GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: long at 1.0670, target 1.0990, stop-loss 1.0570

GBP/JPY: long at 182.20, target 184.50, stop-loss 182.50

Pending Orders

EUR/USD: sell at 1.0845, if filled – target 1.0550, stop-loss 1.0990

USD/JPY: buy at 120.80, if filled – target 123.55, stop-loss 119.60

USD/CHF: buy at 0.9855, if filled – target 1.0230, stop-loss 0.9740

USD/CAD: buy at 1.2550, if filled - target 1.2780, stop-loss 1.2430

EUR/GBP: sell at 0.7215, if filled - target 0.7110, stop-loss 0.7270

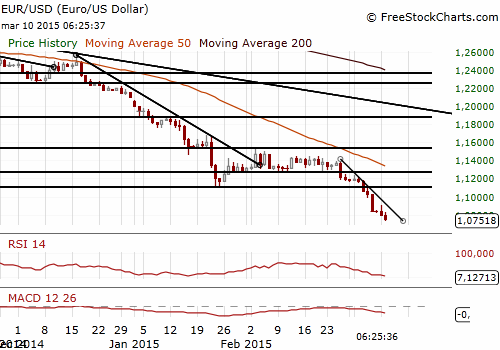

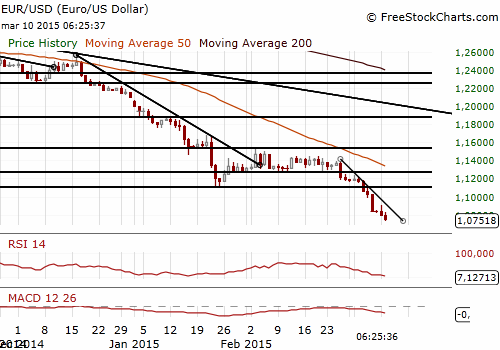

EUR/USD: Greek Worries Return

(sell at 1.0845)

- Dutch Finance Minister Jeroen Dijsselbloem said after chairing Monday's meeting of Euro zone colleagues that the negotiations among financial experts from Greece and the creditor institutions -the European Commission, European Central Bank and International Monetary Fund - would start in Brussels on Wednesday. The negotiations will probably weigh down on the EUR.

- Richard Fisher, president of the Dallas Federal Reserve Bank and a non-voting FOMC member this year, said the central bank should promptly end its easy monetary policy and press ahead with an interest rate hike. He ignored stagnate wage growth, calling it a lagging indicator, and said inflation will bounce back once energy prices stabilize.

- Cleveland Fed President Loretta Mester (non-voting this year) said that when the Fed does decide to raise interest rates the initial hike should probably be a quarter of a percentage point. She also said the Fed can begin raising rates even if inflation is slow to increase.

- The EUR/USD sank below 1.0800 for the first time in almost 12 years today. Our sell offer is at 1.0845, below the level of 1.0855, hourly high on March 10. If the order is filled, our target will be 1.0550, just above the psychological level of 1.0500. In the medium-term the EUR/USD bears target long-term fibo 76.4% of 0.8228-1.6040 at 1.0072, which is very close to the parity.

Significant technical analysis' levels:

Resistance: 1.0855 (hourly high Mar 10), 1.0906 (hourly high March 6), 1.1033 (high, Mar 6)

Support: 1.0734 (low Mar 10), 1.0500 (psychological level), 1.0072 (76.4% of 0.8228-1.6040)

USD/JPY Reached New 8-Year High

(buy offer raised to 120.80)

- Japanese Prime Minister Shinzo Abe said oil price fall are positive for Japan’s economy as they boost household income. Japanese Economy Minister Akira Amari said Q4 GDP downward revision was not something to be pessimistic about and the economy remains on a firm recovery track. He added that private spending was picking up, which is a good trend.

- Etsuro Honda, a key economic adviser to Japanese Prime Minister Shinzo Abe, said on Tuesday that it remains to be seen whether weakness in the JPY will be severe enough to damage Japan's economy, which faces higher resource import costs. He added that the USD/JPY around 120 was not problematic for the economy as a whole.

- The USD rose to an 8-year high against the JPY on the back of expectations that the Federal Reserve may begin raising interest rates as early as summer. In contrast, the Bank of Japan remains deeply committed to monetary easing, buying large amounts of Japanese government debt to support its quantitative easing scheme.

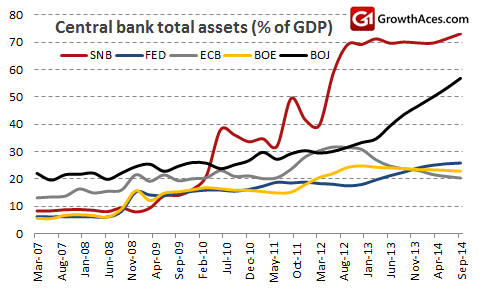

- Divergences in monetary policies are shown in the chart below. The Swiss National Bank and the Bank of Japan are the leaders in expanding their balance sheets in the relation to GDP of their countries. This means that the JPY and the CHF are likely to be under strongest pressure among major currencies. The JPY and the CHF are also known safe-haven currencies and an improvement in risk appetite as a consequence of quantitative easing will be negative for these currencies.

- We have raised our buy offer on the USD/JPY to 120.80. The next strong resistance level is 123.67,daily high on July 9, 2007 and the target of our long position would be placed slightly below this level. The stop-loss level will be set below 119.90, daily low on March 6.

Significant technical analysis' levels:

Resistance: 121.29 (high Mar 6), 121.86 (high Dec 8), 122.00 (psychological level)

Support: 119.90 (low Mar 6), 119.47 (low Mar 4), 119.13 (low Feb 27)