GROWTHACES.COM Forex Trading Strategies:

Taken Positions

EUR/USD: long at 1.0915, target 1.1180, stop-loss 1.0780, risk factor *

GBP/USD: long at 1.4820, target 1.5000, stop-loss 1.4740, risk factor ***

USD/CHF: short at 0.9670, target 0.9300, stop-loss 0.9810, risk factor **

USD/CAD: short at 1.2650,target 1.2350, stop-loss moved to 1.2530, risk factor **

AUD/USD: long at 0.7600, target 0.7800, stop-loss moved to 0.7500, risk factor **

AUD/JPY: long at 90.75, target 93.00, stop-loss moved to 91.35 , risk factor ***

Pending Orders

USD/JPY: sell at 121.20, if filled – target 118.00, stop-loss 122.50, risk factor **

NZD/USD: buy at 0.7450, if filled - target 0.7700, stop-loss 0.7330, risk factor **

EUR/GBP: buy at 0.7270, if filled - target 0.7450, stop-loss 0.7190, risk factor **

EUR/JPY: buy at 129.00, if filled – target 132.50, stop-loss 127.50, risk factor ***

AUD/NZD: sell at 1.0260, if filled – target 1.0000, stop-loss 1.0380, risk factor ***

EUR/USD: Is Fed Getting More Dovish? Eyes On FOMC Minutes

(stay long for 1.1180)

- Minneapolis Fed President Narayana Kocherlakota (non-voting, dove) laid out a case for waiting until the second half of 2016 to start raising interest rates, and to then raise them gradually to just 2% by the end of 2017. He added: “I do worry about the ongoing conversation about tightening monetary policy being a drag on economic performance both in terms of growth and in terms of employment outcomes.” Kocherlakota said the U.S. economy would need at least three more years of labor market improvement like last year to reach the "normal" level seen before the financial crisis. In his opinion inflation will likely not rise back to the Fed's 2% goal until 2018.

- Kocherlakota is probably the most dovish U.S. policymaker, so his opinions may be ignored by the market. Most Fed policymakers, including Fed Chair Janet Yellen, believe the Fed will need to start raising rates this year as the labor market improves and begins to put upward pressure on excessively low inflation. However, in our opinion a hike in June is rather unlikely and we expect the Fed to start its monetary tightening in September.

- The expectations for early interest rates hikes by the Fed are diminishing. On the other hand the ECB’s Governing Council member Yves Mersch said the bank would be free to adjust its programme of money printing if it advanced faster than expected towards its goal of lifting inflation. The European Central Bank bought almost EUR 61 billion of government bonds and other assets in March, just beating its target in the first month of a programme. The ECB has committed to buying EUR 60 billion assets a month with newly created money until September 2016.

- Retail sales in the Eurozone slipped 0.2% mom and rose 3.0% yoy, exactly in line with expectations. This rise was driven by higher demand for non-food products and automotive fuel. Sales of non-food products rose 4.3% yoy in February, from 4.2% in January while sales of fuel for cars rose 4.2% yoy, from a 3.1% increase in January.

- A shift in expectations for rate hikes in the USA and quite “hawkish” suggestions from ECB’s Mersch should support a rise in EUR/USD, pretty in line with our scenario. We said many times that the strong USD was likely to weigh on U.S. economic recovery and might result in later interest rates hikes in the USA, while falling EUR would give a boost to the Eurozone economy and might shorten deflation period.

- The minutes of the Federal Reserve's March meeting will be released later in the day and traders will scrutinize it for any concerns from policymakers about a strong USD and its impact on U.S. growth. Any dovish hints in minutes may cause a drop in the USD.

- The EUR/USD fell strongly below the entry level of our long position. However, it recovered somewhat and in our opinion is likely to rise further, especially in case of dovish FOMC minutes today. Recent weaker-than-expected U.S. macroeconomic figures and quite surprising comments from the ECB’s Mersch reassured us that long position on the EUR/USD is the right direction.

- We stay EUR/USD long with the target at 1.1180.

Significant technical analysis' levels:

Resistance: 1.0955 (high Apr 7), 1.1036 (high Apr 6), 1.1052 (high Mar 26)

Support: 1.0803 (low Apr 7), 1.0789 (21-dma), 1.0750 (low Apr 2)

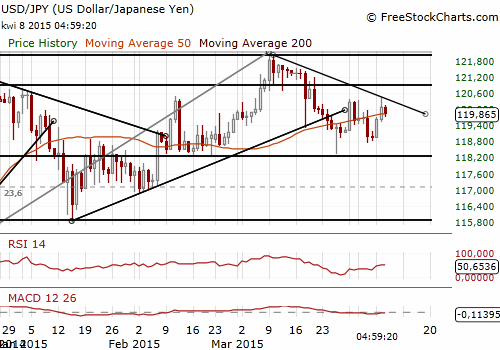

USD/JPY: No Change In BOJ Policy, But Lone Dissenter Proposed Tapering

(sell at 121.10)

- The Bank of Japan stuck with its massive monetary stimulus programme today, as widely expected. The central bank maintained that consumer prices are temporarily depressed by cheaper oil, and will gradually rise as consumers and businesses spend more and the economy recovers further.

- BOJ Governor Haruhiko Kuroda said there is no change to our stance of aiming to achieve 2% inflation at the earliest date possible, with a timeframe of two years in mind. He said: “Output is picking up as exports rebound and inventory adjustment proceeds. The latest tankan survey shows business sentiment is improving as a whole. Household spending is firm as a whole reflecting steady improvements in job and income conditions.”

- Board member Takahide Kiuchi, who has expressed concerns that massive money printing could sow the seeds of a future bubble, called for the BOJ to cut back its asset buying. He proposed reducing the base money target, and the annual pace of increase in the BOJ's government bond holdings, to JPY 45 trillion. The proposal was rejected by an 8-1 vote.

- Investors are focused on the April 30 meeting, when the Japanese board will review its long-term projections and may further cut its inflation forecast.

- Our short USD/JPY reached its stop-loss at 120.40 yesterday. However, the depreciation of the JPY was short-lived and the rate is back below 120.00.

- In our opinion the BOJ will take no additional action and such a scenario should support a slight fall in the USD/JPY in the medium term. However, there are still some investors that believe the BOJ policymakers will accelerate its quantitative easing and these expectations may result in higher levels of the USD/JPY in the very short term. We are the opinion that any USD/JPY upticks should be used to get short on this pair.

Significant technical analysis' levels:

Resistance: 120.45( high Apr 7), 121.20 (high Mar 20), 121.41 (high Mar 17)

Support: 119.45 (low Apr 7), 118.71 (low Apr 3), 118.34 (low Mar 26)