GROWTHACES.COM Trading Positions

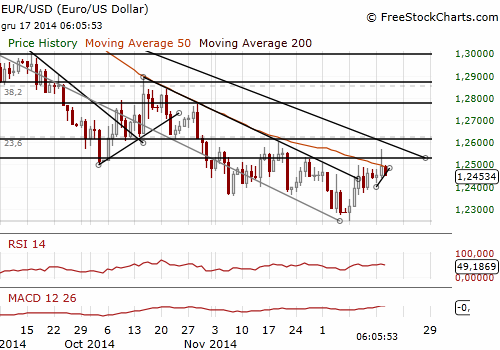

EUR/USD: short at 1.2480, target 1.2280, stop-loss 1.2530

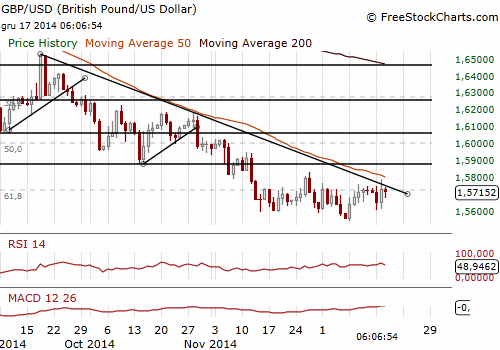

GBP/USD: short at 1.5720, target 1.5530, stop-loss 1.5770

USD/JPY: long at 116.50, target 119.80, stop-loss 115.20

USD/CHF: long at 0.9620, target 0.9770, stop-loss 0.9580

GBP/JPY: long at 183.70, target 186.50, stop-loss 182.70

EUR/CHF:long at 1.2025, target 1.2040, stop-loss 1.1995

GROWTHACES.COM Pending Orders

USD/CAD: buy at 1.1620, target 1.1740, stop-loss 1.1580

AUD/USD: sell at 0.8260, target 0.8100, stop-loss 0.8320

NZD/USD: sell at 0.7810, target 0.7630, stop-loss 0.7880

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading positions summary.

EUR/USD: Ctrl+F, Considerable Time, Trade

(short ahead of FOMC statement)

- U.S. inflation reading is scheduled for today. The market expects a fall in inflation to 1.4% yoy from 1.7% yoy and core CPI to remain at 1.8% yoy. Lower CPI reading could result in a rise in the EUR/USD rate, which in our opinion could be an opportunity to get short ahead of FOMC statement.

- The FOMC will release its statement today (19:00 GMT). Investors will be watching three key words in today’s FOMC statement: „a considerable time”. If the words are missing, it will be read as a hawkish signal and that interest rates hikes are coming sooner than later. If they remain in the statement, the markets will take it as a dovish signal suggesting that the Fed will leave interest rates unchanged for an extended period due to rising market volatility, falling oil prices and low inflation.

- It is not unusual for the Fed to provide an early warning to the markets of such a change in rhetoric. However, Vice Chair Stan Fischer said this month: “It is clearer that we are closer to getting rid of that than we were a few months ago.” And he added: “It would not be appropriate for me to give you a guess as to what will happen at the next meeting”

- In the opinion of GrowthAces.com there is high likelihood that the Fed will eliminate the “considerable time” from its statement and forex traders will certainly focus on this potential change in the wording. Such a change would give a boost to the USD.

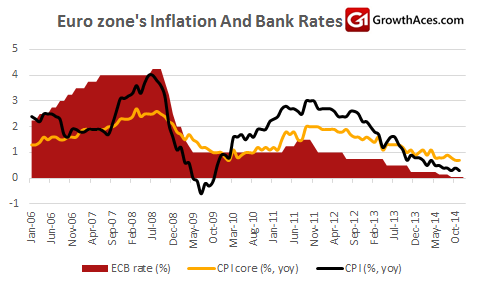

- While the Fed is considering interest rates hike, the European Central Bank is ready to launch additional measures to revive economic growth. Executive Board member of the ECB Benoit Coeure said there is a large consensus within the ECB governing council to step up action and talks are ongoing on what tools to use. He added however: “Nothing guarantees that what worked in the United States or Japan can be done identically here. We must think for ourselves.” Coeure said lower oil prices were undoubtedly good news as long as they did not trigger negative second-round effects.

- Consumer prices in the Euro zone fell 0.2% mom and rose 0.3% yoy, as expected by markets. Eurostat data showed that falling prices of fuel for transport had the biggest downward pull on the yoy number, subtracting 0.22 percentage point from the end result. Core inflation amounted to 0.7% yoy vs. 0.8% yoy in the previous month.

- We got short today at 1.2480 and set the target at 1.2280.

