EUR/USD: Fed To Stay On Hold, But Statement May Be Hawkish

- The Federal Reserve will end its third regular FOMC meeting of the year today. Following an unexpectedly dovish turn by Chair Yellen last month, it seems to be a done deal that the Fed will leave its interest rate unchanged. In addition to Janet Yellen, several FOMC members expressed the view at the March FOMC meeting “that a cautious approach to raising rates would be prudent or noted their concern that raising the target range as soon as April would signal a sense of urgency they did not think appropriate.” To be sure, the March minutes revealed a deep split within the Committee with many members arguing in favor of a somewhat faster normalization of interest rates. But the fact that Chair Yellen and Vice Chair Dudley are in the dovish camp should mean that this side will prevail – certainly at the upcoming meeting.

- As there will be no press release and no update of the Committee’s economic and interest rate projections, the sole focus will be on the post-meeting press release.

- In our opinion the EUR/USD may react positively to the FOMC on-hold decision, but a re-test of recent peaks above 1.1400 seems to be unlikely, unless the Fed does soften its stance even further. In our opinion the statement may be slightly more hawkish than the previous one to prepare markets for a rate hike in June. That is why we are looking to use higher levels to get EUR/USD short. But the risk on this strategy is high and we suggest lower position size.

AUD/USD: Hunting To Buy AUD/USD

- The Australian Bureau of Statistics reported its headline consumer price index fell 0.2% last quarter, the first decline in seven years.

- Annual inflation slowed to 1.3%, from 1.7%, led by falling petrol and food prices.

- Key measures of underlying inflation rose by just 0.15% on average in the first quarter, easily the lowest outcome since the series first began in 2002. The annual pace slowed to 1.6%, again the lowest on record and well under the RBA's long-term target band of 2 to 3%. That would be a shock to the central bank which had projected core inflation would bottom around 2%.

- Even inflation in the services sector, which has been stubbornly high for years, slowed to under 2%.

- The disturbingly weak report revived talk the Reserve Bank of Australia could cut the already record-low 2% cash rate at its May policy meeting next week. Investors answered by ramping up the chance of a cut next week to 48%, from just 12% ahead of the data. That probability rises to 90% by August.

- Yields on three-year government paper fell 12 basis points, the largest daily drop since June last year

- The RBA has repeatedly said that low inflation would allow room for a further cut, but it has also sounded unconvinced ever-easier policy was the right prescription for the economy. In our opinion the RBA will not cut interest rates next month.

- Recent macroeconomic data from Australia were sound. Australia enjoyed relatively rapid growth of 3% last year and recent news on business conditions and investment has been upbeat. Unemployment ticked down to 5.7% in March.

- The AUD plunged by almost 2% today after data showed consumer prices fell unexpectedly in the first quarter. Much depends on tonight's FOMC statement where a hawkish Fed would likely extend AUD/USD's loss. The further the AUD/USD slides however, the less chance the RBA will cut rates. In an April 19 speech in RBA Governor Glenn Stevens was at pains to highlight his concern for the impact of ultra-low interest rates over a lengthy period on savers, devoting a whole section of his speech to this topic.

- We think today’s AUD/USD drop should be used to get long on the AUD/USD, but we stay cautious ahead of today’s Fed statement. We placed our bid at 0.7520.

NZD/USD: The RBNZ Is Likely To Keep Rates Unchanged

- The mild pickup in first-quarter inflation may not rush the Reserve Bank of New Zealand into cutting the official cash rate tonight.

- The NZD/USD has rallied more than 7% since mid-January, but attempts to break 0.70 have failed and, more critically, in trade-weighted terms, the kiwi is still 4% weaker than at the end of December. What is more, the NZD has so far lagged the rebound in commodity currencies.

- Keeping a clear easing bias together with tough FX rhetoric may thus be enough for the RBNZ at the moment.

- We will be looking to use today’s potential drop in the NZD/USD to get long, as the long-term outlook remains bullish.

USD/JPY: Stay Sideways

- The Bank of Japan meeting outcome tonight is probably the most uncertain of the three (Fed, BOJ, RBNZ), given market speculation in favor of renewed easing.

- We think that the bank will not ease further. The BoJ meeting comes very soon after the recent IMF summit in which G20 countries reiterated their intention to avoid excessive FX volatility. Nonetheless, there is a risk of more negative rates (likelihood of more QQE is very low in our view) and it is reasonable to expect that the BoJ FX rhetoric will remain tough, with Governor Haruhiko Kuroda reiterating that the yen’s rise is a potential threat to inflation and that the bank is ready to act if needed.

- In our opinion no position is justified on JPY pairs today from the risk/reward perspective.

