For the 24 hours to 23:00 GMT, the EUR declined 0.36% against the USD and closed at 1.2461.

Yesterday, data from Germany indicated that the nation’s monthly consumer prices remained flat in November, in line with market expectations and following a drop of 0.3% registered in the prior month. Additionally, unemployment rate remained steady at 6.6% in November, lower than market expectations for a rise to a level of 6.7%. Meanwhile, the nation’s GfK consumer confidence index rose to 8.7 in December, higher than market expectations for an advance to a reading of 8.6. The index had recorded a level of 8.5 in the prior month.

In other economic news, the Euro-zone’s economic sentiment indicator registered an unexpected rise to a level of 100.8 in November, compared to market expectations of a fall to 100.3, while the region’s industrial confidence index improved unexpectedly to a level of -4.3 in November, compared to market expectations of a fall to a level of -5.5. On the other hand, M3 money supply in the Euro-zone advanced 2.5% in on an annual basis in October, compared to a similar rise in the previous month, while market anticipations were for it to advance 2.6%.

Elsewhere, Spain’s GDP grew 0.5% on a quarterly basis in 3Q 2014, at par with market estimates, while the nation’s inflation declined 0.4% on a YoY basis in November, higher than market expectations for a fall of 0.3%.

Separately, the ECB Chief, Mario Draghi, urged the region’s member nation governments to implement economic reforms in their respective nations, as failure to do so might “threaten the essential cohesion of the Union”. Furthermore, he cautioned the 18-member currency bloc that unemployment, lack of productivity and structural reforms are the three major risks surrounding the Euro-economy.

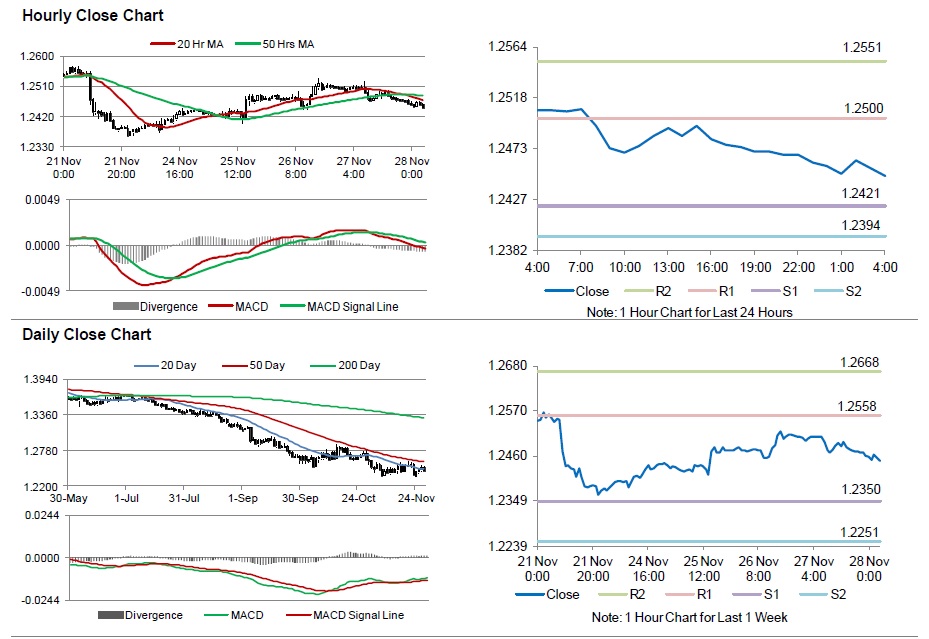

In the Asian session, at GMT0400, the pair is trading at 1.2449, with the EUR trading 0.1% lower from yesterday’s close.

The pair is expected to find support at 1.2421, and a fall through could take it to the next support level of 1.2394. The pair is expected to find its first resistance at 1.2500, and a rise through could take it to the next resistance level of 1.2551.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s crucial CPI data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.