EUR/USD is steady in Tuesday trading, as the pair trades in the low 1.35 range. In economic news, German ZEW Economic Sentiment posted another solid reading, but fell short of the estimate. Eurozone ZEW Economic Sentiment looked sharp, posting a strong gain in December. In the US, it’s an unusually quiet week, with no releases until Thursday.

German ZEW Consumer Sentiment didn’t show much change in December, coming in at 61.7 points, compared to 62.0 points a month earlier. However, the key indicator fell well short of the estimate of 63.4 points. European ZEW Consumer Sentiment surprised the markets with a sharp rise, climbing to 73.3 points, up from 68.3 a month earlier. This easily beat the estimate of 70.2 points.

We continue to see weak inflation numbers out of Europe and this was underscored by Monday's release of German PPI, which posted a paltry gain of 0.1% in December. As inflation indicators remain listless, concerns of deflation are increasing. ECB president Mario Draghi didn't have much to offer at the ECB's last policy meeting, reiterating that monetary policy will remain accommodative for as long as is needed to help the Eurozone economy recover, and that interest rates will likely remain at present or lower levels for the foreseeable future. If growth and inflation indicators continue to look sluggish, the ECB may have to take action at its next policy meeting in February, such as lowering the benchmark interest rate or reducing deposit rates into negative territory.

Last week ended on a busy note in the US, which saw the release of three key events. Building Permits showed little change, coming in at 0.99 million, shy of the estimate of 1.01 million. JOLTS Job Openings rose to 4.00 million, increasing from 3.93 million a month earlier. This beat the estimate of 3.97 million, and was welcome news from the employment front after the recent dismal Non-Farm Payrolls release. UoM Consumer Sentiment dropped to 80.4 points, down from 83.5 in the previous release. This was well below the estimate of 83.4, but a reading over the 80 line is certainly respectable.

Weak inflation levels remain a major concern in the US, as persistently low inflation is an indication of an underperforming economy. This was underscored by Core CPI, which posted a weak gain of just 0.1% in December. Producer Price Index posted a gain of 0.4%, reversing directions after three consecutive declines. Last week, Chicago Fed President Charles Evans said that the low rate of U.S. inflation is “both puzzling and worrisome,” and enough reason to maintain low interest rates, even if the employment picture continues to brighten. Analysts will be watching closely whether incoming Fed chair Janet Yellen shares these sentiments. Yellen takes over the helm of the Federal Reserve on February 1, replacing Bernard Bernanke.

EUR/USD" title="EUR/USD" align="bottom" border="0" height="242" width="400">

EUR/USD" title="EUR/USD" align="bottom" border="0" height="242" width="400">

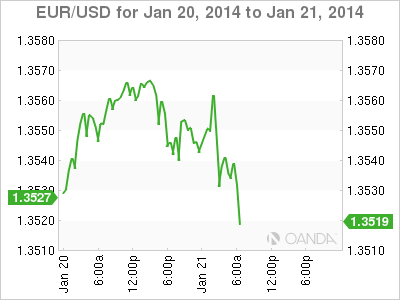

EUR/USD January 21 at 11:20 GMT

EUR/USD 1.3531 H: 1.3563 L: 1.3525

EUR/USD Technical

S3 S2 S1 R1 R2 R3 1.3360 1.3410 1.3500 1.3585 1.3649 1.3786

- EUR/USD has edged lower in Tuesday trading. The pair touched a high of 1.3563, but has since retracted.

- 1.3585 continues to provide resistance. This is followed by a stronger resistance line at 1.3649.

- On the downside, the round number of 1.3500 is providing weak support. 1.3410 is a stronger support line.

- Current range: 1.3500 to 1.3585

Further levels in both directions:

- Below: 1.3500, 1.3410, 1.3347 and 1.3257

- Above: 1.3585, 1.3649, 1.3786, 1.3893 and 1.4000

OANDA's Open Positions Ratio

EUR/USD ratio has reversed positions in Tuesday trading, pointing to gains in short positions. This is consistent with what we are seeing from the pair, as the euro has edged lower. The ratio is made up largely of short positions, indicative of a trader bias towards the dollar continuing to move to higher levels.

The euro has had a slow week so far. With no US releases on Tuesday, the subdued activity from EUR/USD could continue.

EUR/USD Fundamentals

- 10:00 German ZEW Economic Sentiment. Estimate 63.4 points. Actual 61.7 points.

- 10:00 Eurozone ZEW Economic Sentiment. Estimate 70.2 points. Actual 73.3 points.