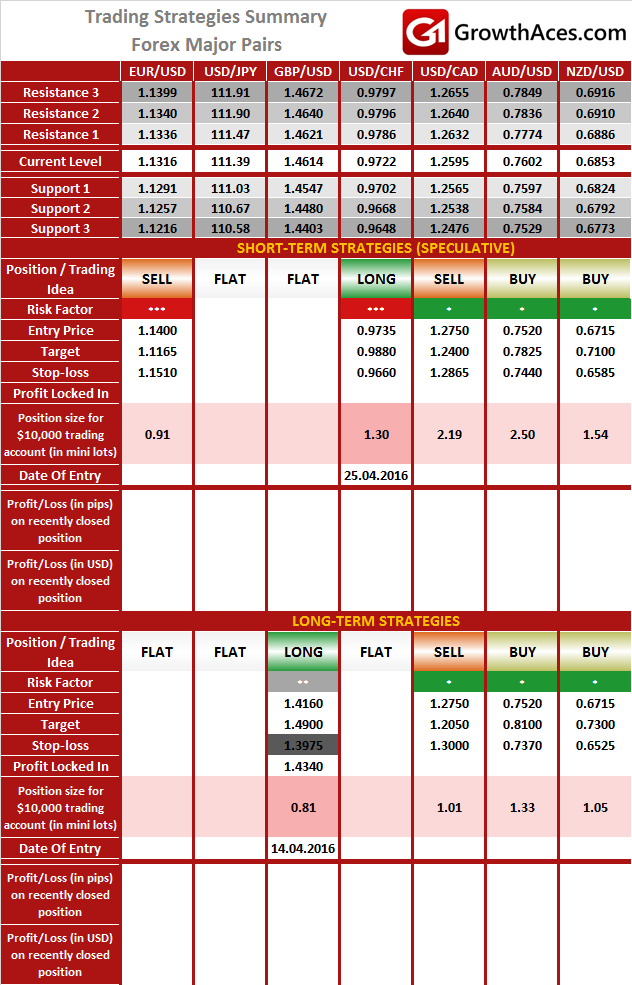

FOREX - MAJOR PAIRS:

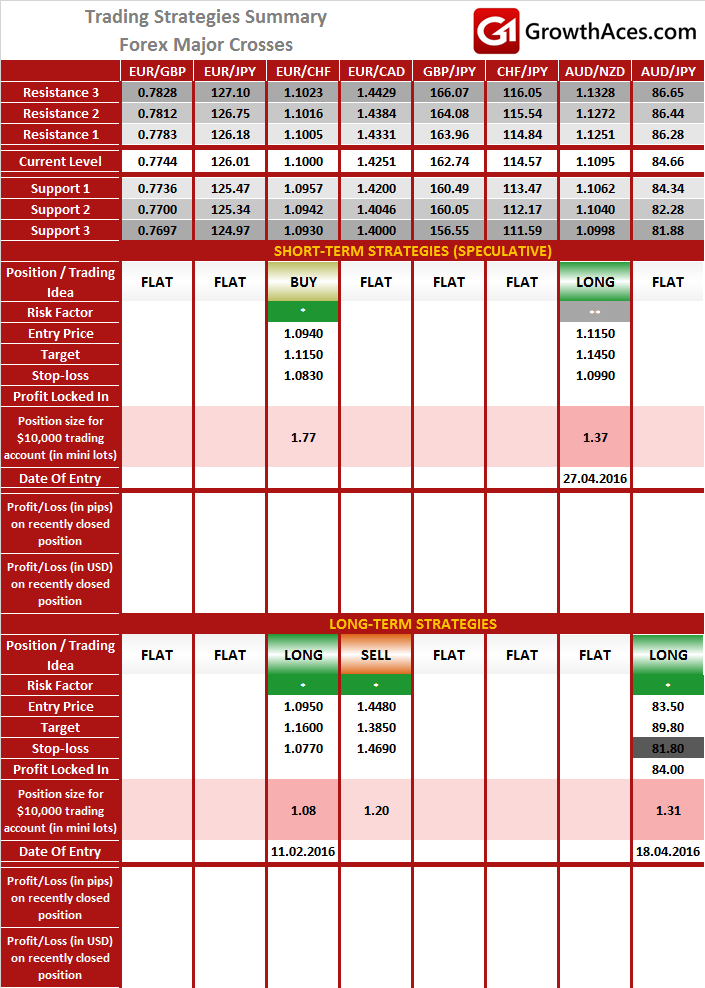

FOREX - MAJOR CROSSES:

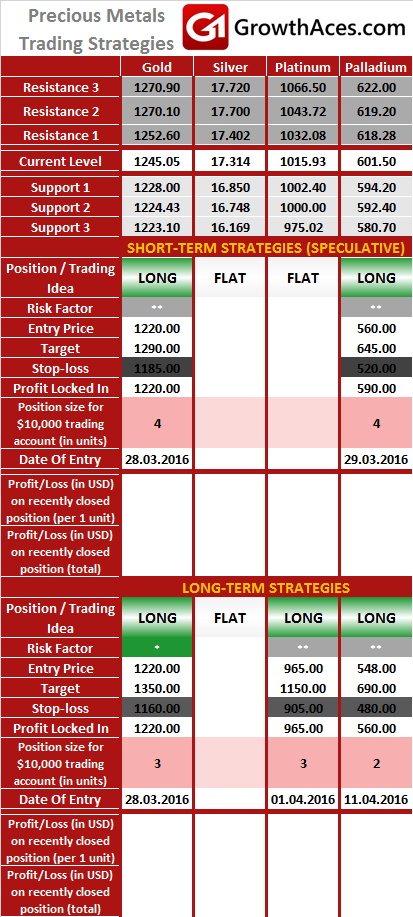

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: Growth Aces - Forex And Precious Metals Trading Signals