pair will move most ahead. Bearishness in EUR/GBP suggests that Sterling is still having a mild upper hand against Euro. But the pound is facing a rather important risk of Scottish independence referendum while ECB easing was past already. USD/CAD's consolidation from 1.0997 would likely extend further, which leaves USD neutral with CAD in near term. AUD/USD would extend last week's recovery, but we'd expect strong resistance below 0.9504 to limit upside. Meanwhile, AUD/USD could indeed reverse any time as the price actions inside a consolidation are usually rather choppy. AUD/CAD attempted to rally last week but was limited below near term resistance at 1.0234. The cross could extend further sideway. Hence, we're rather neutral among USD, AUD and CAD.

Regarding trading strategies, our EUR/USD short was correct last week. We'll stay short in EUR/USD as medium term trade and add to the position around 1.305. The pair should at least have a test on 1.2755 later this year. In addition, we'll try to sell GBP/CAD on a recovery this week, at 1.79, which is slightly below prior support level.