For the 24 hours to 23:00 GMT, the EUR rose 0.43% against the USD and closed at 1.1328, after Germany’s unemployment rate in January fell to its lowest rate since the nation’s reunification in 1990.

Yesterday, data showed that jobless rate in Germany dropped to 6.5% in January, meeting market expectations. In the prior month, unemployment rate had recorded a revised reading of 6.6%.

Gains in the Euro were kept in check, after consumer prices in Germany retreated 1.0% on a monthly basis in January, more than market expectations for a 0.8% drop.

In other economic data, the final consumer confidence index in the Euro-zone registered a rise to -8.50, in line with market expectations, while the region’s economic confidence index unexpectedly fell to a level of 101.2 in January, lower than market expectations for a rise to 101.6 and compared to a revised reading of 100.6 registered in prior month.

In the US, number of people claiming jobless benefits for the first time dropped more than expected to near 15-year low level of 265.0 K in the week ended 24 January 2015, compared to market expectations of a drop to 300.0 K. In the previous week, initial jobless claims had registered a revised level of 308.0 K. Meanwhile, the nation’s pending home sales unexpectedly fell 3.7% on a monthly basis in December, compared to a revised rise of 0.6% in the prior month. Markets were anticipating the pending home sales to climb 0.5%.

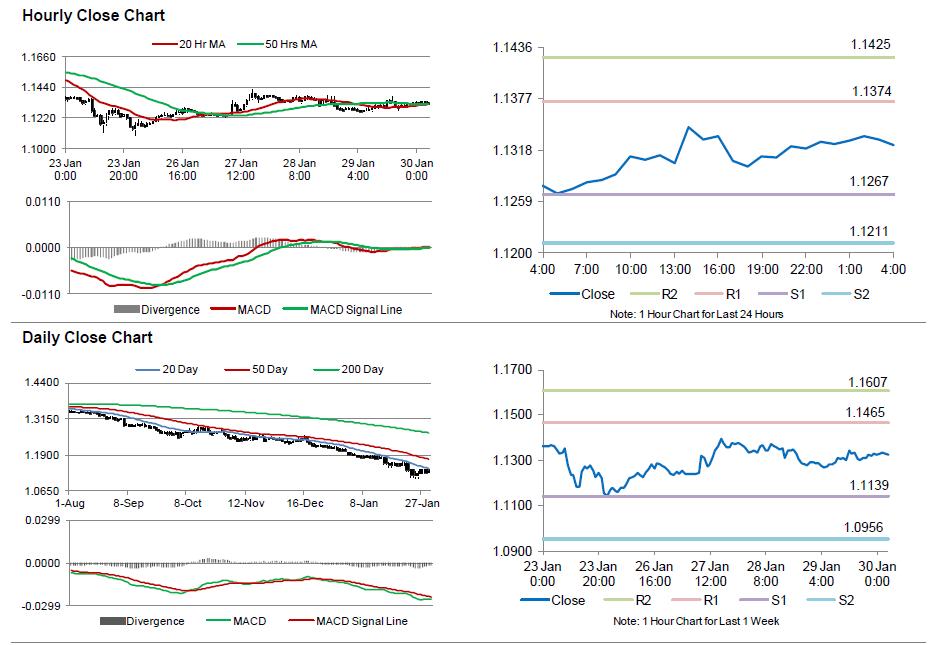

In the Asian session, at GMT0400, the pair is trading at 1.1323, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1267, and a fall through could take it to the next support level of 1.1211. The pair is expected to find its first resistance at 1.1374, and a rise through could take it to the next resistance level of 1.1425.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s CPI and unemployment data, scheduled in few hours. Meanwhile, the US 4Q GDP data would grab lot of market attention, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.