Significant technical analysis' levels:

Resistance: 1.2570 (high Dec 16), 1.2575 (high Nov 30), 1.2602 (high Nov 19)

Support: 1.2435 (low Dec 16), 1.2415 (low Dec 15), 1.2411 (10-dma)

GBP/USD: Still Only Two Dissenters At MPC Meeting

(short at 1.5720)

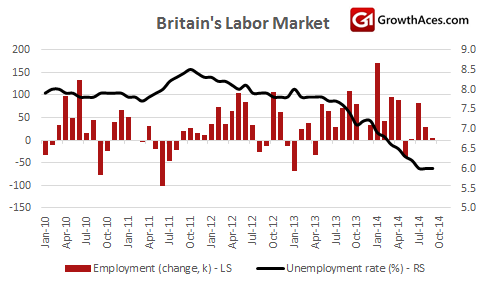

- Minutes of the BoE Monetary Policy Committee's December 3-4 meeting released today showed the majority thought the weak outlook for inflation warranted keeping interest rates on hold at a record low 0.5%. Ian McCafferty and Martin Weale, who have voted for a rate hike since August, continued to argue that below target inflation was largely the result of a higher exchange rate and lower raw material prices.

- The minutes did not repeat November's language of there being a "material spread of views", which had caused market analysts to believe that some members were edging closer towards raising rates. The BoE has focused more on wage growth as it considers when to start raising rates. The labor market data were also released today.

- Unemployment rate remained unchanged at 6.0% in the three months to October, slightly above the median forecast of 5.9%. A fall of 63k unemployed people was the smallest decline since the three months to September 2013.

- The BOE policymakers are keeping a close eye on labor costs. Average weekly earnings, excluding bonuses, rose 1.8% yoy, the same rate as in September. British workers' earnings grew more than inflation that stood at 1.3% yoy in October. In the August-October period, total average weekly earnings, excluding bonuses, rose by 1.6% yoy, picking up speed from 1.2% yoy in the three months to September. Total pay, including bonuses, also gathered speed to rise 1.4% yoy, compared with a gain of 1.0% yoy in the July-September period.

- The number of people claiming unemployment benefit in the month of November fell by 26.9k, a bigger fall than economists' forecasts for a fall of 20k, compared with a revised fall of 25.1k in October.

- We got short on the GBP/USD at 1.5720 today. The most important event today is FOMC meeting. Hawkish statement may result in strong fall of the GBP/USD. Our target is at 1.5530, but we should keep stop-loss tight in case of dovish comments from the Fed.

Significant technical analysis' levels:

Resistance: 1.5785 (high Dec 16), 1.5826 (high Nov 27), 1.5917 (38.2% of 1.6525-1.5541)

Support: 1.5678 (low Dec 17), 1.5610 (low Dec 16), 1.5602 (low Dec 15)

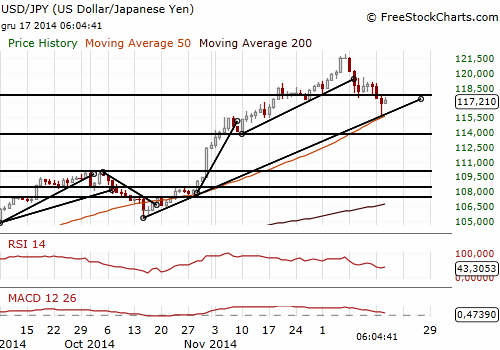

USD/JPY: Long Again, Waiting For FOMC

(long at 116.50, target 119.80)

- Economics Minister Akira Amari said Japan's government is working on compiling emergency economic steps by around December 27. Japanese Prime Minister Shinzo Abe said he wanted economic stimulus measures to be compiled by the year's end and steps to be taken to ease concerns about rising import prices.

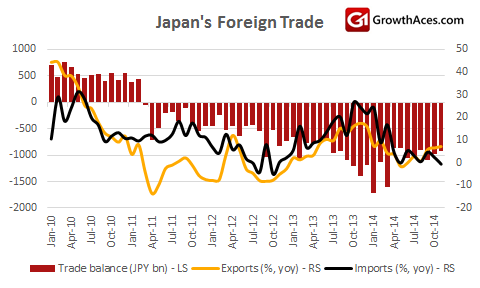

- Japan's trade deficit expanded in November to JPY 891.9 bn compared with JPY 737 bn the month before. Japan's costs for oil imports sank 22% yoy in November, reducing total imports by 1.7% yoy. Exports rose 4.9% yoy. The recovery of the U.S. economy has helped Japan's exports, making up in part for China's slowing growth. Japan's trade surplus with the U.S. grew 20% yoy to JPY 582.1 bn.

- The USD/JPY was very volatile yesterday. The rate fell as low as 115.57 on rising risk aversion. The USD/JPY rallied then to 117.76. We saw it trade 116.25-117.12 in Asia and we used lower levels to get long again at 116.50. Our medium-term outlook for the USD/JPY is still bullish, however recent volatility of this rate makes USD/JPY trading risky. If FOMC turns hawkish today, the USD/JPY is likely to jump above 119.00.

Significant technical analysis' levels:

Resistance: 118.01 (high Dec 16), 118.78 (50% of 121.86-115.56), 118.85 (10-dma)

Support: 116.30 (low Dec 17), 115.56 (low Nov 16), 115.49 (38.2% of 105.19-121.86)