GROWTHACES.COM Forex Trading Strategies

EUR/USD: sell at 1.0665, target 1.0470, stop-loss 1.0725, risk factor

EUR/USD: ECB Plans Two-Tiered Charge On Liquidity

(sell at 1.0665)

- The Commerce Department new US single-family home sales increased 10.7% in October to a seasonally adjusted annual rate of 495k units. September's sales pace was revised down to 447k units from the previously reported 468k units. Though new home sales tend to be volatile month-to-month because they are drawn from a small sample, October's bounce back should offer some assurance that the housing market remains on solid ground despite declines last month in home resales, housing starts and confidence among builders.

- Separate data showed non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, increased 1.3% last month after an upwardly revised 0.4% rise in September. The data were much better than expected (0.4% rise). The report came on the heels of data this month showing a solid increase in manufacturing output in October. A survey of factories also showed a rise in new orders last month. Recent data are very good news, as manufacturing has been slammed by the dollar strength and the spending cuts in the energy sector.

- Shipments of core capital goods, which are used to calculate equipment spending in the government's GDP measurement, fell 0.4% last month after an upwardly revised 0.7% gain in September. Core capital goods shipments were previously reported to have risen 0.5% in September.

- The Commerce Department said also consumer spending edged up 0.1% mom after a similar increase in September. That suggests consumer spending has slowed from the third quarter's brisk 3.0% annual pace. The tepid rise in consumer spending could combine with an anticipated drag on the economy from an ongoing inventory reduction to hold the economy to around a 2% growth rate in the fourth quarter. The government reported on Tuesday that the economy expanded at a 2.1% rate in the third quarter.

- On the other hand, personal income increased 0.4% last month, accelerating after a 0.2% gain in September. Wages and salaries shot up 0.6%, the largest increase since May. With income outpacing spending, savings rose, which could boost consumer spending in the coming months.

- Yesterday’s news that the ECB might be considering two-tiered bank charges on excess liquidity (together with a step-up in QE) had a sizable impact on the market, contributing to push the EUR/USD to below 1.06 and triggering a sharp rally on government bond curves, with the German curve negative up until the 7Y tenor. This framework could allow the ECB to deliver a larger-than-expected cut in the deposit rate, while trying to mitigate the cost for the banking sector.

- The deposit rate cut poses issues it might have a large impact on yields and the currency, but would also carry negative implications for the banking sector while excess liquidity is on the rise due to QE.The possibility of two-tier charges might be a way to manage this trade off, ideally maximizing the impact on the market while limiting the cost for banks of holding excess reserves. To be clear, this is just part of the potential total costs banks could bear in case of a lower depo rate.

- Yesterday’s news suggests that the ECB could charge A percent on excess liquidity up to a certain threshold, and a more negative B percent on funds beyond that threshold. Assuming excess liquidity would be split 50-50 between the two tiers, setting A at -0.2 and B at -0.5 would cost the banking system the same as a flat depo rate cut to -0.35% (which is currently priced in by the market).

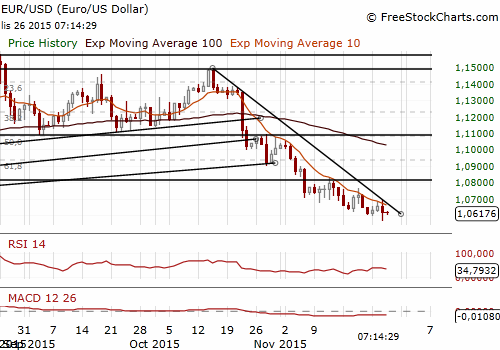

- The EUR fell back towards seven-month lows against the USD yesterday. The market activity is low today because of US Thanksgiving holiday. The 10-day exponential moving average stopped recent EUR/USD recovery and it is now at 1.0674. Our sell order is slightly below this level, at 1.0665. If the order is filled, the EUR/USD short target will be at 1.0470, slightly above the 2015 lows at 1.0457.

Significant technical analysis levels:

Resistance: 1.0674 (10-day ema), 1.0763 (high Nov 19), 1.0830 (high Nov 12)

Support: 1.0565 (low Nov 25), 1.0521 (low Apr 13), 1.0457 (low Mar 16)

Source: Growth Aces Forex Trading Strategies