GROWTHACES.COM Forex Trading Strategies:

Trading Positions:

EUR/USD trading strategy: long at 1.1300, target 1.1550, stop-loss 1.1240

GBP/USD trading strategy: long at 1.5080, target 1.5300, stop-loss 1.5100

USD/CHF trading strategy: long at 0.9160, target 0.9400, stop-loss 0.9090

EUR/GBP trading strategy: long at 0.7470, target 0.7650, stop-loss 0.7390

EUR/CHF trading strategy: long at 1.0160, target 1.0650, stop-loss 1.0230

GBP/JPY trading strategy: long at 179.00, target 182.00, stop-loss 177.55

Pending Orders:

USD/JPY trading strategy: sell at 119.20, if filled target 116.60, stop-loss 120.00

USD/CAD trading strategy: buy at 1.2400, if filled target 1.2720, stop-loss 1.2320

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies.

EUR/USD: FOMC Rather Neutral Than Hawkish, Buy EUR

(long again for 1.1550)

- The meeting of the Federal Reserve ended yesterday. The Fed reiterated that it would be "patient" in raising rates from record lows. The Fed said that inflation would likely decline further before starting to rise gradually.

- The contracts now show that traders see a 66% chance that the first Fed rate hike will come in October 2015.

- European Central Bank Executive Board member Benoit Coeure said the quantitative easing programme that was announced last week would end “only once we get a strong sense that inflation is converging towards 2%”. Another ECB Executive Board member Peter Praet said Euro zone money supply for December is showing some positive signs as credit to companies rose. He also noted the fall in prices of credit to companies.

- Traders interpreted yesterday’s Fed’s statement as hawkish and the EUR/USD fell after its release to today’s low of 1.1263. In our opinion such a reaction was unjustified – the statement was as widely expected, neither dovish nor hawkish, and we still see more and more reasons to expect that Fed’s hike will take place later than sooner (low inflation, strong USD, more dovish FOMC composition in 2015 than in 2014).

- A fall in the EUR/USD was short-lived and now it is back above 1.1300. We expect the EUR/USD to rise in the short and medium term.

- Our EUR/USD long reached its stop-loss yesterday at 1.1280, but we took small profit (1.1220-1.1280). We got long again today at 1.1300 and keep our previous target of 1.1550.

Significant technical analysis' levels:

Resistance: 1.1384 (high Jan 28), 1.1412 (10-dma), 1.1423 (high Jan 27)

Support: 1.1263 (low Jan 29), 1.1224 (low Jan 27), 1.1098 (low Jan 26)

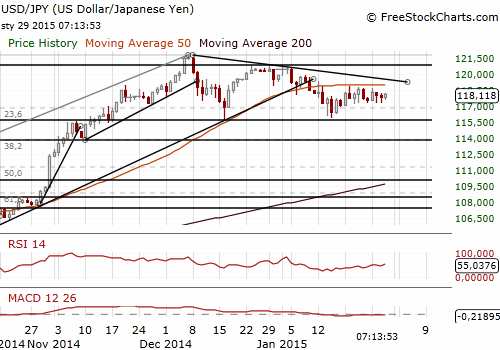

USD/JPY: Watch Today’s Macro Data

(looking to get short on upticks)

- Bank of Japan Governor Haruhiko Kuroda said that while consumer inflation may slow in the short-term due to slumping oil prices, it will accelerate in the latter half of the next fiscal year beginning in April as companies raise wages and an economic recovery pushes up prices. Kuroda repeated that Japan is likely to hit the BOJ's price target "in a period centering (in or around) fiscal 2015" and that there was no change to the bank's stance of aiming to achieve its price goal in roughly two years.

- Japan's retail sales rose 0.2% yoy in December, much weaker than the median forecast for 0.9% gain. Other important macroeconomic releases are scheduled for today (CPI, unemployment rate at 23:30 GMT and industrial output at 23:50 GMT).

- Our USD/JPY trading strategy remains unchanged. We are looking to sell USD/JPY at 119.20.

Significant technical analysis' levels:

Resistance: 118.28 (high Jan 28), 118.66 (high Jan 27), 118.81 (high Jan 23)

Support: 117.40 (session low Jan 29), 117.34 (low Jan 27), 117.26 (low Jan 26)

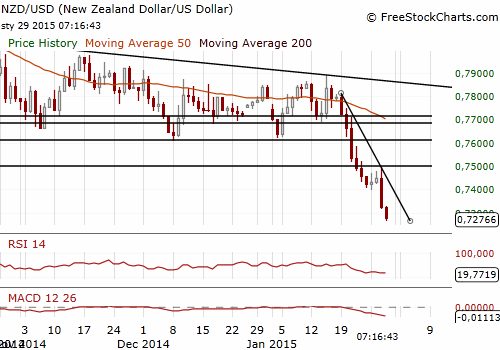

NZD/USD: The RBNZ Left The Door Open To A Rate Cut

(we stay sideways, waiting for the RBA meeting next week)

- New Zealand's central bank held its official interest rate at 3.5% as widely expected, and said it expected to leave it unchanged "for some time" because of low inflation. The bank said: “Future interest rate adjustments, either up or down, will depend on the emerging flow of economic data.”

- Ahead of the announcement, markets had priced a slightly chance of a 25 bps cut following weaker than expected local inflation data, a surprise rate cut by Canada's central bank and quantitative easing measures from the European Central Bank last week.

- The central bank believes the NZD exchange rate remains unjustified in terms of current economic conditions, particularly export prices, and unsustainable in terms of New Zealand's long-term economic fundamentals. The central bank expects to see a further significant depreciation of the NZD.

- Although the RBNZ kept interest rates unchanged against the expectations of some market participants for a rate cut, the NZD/USD fell strongly after the announcement. The central bank left the door open to a possible easing in the future, which made investors sell the NZD.

- New Zealand's annual trade deficit widened in December to NZD 159 million vs. the median forecast NZD 26 million. Exports rose 9.4% mom, but were down 6.9% yoy as the slide in dairy exports more than offset a rise in meat sales. Imports rose 7.6% yoy with increased purchases of capital goods, including several large aircraft for Air New Zealand, and heavy machinery, leading the growth. The government agency said if the import of big ticket items, such as the aircraft, was excluded the annual deficit would have narrowed to NZD 137 million.

- Fonterra has reduced its milk volume forecast for the 2014-15 season to 1,532 million kgMS, reflecting the impact of dry weather on production in recent weeks. The new forecast is 3.3% lower than the 1,584 million kgMS collected last season.

- The NZD/USD broke below 0.7300 today and is testing levels last seen in March 2011. The meeting of the Reserve Bank of Australia is scheduled for next week – expectations for dovish statement may weigh on the NZD and the AUD in the coming days. However, medium-term outlook is slightly bullish and we will be hunting for lower levels to get long.

Significant technical analysis' levels:

Resistance: 0.7358 (hourly high Jan 29), 0.7495 (high Jan 28), 0.7522 (10-dma)

Support: 0.7200 (psychological level), 0.7125 (monthly low Mar, 2011), 0.7000 (psychological level)

Source: Growth Aces