For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.2608, after Germany’s CPI eased 0.3% on a monthly basis in October, higher than market expected drop of 0.1%. The index had registered an unchanged reading in the previous month.

In other economic news, the jobless rate in Germany remained flat at a level of 6.7% in October, at par with market expectations, while number of unemployed people unexpectedly dropped by 22.0 K in October, compared to a revised advance of 9.0 K in the prior month. Market anticipations were for the number of people unemployed to rise by 4.0 K. Meanwhile, the Euro-zone’s economic sentiment index surprisingly advanced to a reading of 100.7 in October, compared to market expectations for a fall to 99.7, while the region’s consumer confidence stood at -11.1 in October, match market expectations.

Elsewhere, Spain’s GDP advanced 0.5% on a QoQ basis in 3Q 2014, compared to a growth of 0.6% registered in the previous quarter.

In the US, the annualized GDP recorded a rise of 3.5% in 3Q 2014, compared to a rise of 4.6% in the prior quarter, while markets were anticipating the annualized GDP to advance 3.0%. Meanwhile, the nation’s personal consumption rose 1.8% on a quarterly basis in 3Q 2014, less than market expectations for an advance of 1.9%.

On the other hand, initial jobless claims climbed to 287.0 K, in the week ended 25 October 2014, compared to a revised level of 284.0 K in the previous week. Market anticipations were for initial jobless claims to advance to 285.0 K. Additionally, continuing jobless claims recorded an unexpected rise to 2384.0 K, compared to market anticipations to fall to a level of 2352.0 K.

Separately, the Fed Chairwoman, Janet Yellen, stated that the central bank could benefit from diverse range of views. She further opined that having a range of different ideas and perspectives would help the US central bank to make correct policy decisions. Yellen did not comment on the outlook for the economy or monetary policy.

In the Asian session, at GMT0400, the pair is trading at 1.2603, with the EUR trading marginally lower from yesterday’s close.

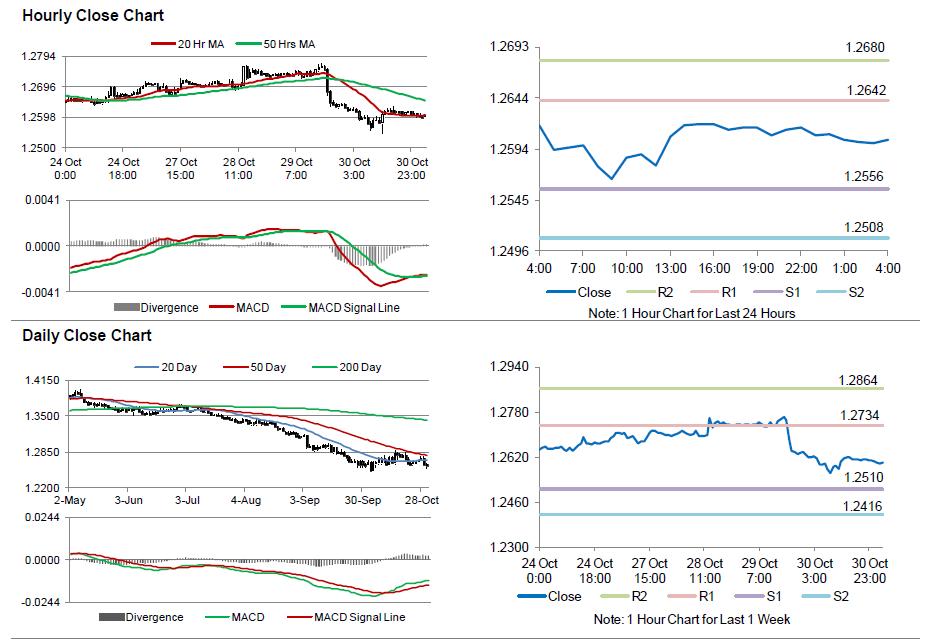

The pair is expected to find support at 1.2556, and a fall through could take it to the next support level of 1.2508. The pair is expected to find its first resistance at 1.2642, and a rise through could take it to the next resistance level of 1.2680.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s CPI as well as Germany’s retail sales data, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.